NRA Capital maintains 19-c fair value for Serial System

Analyst: Jacky Lee (left)

Analyst: Jacky Lee (left) Earnings in-line with expectation. Serial's 2Q14 net profit of US$5.0m was in line with our net profit forecast of US$4.9m (including the US$1.38m exceptional gain on the disposal of its 13.6% stake in Jubilee Industries Holdings). However, other key variance included higher-than-expected finance costs and taxation but offset by lower-than-expected other expenses.

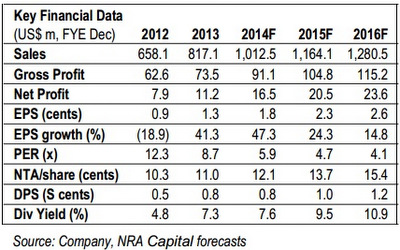

We maintain our FY14-16 net profit forecast and fair value at S$0.19, still pegged at 8x FY14 PER. Maintain Overweight with 36% potential upside and generous dividend of 8-11% projected.

Sales continue to outpace the industry growth by increasing 28% yoy to US$263m in 2Q14, led by North Asia market (+30% yoy). Greater China revenue grew 47% yoy driven by expansion of major product lines to cater to strong demand in the smartphones, household appliances and consumer electronic sectors and 25% rise in Taiwan’s revenue due to the growth of major product lines, supported by addition of new customers.

Gross margins slid by 0.6% pt yoy to 8.6% in 2Q14 as a result of higher volume of lower-margin components. Mobile devices now account for more than 15% of the group’s semiconductor turnover, which increased significantly from 6.5% in 1Q13.

Gross margins slid by 0.6% pt yoy to 8.6% in 2Q14 as a result of higher volume of lower-margin components. Mobile devices now account for more than 15% of the group’s semiconductor turnover, which increased significantly from 6.5% in 1Q13. Balance sheet remains healthy. S$28m negative free cash flow generated in 2Q14 due mainly to higher working capital requirement. As a result, net gearing increased from 95% as at end-Mar quarter to 118%.

We believe the credit risk is mitigated as the group has purchased credit insurance covering the majority of its customers in the electronic components distribution business. The board declared a higher 0.3 cts interim dividend.

Recent story: SERIAL SYSTEM to acquire GSH businesses; TECHNICS wins contracts

|

|