Excerpts from analysts' report

RHB Research analysts: Edison Chen & Goh Han Peng

| Having been dormant for a few months, we are re-initiating our model portfolio with a fresh $1m mandate. The STI officially entered bear market territory last week with a 20% correction from its April peak. Fear has gripped the market with anecdotal accounts of minimal buying interests from retail and institutional buyers alike. However, a bear market and the bargain prices it throws up offer ample opportunities for the intrepid investor. We are cognizant that it is nigh impossible to catch the bottom, and will deploy the cash in a measured fashion. 60% of our initial $1m will go into five high-growth counters. » Our investing philosophy is value-driven with an absolute-return focus. The portfolio is concentrated with around 8-10 holdings. The portfolio has no market capitalization constraints, but will have a small cap bias due to the greater pricing inefficiencies in that segment. Over a 3-year period, we aim to achieve a doubling of the portfolio. » While we generally take a long-term, fundamental view in our holdings, the portfolio will also be opportunistic and seek to take advantage of short-term mispricing and arbitrage situations. » We are deploying $600,000 into the following 5 counters: 1) Chinese jet fuel supplier China Aviation Oil; 2) satellite technology equipment supplier Global Invacom (BUY, TP SGD0.45); 3) k1 Ventures (BUY, TP0.23); 4) Niche ship charterer and owner Singapore Shipping Corporation (BUY, TP SGD0.59) and 5) Myanmar play Yoma Strategic.

|

» China Aviation Oil is majority-owned by British Petroleum and the Chinese government. It has a monopoly on the supply of all of China’s imported jet fuel and owns a number of lucrative downstream assets. As it is a jet fuel/petrochemical trader, it was previously impacted by the oil shock in 4Q14. However, it is actually a physical fuel supplier operating at a cost-plus model, meaning that there is actually only one quarter’s of mark-to-market inventory losses. And for 4Q14, there is also a one-off write down related to the OW bunker bankruptcy incident.  CAO is the largest physical jet fuel trader in the Asia Pacific region and the sole supplier of imported jet fuel to the PRC’s civil aviation industry. Photo: CAO (Singapore)The market appears to be incorrectly linking their profitability with oil price and is not aware of the positive impacts that the current contango price environments will bring to the company. Profits have already begun recovering in FY15. Its downstream assets include a 33% stake in the highly profitable Shanghai Pudong International Airport Aviation Fuel Supply Company, the exclusive refueller for the busiest airport in China by cargo. We are buying 250,000 shares of the stock at SGD0.620 apiece.

CAO is the largest physical jet fuel trader in the Asia Pacific region and the sole supplier of imported jet fuel to the PRC’s civil aviation industry. Photo: CAO (Singapore)The market appears to be incorrectly linking their profitability with oil price and is not aware of the positive impacts that the current contango price environments will bring to the company. Profits have already begun recovering in FY15. Its downstream assets include a 33% stake in the highly profitable Shanghai Pudong International Airport Aviation Fuel Supply Company, the exclusive refueller for the busiest airport in China by cargo. We are buying 250,000 shares of the stock at SGD0.620 apiece.

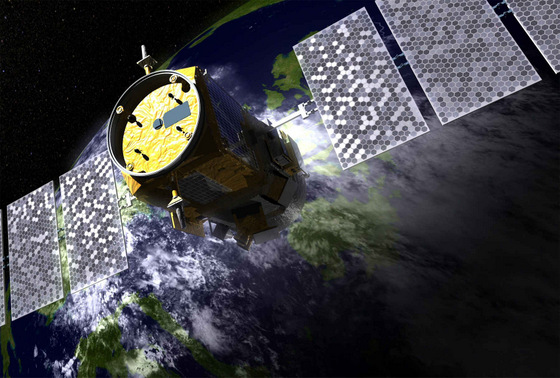

» We also like Singapore Shipping Corporation (BUY, TP SG0.59), a ship charterer group that offers both safety and growth. SSC operates in a niche segment (Pure Car Truck Carriers). Thanks to its close relationships with blue chip shipping majors such as NYK Line and Japanese banks, the group is able to secure profitable, decade-long charters for its vessels at attractive financing rates. Unlike its other shipping peers which are susceptible to the swings of the shipping cycle, SSC enjoys robust cash flows and solid earnings visibility. Management is confident of the company’s balance sheet to gear up for further vessel acquisitions. Under Ow Chow Kiat, SSC has an excellent track record of reading the shipping cycle, disposing of its shipping fleet before the 2008 peak and distributing some USD200m in dividends to shareholders. The current expansion phase over the last 2 years is funded primarily by debt. We will be acquiring 500,000 shares of the group at SGD0.290.  "We expect a strong 2H15 to more than offset the loss in 1H15. We expect a strong turnaround in FY16..." -- RHB Research» We are also adding Global Invacom, which has been severely beaten down alongside the rout in the market. Our tech analyst Jarick Seet likes the company for its strengths as a manufacturer-cum-supplier of satellite TV and cable peripherals products. YTD, the stock is down 65% due to a series of one-off expenses (M&A expenses and write-down) and orders pushback. Our recent channel checks with its suppliers indicate that order flows are still heathy. We expect a strong 2H15 to more than offset the loss in 1H15.

"We expect a strong 2H15 to more than offset the loss in 1H15. We expect a strong turnaround in FY16..." -- RHB Research» We are also adding Global Invacom, which has been severely beaten down alongside the rout in the market. Our tech analyst Jarick Seet likes the company for its strengths as a manufacturer-cum-supplier of satellite TV and cable peripherals products. YTD, the stock is down 65% due to a series of one-off expenses (M&A expenses and write-down) and orders pushback. Our recent channel checks with its suppliers indicate that order flows are still heathy. We expect a strong 2H15 to more than offset the loss in 1H15.

We expect a strong turnaround in FY16, due to: 1) demand surge from new satellite launches 2) potential Skyware turnaround 3) cross-selling of products and 4) a new generation product. Our SGD0.45 TP (implying a FY16F P/E of 9.8x), represents 200% upside potential return from current depressed levels. The stock is trading at an ex-cash FY16 P/E of 1.6x (net cash is equivalent to about 60% of market cap). We will be buying 700,000 shares at SGD0.142.

|

» K1 Ventures is a workout situation which we initiated 2 years ago. After a failed management buyback in 2012, the company embarked on a divestment track and has been unwinding its assets and distributing sales proceeds. To date, the group has distributed 12 cents/share in the past 2 years. The group recently declared a 1.5 cents/share payout via a capital reduction after announcing its full year results. Separately, it received an additional US$61.5m from KUH, its education-related investment in the U.S., after KUH’s 65%-owned subsidiary Knowledge Universe Education (KUE) sold its U.S childcare operation in August. |

Full report here.