Booming US construction market

In the US, there is strong replacement demand for Yongmao cranes as its economy recovers from recession.

Prior to the global financial crisis in 2008, the Group had sold close to 100 units of cranes to the US.

"Even though rental services generate higher margins, we prefer to focus on manufacturing sales for two reasons. Firstly, we do not wish to jeopardize our relationship with customers which are crane rental companies by openly competing with them. Secondly, working capital requirements for manufacturing cranes is much lower than for the crane rental business," said CFO Yap Soon Yong.

"Even though rental services generate higher margins, we prefer to focus on manufacturing sales for two reasons. Firstly, we do not wish to jeopardize our relationship with customers which are crane rental companies by openly competing with them. Secondly, working capital requirements for manufacturing cranes is much lower than for the crane rental business," said CFO Yap Soon Yong.Photo by Leong Chan Teik

"Following the global financial crisis, the property market tumbled and cranes, with no work for them in the US, were shipped out to other parts of the world," said Mr Sun.

There are currently less than 40 units of Yongmao's cranes left in the US.

"We believe the US economic recovery will renew demand for new Yongmao cranes there," he said.

The American Institute of Architects’ Consensus Construction Forecast projects that spending on non-residential construction is expected to rise 7.7% in every commercial property sector this year.

Separately, Jones Lang LaSalle projected construction growth where replacement costs have become lower than leasing, and where new facilities are needed to support sophisticated logistics strategies.

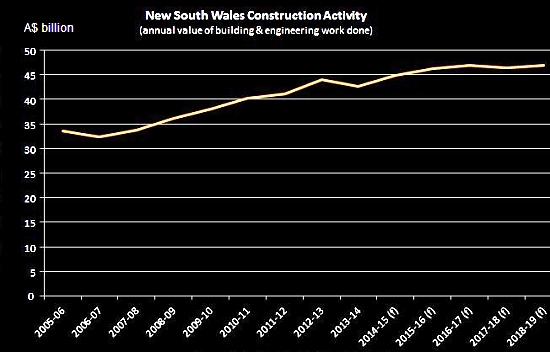

Data from Australian Construction Industry Forum

Data from Australian Construction Industry ForumConstruction output in New South Wales is expected to increase from record levels of A$42.6 billion in 2013/2014 to more than A$46 billion by 2016/2017, according to the Australian Construction Industry Forum.

The Australian government has planned major infrastructure upgrades to transform Western Sydney's economy, including the construction of a second airport in Sydney that will cost about A$4 billion.

The Group recently clinched a S$2.5 million order from Australia.

"Our people have gone into Taiwan, Australia and North America to tap on the demand potential there," said Mr Sun.