Excerpts from analysts' reports

|

OSK-DMG: Maintain buy and $1.17 TP for Lian Beng Group

Analyst:Sarah Wong

Ong Pang Aik, chairman of Lian Beng Group. NextInsight file photo.Lian Beng (LBG SP) announced that its JV company Wealth Property has won the tender to purchase a land parcel at Mandai Link Lot No. 1718L of Mukim 14) for a purchase price of SGD21.3m. Ong Pang Aik, chairman of Lian Beng Group. NextInsight file photo.Lian Beng (LBG SP) announced that its JV company Wealth Property has won the tender to purchase a land parcel at Mandai Link Lot No. 1718L of Mukim 14) for a purchase price of SGD21.3m.

Wealth intends to redevelop the property, subject to obtaining all the necessary approvals from the relevant authorities. Wealth is a 65:35 JV between Lian Beng and The Legacy Industrial (Mandai).

Lian Beng recently reported a strong set of 1QFY15 results, with net profit surging 59% y-o-y to SGD12m on the back of higher contribution from its property development projects and a robust construction orderbook of SGD1bn.

Beyond organic growth from its core construction and property development businesses, Lian Beng will also benefit from the sale of all strata-titled units in Prudential Tower and its upcoming granite supply business in Ipoh, which we expect to start contributing in early 2015. We maintain our Buy rating and SGD1.17 TP.

Recent story: LIAN BENG: Stock price decline stemmed by share buyback

|

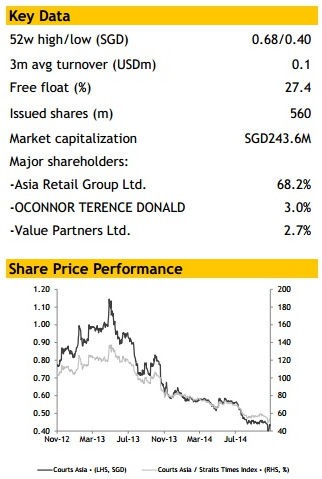

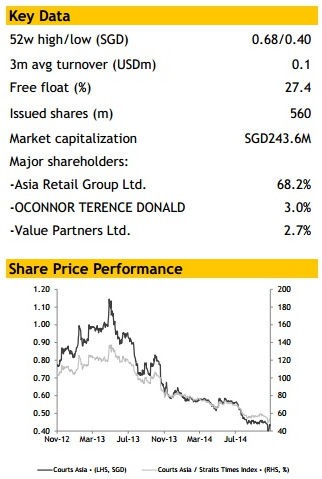

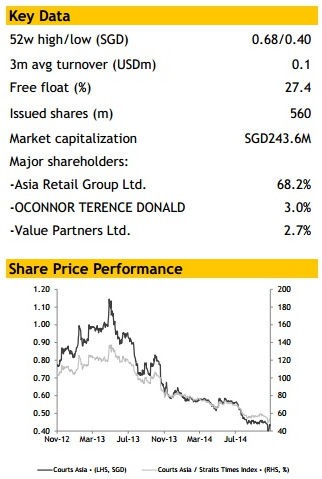

Maybank Kim Eng: "Most negatives priced in" for Courts Analyst:

Analyst: Truong Thanh Hang

(left)

Not pretty for core markets

Core markets are expected to remain weak due to poor consumer sentiment. 1HFY15 sales in Singapore plunged 15% YoY. Malaysia’s failed to pick up despite Hari Raya celebrations. In fact, revenue fell 10% YoY in 2Q, as the effects of its earlier credit campaign faded. With Malaysian GST introduction still ahead and Singapore property prices slipping further, demand in both markets is expected to remain lacklustre

.

But Indonesia is new hope

Courts opened its first megastore in Bekasi, Indonesia in Oct 2014. It plans to open two more stores in Indonesia next year. We visited the store recently and left feeling more optimistic. Management shared that Indonesia’s revenue contributions have the potential to match 30% of Malaysia’s revenue by FY3/16 or ~8% of group revenue, based on expected PSF sales and further store expansion.

Cutting costs to prop up bottom line

Courts has taken extreme measures to prop up its bottom line. It has cut its workforce by 10%, closed loss-making branches, rationalised its tradeshow schedule and outsourced lower-value operations. Early results are encouraging. Gross margins rose from 29.5% in 1HFY14 to 32.7% in 1HFY15.

HOLD: Most negatives priced in

We cut FY15E/16E/17E EPS by 36%/28%/6% for lower sales. This lowers our TP to SGD0.40 from SGD0.52, based on 8x FY16E-17E EPS, on par with Malaysia-listed AEON Credit Services. Maintain HOLD as we believe most of the negatives are in its price.

Analyst: Truong Thanh Hang (left)

Analyst: Truong Thanh Hang (left) .

. NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

Analyst: Truong Thanh Hang (left)

Analyst: Truong Thanh Hang (left) .

.