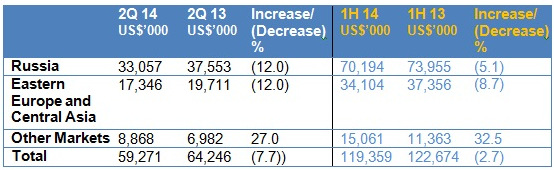

Above: Food Empire's revenue by region.

Above: Food Empire's revenue by region.

For 2Q2014, Group profit after tax was US$2.6 million, a decrease of 29.2% year-on-year. For 1H14, the net loss was US$0.5 million.  Chin Tze Ting of Food Empire. NextInsight file photo.

Chin Tze Ting of Food Empire. NextInsight file photo.

DESPITE THE civil strife in Ukraine and the depreciation of the Ukranian and Russian currencies, Food Empire has continued to sell its instant coffee there virtually unaffected.

"In terms of volume and in local currency terms, our sales have in fact gone up by 2-10%," said Chin Tze Ting, personal assistant to the chairman of Food Empire, in a meeting with NextInsight last week.

And the higher sales have happened despite Food Empire upping its retail selling prices by 3-5% this year.

But when converted into USD, revenues have fallen because of a fall in the value of the local currencies, resulting in forex losses.

In 2Q, the Ukrainian currency (Hryvnia) fell 30-40% year-on-year while the Russian ruble, about 10%. The Ukranian currency-USD exchange rate was 1:0.12 at the start of this year. Recently, it's just 1:0.074. Chart : Bloomberg"The currency depreciation in our two major markets accounts for most of the fall in our sales value," said Mr Chin.

The Ukranian currency-USD exchange rate was 1:0.12 at the start of this year. Recently, it's just 1:0.074. Chart : Bloomberg"The currency depreciation in our two major markets accounts for most of the fall in our sales value," said Mr Chin.

Going into 3Q as various sanctions are imposed on Russia by various countries and vice-versa, Food Empire sales in Russia and Ukraine are steady still, he added.

Food Empire does not import ingredients (coffee powder, non-diary creamer and sugar) from the sanctioning countries, so there is no disruption to the supply chain that it depends on for its manufacturing of instant coffee in Russia and Ukraine, said Mr Chin.

Neither are Food Empire's exports of finished products -- instant coffee packaged by its plants elsewhere -- to the two markets affected by the sanctions.

For now, the conflict has been confined to the eastern part of Ukraine and is quite a distance away from Food Empire's manufacturing facility in the southern part of the country.

(For pictures and a report on the opening of this factory in 2012, see: FOOD EMPIRE Opens Its First Manufacturing Plant In Ukraine)

On why sales of 3-in-1 beverages have not been impacted, Mr Chin ventured that drinking instant coffee is part and parcel of daily life for many people, who might cut back on luxuries.

In Ukraine, Food Empire has about 40% share of the instant coffee market with its MacCoffee and Petrovskaya brands. Another two players -- Kraft and Nestle -- command in aggregate more than 50%.

In Russia, Food Empire's market share is more than 50%. In Myanmar: Food Empire's MacCoffee brand of instant coffee being offered for sampling. Photo: Wunna Htun (Facebook)Other markets: 33% growth in 1H

In Myanmar: Food Empire's MacCoffee brand of instant coffee being offered for sampling. Photo: Wunna Htun (Facebook)Other markets: 33% growth in 1H

As can be seen in the table at the top of the page, Food Empire's revenue from "other markets" grew sharply in 1H14 by 32.5%.

But in absolute dollars, the amount of US$15.1 million is still relatively small and as a whole, "other markets" is only marginally profitable as some specific markets are loss-making while others, profitable, said Mr Chin.

China is looking the most promising among these new markets with Food Empire focusing on Guangzhou, Shanghai and Beijing where its products are sold through hypermarts, he said.

For Food Empire's 2Q financial statement, click here.

Recent story: @ Food Empire's AGM: Updates on greenfield projects and more....