|

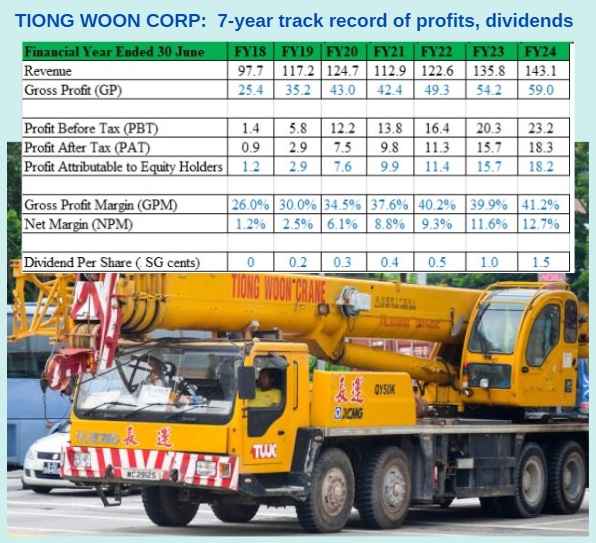

Forget the flashy AI and tech plays for a second. Let’s talk about cranes. Singapore-listed Tiong Woon Corp, which Lim & Tan Securities has just issued a "buy" call on, is ranked the 15th largest crane operator globally. Its scale gives it a massive "moat," says the broker. |

The "Harvest" Has Finally Arrived

For the last few years, Tiong Woon has been spending heavily to build up its fleet at some expense to short-term profits.

| "With operating leverage amidst tightening utilisation, we believe TWC remains undervalued and is still early in the current construction cycle." -- Lim & Tan Securities |

But that phase is over.

Now, it's the "harvest phase," and the timing couldn't be better: a multi-year construction upcycle is evident in Singapore driven by two massive engines:

- Singapore’s Boom: Public housing (BTOs), private sector demand, and data centre construction are keeping utilisation rates high.

- Global Megaprojects: This is where the real "alpha" comes in. Tiong Woon is securing high-value work in India’s petrochemical sector and the massive NEOM project in Saudi Arabia.

As utilisation tightens, Tiong Woon's operating leverage kicks in—meaning more revenue drops straight to the bottom line.

Trading At Discount to Peers

Despite the growth story, Tiong Woon is still trading at attractive prices.

- The Valuation: At S$0.995, it’s trading at roughly 9.2x forward PE and 0.7x Price-to-Book.

- The Comparison: Construction peers like BRC Asia and Centurion trade closer to 12x PE, while Pan United is up around 18x.

If Tiong Woon just catches up to a "fair" valuation of 12x PE, Lim & Tan pegs the target price at S$1.30. That represents a potential 30% upside from the recent price.

"This valuation gap will likely be narrowed via better earnings as we now see heavier cranes (which carries higher margins) being utilized for both local infrastructure (data centres, etc) and overseas projects, which were not present previously."

The company is in solid financial shape, generating healthy operating cash flows of roughly S$51.5 million annually and is sitting on an "almost net cash" position. Well, management incentives are aligned with yours. |

The Lim & Tan report is here.