This article from the January 2016 issue of The CFA Singapore Quarterly is republished with permission from CFA Singapore. Produced by NextInsight, the magazine features the latest investment thought leadership, best practices and industry analysis. To read past issues, click here.

For enquiries on editorial, copywriting, graphic design and publication services, email This email address is being protected from spambots. You need JavaScript enabled to view it..

In conjunction with the Singapore International Film Festival, leading practitioners from the movie industry spoke at a CFA Singapore lunch time talk about the industry’s financing structure and supply chain, and provided insights into how to manage risk when investing in movies. The panel speakers were

- Mark Montgomery (President of Xeitgeist Entertainment Group)

- Jomon Thomas (CEO of Xeitgeist Entertainment Group)

- Aditya Shastri (Head of Filmed Entertainment at B4U)

- Dr Jim Frazier (Academy and Emmy Award Winner)

- Joseph Cohen (President of American Entertainment Investors)

The Professional Development event took place at SGX Auditorium on 3 December 2015. |

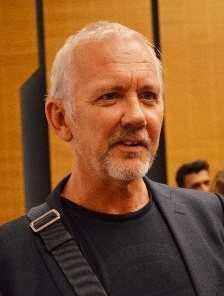

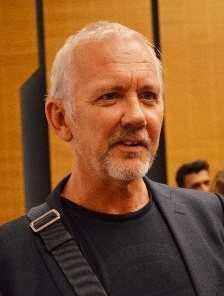

Joseph Cohen, Founder, American Entertainment Investors. Photo by Sim KihJOSEPH COHEN is a mezzanine financier for the film industry. His company, American Entertainment Investors, invested in The Man who Knew Infinity, a film adaptation of the biography of Indian mathematics genius Srinivasa Ramanujan. Filming began in August 2014 at Trinity College in Cambridge and was completed about a year later. It premiered at the Toronto International Film Festival in September 2015.

Joseph Cohen, Founder, American Entertainment Investors. Photo by Sim KihJOSEPH COHEN is a mezzanine financier for the film industry. His company, American Entertainment Investors, invested in The Man who Knew Infinity, a film adaptation of the biography of Indian mathematics genius Srinivasa Ramanujan. Filming began in August 2014 at Trinity College in Cambridge and was completed about a year later. It premiered at the Toronto International Film Festival in September 2015.

At the CFA Singapore seminar on movie investing, he said: “Investments in the film industry can generate returns with relatively low correlation to stock and bond markets. The film industry is highly complex with many players, ranging from producers, financiers, distributors, talent to completion guarantors. You can get a lot of financial leverage in the film industry. Leverage cuts both ways. If the project does well, leverage increases your IRR. If the project does not do well, equity investors in the last part of the film making chain can sustain significant loss.

“I like to think that I can take mezzanine type risk and get equity type return. Many film investors use mezzanine funds to reduce their committed capital. If the film does very well, my IRR can be very high. But if it does not, I get my returns on a mezzanine basis. I try to generate IRR of about 20% for what I consider to be fairly low-risk investments.”

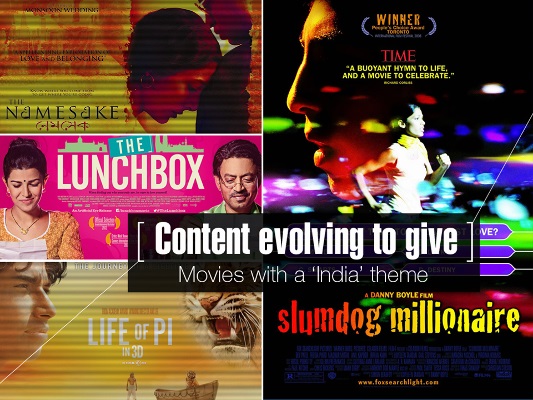

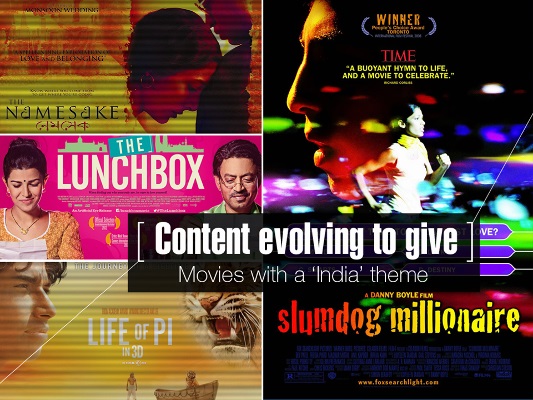

Casting Indian talent may be one way to raise box office proceeds - by appealing to the huge mass of movie consumers in India. The Man who Knew Infinity stars Indian actor Dev Patel, the protagonist of Slumdog Millionaire fame.

|

Aditya Shrasti, Head of Filmed Entertainment, B4U. Aditya Shrasti, Head of Filmed Entertainment, B4U.

Photo by Mabel Lee

Also on the panel of experts at the talk was Aditya Shastri, Head of Filmed Entertainment at B4U, a leading worldwide television network channel for Bollywood entertainment. Mr Shastri highlighted the exciting outlook for the Indian movie market over the next 15 years.

Largest movie market

“India has a population of 1.3 billion, of which 300 million speak English, live with an American culture, as well as understand and relate to every international product. It is a group of people who wants everything, and they want it right now.”

The huge number of media consumers there was also why more people saw the Titanic in India than in America.

India’s huge digital distribution

India has over 12,000 movie theatre screens connected digitally via satellite. Technology is also taking movie content from India to Europe and the Middle East. From being inward looking, India productions have evolved to cater to the tastes of the larger world. Some global successes include Slumdog Millionaire, The Lunchbox, Namesake and Life of Pi.

There is huge demand for media entertainment. More than 160 million households subscribe for television in India and more than 80% of them pay to receive content via cable and satellite. In the past, 90% of TV revenue came from advertising, and 10% revenue from content subscription. Subscription revenue has increased to about 40% and advertising now accounts for 60%.

In February 2015, Star TV (Indian subsidiary of 21st Century Fox) launched a mobile app in India called Hotstar for watching the latest movies, Live Sports and television. The app has had over 25 million downloads and more than 100 advertisers.

|

|

Financing structure

The Man who Knew Infinity was produced by Xeitgeist Entertainment Group. Xeitgeist President Mark Montgomery shared insights into the financing structure of film-making.

Mark Montgomery, President of Xeitgeist Entertainment Group Mark Montgomery, President of Xeitgeist Entertainment Group

Photo by Sim Kih“We produced The Man who Knew Infinity at a cost of about US$10 million. After we firmed up the producers and actors, we estimated expenses of around US$6.5 million in cash, of which around US$1.5 million was from internal resources. We had to raise another US$5 million. We offered anchor investors a 30% return on their investment. So, that brings our cost to US$6.5 million.

“We looked at cornerstone investors and mezzanine investors like Joseph Cohen’s company. These anchor investors typically invest US$2 million each for a US$10 million production.

“The mezzanine investor then links up with a bank. Of the US$2 million, he may put in US$500,000. The bank loans him US$2 million at a low interest rate. The investor exits his investment as soon as we have made the film and sold it. His is a low-risk investment with a fairly high return for putting in a fairly small portion of the capital.

“We get sales agents who sell the film to the rest of the world as well as the US (domestic) market. On the initial production budget of US$6.5 million, the sales agent gets about 10%, which brings the cost to about US$7.2 million.

“We typically try to sell the film progressively over the period of time leading up to the completion of film production. Each sales agent is allocated the right to distribute to a specific geographic territory. After that, we appoint the US sales agent. Films are typically released nationwide outside the US only after its domestic nationwide premiere.

"The Man who Knew Infinity is about an Indian mathematician who lived in the early 1900s in a village in India. How do you make that into a commercially viable film that touches emotionally? "The Man who Knew Infinity is about an Indian mathematician who lived in the early 1900s in a village in India. How do you make that into a commercially viable film that touches emotionally?

"Somebody said people never forget their first love and the money they wasted on a bad movie. It is very important to Xeitgeist that we make movies that touch people emotionally."

- Jomon Thomas, CEO of Xeitgeist Entertainment Group.

Photo by Mabel Lee“When we sell the film to distributors in America, we get a minimum sales guarantee. This is paid to us in the form of upfront cash before the film is released at the box office. The minimum sales guarantee provides an exit route for our anchor investors.

“After this stage, the quantum of net proceeds to Xeitgeist depends on how well the film does at the box office. Films like The Man who Knew Infinity have the potential to generate box office sales of US$150 million or more.

“Typically, 60% of box office returns go the distributors and exhibitors for prints and advertising, as well as for theatre costs. The remaining 40% is deposited in a cash management account managed by an independent administrator who disburses the share of profit at the end of the day to each party involved. As a production company, Xeitgeist also takes management fees for putting the film together, and for taking on producer and executive producer roles.

“We try to produce cross cultural films with a budget of US$15 million or less,” said Mark.

Managing risk

“To mitigate financial risk, you must first have a great story. Then, you need to have a good actor to enable the sales agents to do their job. We find great stories that good actors want to be in. The great stories, in our view, are about people’s lives.

“There are the high budget movies with special effects that definitely have a place in the market. And then, there are the low budget independent films like ours that create memories and become a part of you.

“You also need a really great team: You need a talented director. You need high quality costumes and a cinematographer with a superb eye. Even after you have done all of that, a must-have is a well-connected sales agent.

“Investors looking at movie investment need to connect the whole chain and a company like Xeitgeist understands that chain,” he said.

|

Environmental investments

Academy and Emmy award winner and cinematographer, Dr Jim Frazier, is Chairman Emeritus of Xeitgeist Entertainment Group

Academy and Emmy award winner and cinematographer, Dr Jim Frazier, is Chairman Emeritus of Xeitgeist Entertainment Group

Photo by Mabel Lee

One of the panelists, Dr Jim Frazier, urged investors to make pro-environmental investments.

“We are rapidly losing biodiversity on this planet. The sea has become warmer, more acidic and polluted by radioactive substances. The lungs of the earth - our forests, are being decimated. If we continue on our present path, our children will not know the world that we now have. I wanted to harness the power of the film and music industry and put it in the Symphony of the Earth. We intend to plough the profits from the Symphony into an educational film that will be issued to all schools on the planet for free.”

Symphony of the Earth is Dr Frazier’s environmental feature film that aims to change attitudes to the world’s current environmental crisis.

Joseph Cohen, Founder, American Entertainment Investors. Photo by Sim KihJOSEPH COHEN is a mezzanine financier for the film industry. His company, American Entertainment Investors, invested in The Man who Knew Infinity, a film adaptation of the biography of Indian mathematics genius Srinivasa Ramanujan. Filming began in August 2014 at Trinity College in Cambridge and was completed about a year later. It premiered at the Toronto International Film Festival in September 2015.

Joseph Cohen, Founder, American Entertainment Investors. Photo by Sim KihJOSEPH COHEN is a mezzanine financier for the film industry. His company, American Entertainment Investors, invested in The Man who Knew Infinity, a film adaptation of the biography of Indian mathematics genius Srinivasa Ramanujan. Filming began in August 2014 at Trinity College in Cambridge and was completed about a year later. It premiered at the Toronto International Film Festival in September 2015. Academy and Emmy award winner and cinematographer, Dr Jim Frazier, is Chairman Emeritus of Xeitgeist Entertainment Group

Academy and Emmy award winner and cinematographer, Dr Jim Frazier, is Chairman Emeritus of Xeitgeist Entertainment Group