Riverstone CEO Wong Teek Son chats with analysts. In the background is CFO Lim Sing Poew (in blue long-sleeved shirt). Photo by Leong Chan Teik

Riverstone CEO Wong Teek Son chats with analysts. In the background is CFO Lim Sing Poew (in blue long-sleeved shirt). Photo by Leong Chan Teik

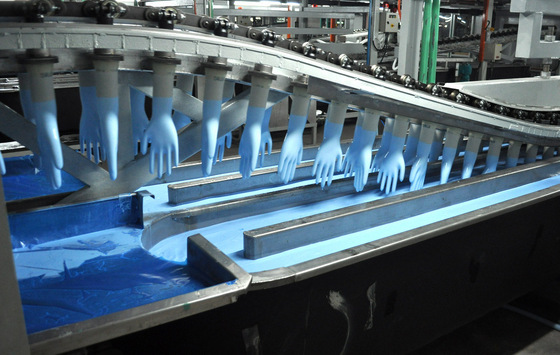

AFTER A sterling 2Q, Riverstone Holdings moves into another sweet spot -- the start of production of a new factory (Phase 2 of an expansion programme), which will add one billion gloves to the company's production capacity.

|

For 2Q this year, Riverstone saw the benefit of the production of the new factory under phase 1: Revenue rose 33.2% to RM129.0 million. And net earnings jmped 68.1% to RM27.0 milion.

To recap, Riverstone saw a 1.1-billion capacity rise from end-2014 to 4.2 billion currently.

The second new plant -- whose construction was accelerated to meet increased customer demand -- will boost the capacity to 5.2 billion by the end of this year (2015).

Just like the first plant, indications from the Riverstone management are that the new capacity will enjoy high utilisation rates.

Aside from volume growth, Riverstone has been benefitting from a rise in the USD against the ringgit as it sells in USD and incur operating costs in ringgit.

Despite higher capex spending for phase 2 and phase 3 plants, Riverstone generated RM16m positive free cash flow in 2Q15. Solid stock gains in the last 4 years. Chart: FT.comThe share price has exceeded $1.80, a new record level for the Malaysian-based company. The trailing PE is close to 20X while the dividend yield is 1.44%.

Solid stock gains in the last 4 years. Chart: FT.comThe share price has exceeded $1.80, a new record level for the Malaysian-based company. The trailing PE is close to 20X while the dividend yield is 1.44%.

Here are excerpts from the Q&A session which Riverstone CEO Wong Teek Son and CFO Lim Sing Poew had with analysts last week:

|

Q: What was the total shipment and utilisation rate for 2Q2015? A: Breakdown of costs: Raw material prices: 35 – 40% Labour: 15 – 17% Fuel: 10 – 12% Chemicals: 7% Utilities: 8% Every year our labour costs increases by about 5 – 8%. Raw material prices are quite stable and we do not expect much changes in price till the end of this year. There is also an increasing trend in unit costs for gas by about 10%, which also results in the increase in unit costs for biomass. To counteract this, we are trying to make our production processes more efficient in order to reduce wastage. Q: What does your order book like for 2H2015? Q: Could you provide us with updates on Phase 3? Q: Is there any change in the CAPEX for Phase 3? A: CAPEX will be RM76 million. Q: Are you confident in filling the new capacity for the 2016 expansion?

A: We are targeting new customers from both the healthcare and cleanroom segment. Q: Can you explain more about the new Cleancare & A Clean glove products mentioned? A: We launched these two products last year. They are our lower end cleanroom gloves marketed under Eco Medi Glove and is used to compete with other manufacturers within the segment. They are slowly gaining popularity among customers. We chose not to use our premium RS brand to market these gloves. Q: How do the margins for these lower end cleanroom gloves compare to your premium RS cleanroom gloves? A: The gross profit margins are similar. Q: How is the competition in the higher end glove segment? A: There is less competition within this segment. Our main competitors are still Kimberly Clark and Ansell. Q: You mentioned previously that Kimberly Clark recently closed down one of its plants? A: That plant was for healthcare gloves. Q: Is the utilization rate for the whole industry generally very high or is this just unique to Riverstone? You also mentioned that you could not meet some of your orders, is this a trend you see within the whole industry as well? A: Yes, this is usually the case for the industry in general. However I am referring to the more established glove manufacturers in Malaysia (Hartalega, Top Glove etc). There are also about 30 smaller manufacturers in the industry but I am not sure how they are faring. Q: The global environment seems rather tough and some of your customers are also facing headwinds. However I notice that the glove manufacturing industry seems to be going against this trend. What is your take on this? A:The growth for the glove industry is about 8 – 10% yoy, which results in new demand of 16 billion every year. Nitrile gloves currently makes up less than 50% of the entire industry as cheaper alternatives such as PVC and latex are still more popular. However if nitrile prices and costs can be reduced to match that of PVC, we should be able to substitute this market segment. Q: How has the market share of nitrile gloves changed from five years ago till today? A: Market share for nitrile gloves is still below 50%. The change in trend from latex to nitrile gloves started in Europe and now the US has begun changing their preference as well. The regions that still use a lot of latex gloves are the Middle East, South America and Africa. Q: When can you start to claim the reinvestment tax allowance from Phase 2? A: We can start to claim the allowance once our lines start operation. We should be able to claim the allowance by 4Q2015. Q: Would you not be able to claim the allowance by 3Q2015? A: It depends on how substantial the allowance is. However we usually capture the amount at the end of the year. Q: What is the impact on Riverstone due to the weak RM in Malaysia? A: We benefit from the weaker RM. However not in its entirety as we purchase our raw materials in USD. We benefit more from the weaker RM within our cleanroom glove segment as we do not adjust the ASP as frequently. For the healthcare glove segment, we usually pass on some of our cost savings to our clients. Q: Did you see an increase in ASP in USD for July 2015? A: No we did not. There was a slight increase in terms of RM. Q: Are you confident in growing the cleanroom segment by 20% to maintain the volume ratio of 30:70? A: If everything goes smoothly, then yes. We were initially only targeting an internal growth rate of 10% but the new lower end cleanroom gloves that we mentioned above have been helping us grow the segment. However it is still difficult to predict what will happen in 2H2015. Q: Do you expect demand within the HDD segment to be back to normal going forward? A: It is back to normal as of August. The growth is slowing slightly. We expect demand for our gloves to come more from our new lower end cleanroom glove segment and other semi-con and wafer manufacturing customers. Q: Are you still able to maintain your market share within the cleanroom glove segment? A: Yes. |

Stephanie Chong contributed to this article.