| Rapid changes in the geopolitical and geoeconomic landscapes in Asia-Pacific are posing escalating challenges to the wealth management industry in the region. In particular, the competition between Hong Kong and Singapore as the region’s wealth management hub for high-net-worth individual has never been more fierce. Singapore has been proactive in increasing its attractiveness for wealth planning. The city-state has in recent years been trying to attract a greater share of Asia’s growing high net worth clients. Its trust laws offer confidentiality to settlors and beneficiaries, as well as tax exemptions. Hong Kong, meanwhile, has long been integrating into China’s economic system and boasts high convenience for Chinese clients seeking to move money abroad. In early 2023, the SAR even introduced a new regime for limited partnerships, facilitating establishments of vehicles designed specifically for the needs of private equity funds. The city’s government is also considering potential tax concessions in respect of carried interest for private equity funds. |

Regulations aside, the twin cities are competing on quality of supervision on wealth management service providers, especially regarding the protection of vulnerable clients. Hong Kong is obviously lagging behind in this area.

Private banking clients cover a wide spectrum of individuals. At one end there are clients who are highly seasoned investors, at the other end are unsophisticated clients with only very basic investment knowledge, notwithstanding that they have substantial wealth.

Private banks need not mechanically match their client’s overall risk tolerance level to product risk level. Private banking customers often look to their private bankers for investment advice on a continuous basis having regard to the customers’ entire portfolios or balance sheets.

Suitability assessment for private banking customers is often conducted on a holistic or portfolio basis, taking into account all relevant circumstances of the customers.

Insofar as the portfolio allocation and the overall risk level agreed with the client is adhered to, a low or medium risk tolerance client buying high risk products that only constitute a minor proportion of his portfolio is often acceptable, provided necessary authorizations have been secured and ongoing monitoring is in place.

The documentation of rationale for decisions made against usual patterns can be done on a portfolio level at the outset, subject to conditioning including presence of a consented investment mandate stipulating the types, risks and allocation of investments after taking into account all relevant circumstances of the client.

The investment mandate should be explained to and agreed by the client, and a copy of the mandate should be provided to and acknowledged by the client. The investment mandate should of course be reviewed and, if necessary, modified whenever there are material changes to the relevant circumstances of the private banking customer.

Moreover, private banks are duty-bound to document the rationale for recommendations and seek client authorizations in writing when it comes to effecting transactions not in line with the usual practices under this account, including but not limited to increasing leverage positions or exposure to higher risk asset classes.

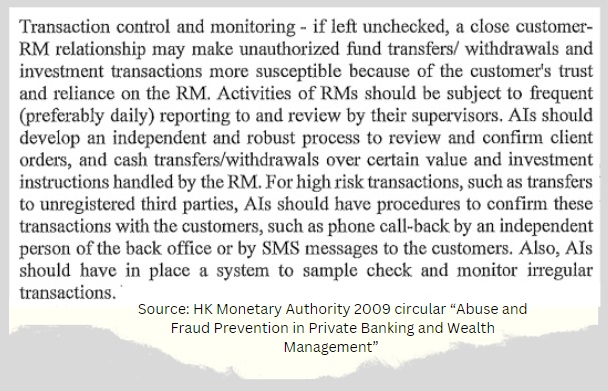

In this case, which has been reported in local media, the customer was offered US$37 million in loan facility cross-pledged with his family assets. In this case, which has been reported in local media, the customer was offered US$37 million in loan facility cross-pledged with his family assets. The customer has alleged that the loan sum has been embezzled and misappropriated by the bank’s relationship manager, who is also a defendant in the writ. The relationship manager and money have since vanished. The customer filed the writ when he was asked to repay the facility by the bank. The customer accused the bank of failing to monitor its business relationship with him through ongoing customer due diligence, i.e., reviewing from time to time, documents, data and information relating to the customer that have been obtained by the bank for the purpose of complying with requirements imposed to ensure that they are up to date and relevant. The customer also said the bank failed in transaction monitoring, i.e., identifying transactions that are complex, and unusually large in amount, any unusual pattern; and examining the background and purpose of those transaction, and setting out findings in writing. This case raises questions about the bank's internal controls as well as inadequacies of the regulator in ensuring private banking service providers act for customers’ best interests. The black-and-white guidelines are spelt out though by the authority:  |

| In Singapore ... |

A similar case in Singapore emerged in late 2023, however, highlighted the better vigilance of the city-state’s regulator. The Monetary Authority of Singapore (MAS) imposed a SGD3.9 million penalty on Credit Suisse for failing to detect misconduct by relationship managers at its Singapore branch. The fine was levied after the MAS found Credit Suisse relationship managers provided incomplete or incorrect information, or omitted key information, to clients in post-trade disclosures affecting 39 over-the-counter bond transactions.

The fine was levied after the MAS found Credit Suisse relationship managers provided incomplete or incorrect information, or omitted key information, to clients in post-trade disclosures affecting 39 over-the-counter bond transactions.

The misconduct was discovered during an MAS review of pricing and disclosure practices in the private banking industry.

The competition between these two cities is set to evolve over the next decade with the winner set to be positioned as the more preferred destination for private wealth management in Asia.

The city that can best help manage, preserve and grow the wealth of the most affluent families will have a better edge attracting quality money from these families. In this specific area of service provider supervision, Hong Kong obviously still has much room to catch up.