Chip Eng Seng was the main contractor for the iconic HDB flats, The Pinnacle @ Duxton, which was awarded the 2011 Urban Land Institute Global Awards for Excellence.

Chip Eng Seng was the main contractor for the iconic HDB flats, The Pinnacle @ Duxton, which was awarded the 2011 Urban Land Institute Global Awards for Excellence.

Image by HDB.

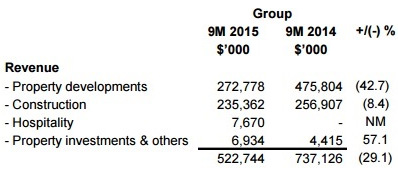

CHIP ENG SENG CORPORATION has proposed to spin off and list its construction business on the Singapore Exchange.  Chip Eng Seng reported $235.4 million in construction revenue for 9M2015.The company, which also has a sizeable property development division, has appointed United Overseas Bank as the financial adviser for this plan.

Chip Eng Seng reported $235.4 million in construction revenue for 9M2015.The company, which also has a sizeable property development division, has appointed United Overseas Bank as the financial adviser for this plan.

Following a submission made by Chip Eng Seng to the SGX-ST and based on the representations made, the SGX-ST has advised that it has no objections to the proposed spin-off, said Chip Eng Seng.

| Stock price | 67.5 cents |

| 52-week range | 57 – 96.8 cents |

| PE (ttm) | 1.94 |

| Market cap | S$419.2 million |

| Shares issued | 621.0 million |

| Dividend yield | 5.93% |

That is subject to the company being able to demonstrate that its management team and Board is separate and distinct from that of the spin-off group.

The SGX-ST, however, reserves the right to amend and/or vary the above confirmation/decision.

Chip Eng Seng said the proposed restructuring is in its preliminary stages and is subject to the approval of shareholders at an EGM to be convened.

|

Comparing Chip Eng Seng with Tiong Seng and Lian Beng That is relatively small compared to, say, Tiong Seng Holdings's 9M15 construction revenue of $341.4 million and Lian Beng Group's FY2015 (ended May) construction revenue of $628.8 million. As at 30 Sept 2015, Chip Eng Seng’s construction order book stood at $641.8 million compared to Tiong Seng's $1.4 billion. Lian Beng Group's orderbook was $452 million as at end-Aug 2015. |

The family holds a combined 35% but the largest holder Mr. Lim Tiam Seng holds only 9.42%. In recent times, Kenyon Holdings managed to acquire over 8% of the shares, making Tan Keng Yong the second largest shareholder, only behind Mr. Lim.

Their CEO and son-in-law of the founder Raymond Chia left to start his own property development company, LGB Development which seems to have regional focus

Recent shuffle of directors.

Possible reasons for the spinoff include

1) Restructuring of family holdings to avoid potential hostile takeovers in future

2) Split within the family with Mr. Lim Tiam Seng and young brother Lim Tiang Chuan each going their own ways to prepare the group for the next generation.

3) Increasing the value of the group

http://www.stproperty.sg/articles-property/singapore-property-news/buyers-snap-up-units-at-alexandra-central/a/102092

Current NAV = $1.18 (September 2015)

ADD: Revaluation Gain from Park Hotel Alexandra = $0.25

ADD : High Park Residence = $0.20 (TOP 2018)

ADD : Tower Melbourne (Australia) = $0.20 (TOP 2019)

ADD : Fulcrum = $0.05 (TOP early 2016)

ADD : Sales of Land (with planning approval) at Victoria + Doncaster Project = $0.06

(TOP 2016)

ADD : Remaining portion of Nine Residence/Junction 9 = $0.05 (TOP end 2015/early 2016)

ADD : Investment property profit = $0.015 per annum

ADD : Construction arm EPS = $0.04 per annum

Assuming a P/E of 6, RNAV of construction arm =$0.24

MINUS: Dividend = $0.04 per annum

RNAV = $2.09 by end of 2019.