|

If you’ve been following the news, you would probably be aware that the property market in Australia is heating up as foreign buyers enter the country. As a matter of fact, Starhill Global REIT has three assets in Australia. Two of them are located in Perth — David Jones Building and Plaza Arcade and the newly acquired property, Myer Centre, located in Adelaide. At its most recent AGM in October 2015, Starhill Global pointed out that the trust is looking at further opportunities in the Australian market.

|

While the chairman thinks that the REIT is in a very good position in the Australian market, there were also some other points discussed during the AGM:

1. According to the CEO, distribution per unit for Starhill Global has grown at a compounded annual growth rate of 7.2%. In fact, unitholders who subscribed to Starhill Global REIT (formerly known as Prime REIT) during its IPO at $0.98 and who took up their entitled 1-for-1 rights issued at $0.35 (an average price of $0.665 per share) have received an average dividend yield of 6% since 2006.

2. The REIT changed its financial year ended from 31 December to 30 June. The reason for the change is to align its financial year with its sponsor, YTL Corp Berhad. It’s important for investors to note that Starhill Global’s FY2014/15 is over 18 months.

3. Starhill Global’s portfolio of properties is primarily located in Singapore which makes up 66% of total assets while Australia and Malaysia make up 29% of total assets. You’re probably very familiar with some of these properties — Ngee Ann City & Wisma Atria located along Orchard Road in Singapore and Starhill Gallery & Lot 10 located in Bukit Bintang in Malaysia. Do note that Starhill Global doesn’t always own an asset fully. For example, Isetan owns the some of the gross floor area in Wisma Atria.

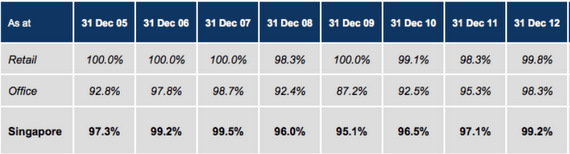

4. The occupancy rate for its Singapore assets, primarily Wista Atria and Ngee Ann City, has consistently been above 95% since the REIT’s listing in 2005. The table below shows that prime assets tend to be well tenanted regardless of market conditions.

5. 42% of gross rental income is from master and long-term leases. These leases were agreed with anchor tenants like David Jones (4.2% gross rent) whose lease expires in 2032 and Toshin Development (19.2% gross rent) whose Ngee Ann City lease expires in June 2025. There is a rent review every three years to provide stability and growth for the REIT. The next rent review for Toshin and David Jones is June 2016 and August 2017 respectively.

6. With properties located overseas, Starhill Global is mindful of the foreign exchange risk and thus hedges its loans for its foreign assets. For example, its Japanese properties are fully hedged using yen-denominated loans. It is not in the business of the REIT to speculate on foreign exchange movement; it makes more sense to safely manage any foreign exchange volatility that may affect net property income and dividends. According to the CEO, a 10% depreciation in foreign currencies is not expected to affect dividends by more than 5%.

7. By improving tenant mix, Starhill Global can create a better shopping experience for shoppers to increase consumer spending for its new and existing tenants. For example, there was a change in tenant mix when renovations in Wisma Atria were completed in 2012. The mall used to have a Nike store that generated $100 per square foot in sales. When the luxury fashion label, Coach, took over, sales per square foot jumped to a few hundred dollars. As a result, Starhill Global is able to earn additional income for unitholders by increasing rent when tenants are doing well. CEO Ho Sing pointed out there is a common misconception among investors and analysts who look at occupancy costs alone. According to him, it’s also important to look at sales efficiency on a per square foot basis. The typical suburban mall’s sales per square foot is usually $60-70 which translates to 15-17% in occupancy costs. If it exceeds 20%, it is not sustainable. However, that is not entirely true for city malls because the REIT can find ways to increase tenant sales per square foot up to the range of hundreds of dollars.

8. The manager estimates that 30-40% of sales come from tourist spending. However, it’s difficult to track as some Indonesians and Malaysians use local credit cards when shopping.

9. CEO Ho Sing believes that e-commerce is complementary to brick-and-mortar shops because it helps educates consumers. A member of Amazon Prime himself, the CEO buys books online from Amazon but realized that the appreciation of the U.S. dollar and cost of shipping has removed the price savings. He acknowledged there is a growing trend in buying things online but as he pointed out, these are not the REIT’s tenant’s target market. Their target market is high-end (e.g. watch and jewelry retailers that offer a more exclusive shopping experience and personalized customer service. Some of the retailers in Ngee Ann City property include high-end brands like Louis Vuitton, Chanel, Hugo Boss, Piaget, etc. In fact, Ho believes that some shoppers may buy expensive watches or jewelry online but most people still prefer to visit a tangible, brick-and-mortar shop to buy these items. He said, “It’s the reverse when it comes to buying a watch. You check the prices online, then come and bargain with watch retailers offline.”

10. The chairman said the ‘worst is over’ for the Singapore property market after a shareholder asked his opinion about the local property market outlook. The government didn’t expect the cooling measures to have such a huge impact on the property market. The high-end market especially has taken a hit and remains challenging today. He believes that it is not in the government’s interests to create a situation where there is low demand (like we see today) as that would cause the economy to slow down. As a result, he feels that it is highly like that the government will review the cooling measures.

Rusmin Ang (left) is an equity investor and the co-founder of The Fifth Person on whose site this article first appeared on 23 April 2015. He has been featured multiple times on national radio 938LIVE for his views on how to invest profitably in the stock market and his investment articles have appeared on The Business Times BTInvest and Business Insider. Rusmin is also on the speaking circuit for CIMB Securities (Malaysia) and has spoken at events in Penang, Sibu and Kuala Lumpur. Rusmin is also the co-author of Value Investing in Growth Companies which is published by Wiley, Inc. The book can be found in all major book stores worldwide and on Amazon.com, Barnes & Noble and Apple's iBooks.

Rusmin Ang (left) is an equity investor and the co-founder of The Fifth Person on whose site this article first appeared on 23 April 2015. He has been featured multiple times on national radio 938LIVE for his views on how to invest profitably in the stock market and his investment articles have appeared on The Business Times BTInvest and Business Insider. Rusmin is also on the speaking circuit for CIMB Securities (Malaysia) and has spoken at events in Penang, Sibu and Kuala Lumpur. Rusmin is also the co-author of Value Investing in Growth Companies which is published by Wiley, Inc. The book can be found in all major book stores worldwide and on Amazon.com, Barnes & Noble and Apple's iBooks.