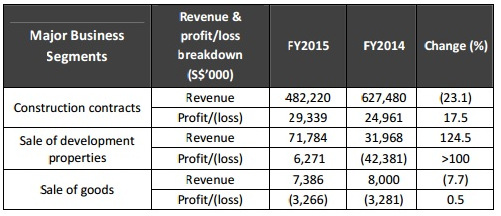

MAINBOARD-LISTED construction group and property developer Tiong Seng Holdings Limited (長成控股) reported a net profit of S$14.7 million for the full year ended 31 December 2015.

This reversed a loss of S$29.6 million for FY2014 which was impacted by an one-off allowance for diminution in value in the Group’s property development segment.  Pek Lian Guan, CEO of Tiong Seng Holdings. NextInsight file photo.Mr Pek Lian Guan (白連源), CEO of Tiong Seng Holdings Limited, said, “Although overall revenue for FY2015 registered a decline, this was mainly due to our revenue recognition model for both our construction and property development businesses.

Pek Lian Guan, CEO of Tiong Seng Holdings. NextInsight file photo.Mr Pek Lian Guan (白連源), CEO of Tiong Seng Holdings Limited, said, “Although overall revenue for FY2015 registered a decline, this was mainly due to our revenue recognition model for both our construction and property development businesses.

"Our mainstay construction business, however, remains bolstered by a resilient order book size of approximately S$1.3 billion which extends to 2020.

| Stock price | 22.5 cents |

| 52-week range | 15.5 – 31.4 cents |

| PE | 10.1 |

| Market cap | S$103.1 million |

| Shares issued | 458.27 million |

| Dividend yield | 2.22% |

| Net asset value | 56.75 cents/share |

"Amidst a challenging industry landscape, our priorities lie in consistent delivery of our expertise to our customers and we continue to increase our returns on investment by investing in various construction technologies such as the Prefabricated Pre-finished Volumetric Construction that has been widely endorsed by regulators. As we push for greater productivity enhancements, it improves our competitive advantage."

The Board of Directors has recommended a final dividend of 0.5 Singapore cents per share (FY14: 0.4 cents a share, adjusted for recent share consolidation).