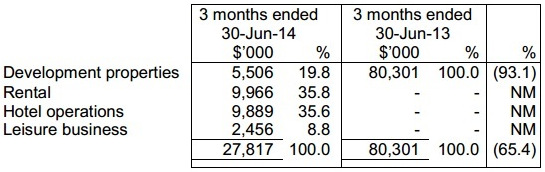

Very contrasting quarters: From relying totally on property sales and construction work in 2Q last year, Hiap Hoe's 2Q2014 saw a plunge in revenue from the "development properties" segment. But there were contributions from new segments, as a result of its acquisition of sister company Superbowl and investment properties in Australia.

Very contrasting quarters: From relying totally on property sales and construction work in 2Q last year, Hiap Hoe's 2Q2014 saw a plunge in revenue from the "development properties" segment. But there were contributions from new segments, as a result of its acquisition of sister company Superbowl and investment properties in Australia.Sumer, who is regarded as the resident guru in the NextInsight forum on property stocks, posted the following this morning in the Hiap Hoe thread:

AS EXPECTED, there is nothing to worry about with regards to the loss, as it consists of one-time charges and/or timing of expense reporting.

Hiap Hoe reported S$9.9m in revenue from hotel operations in Zhongshan Park in Balestier in 2Q2014. NextInsight file photo.$9.2m was attributed to admin expenses for the Superbowl exercise (although I have no idea what this is), $3.9m depreciation of Aussie property acquisition, and $5.5m stamp duty for its Aussie buy.

Hiap Hoe reported S$9.9m in revenue from hotel operations in Zhongshan Park in Balestier in 2Q2014. NextInsight file photo.$9.2m was attributed to admin expenses for the Superbowl exercise (although I have no idea what this is), $3.9m depreciation of Aussie property acquisition, and $5.5m stamp duty for its Aussie buy.The items are not recurring and are all lumped into one quarter’s results. Nothing sinister.

There was also very little revenue recognition from Waterscape this past quarter, with only 1.67% taken into its books. This adds further to its poor results.

In any case, Hiap Hoe is not an earnings-story for these couple of years, so “poor” results are not unexpected. It probably has some earnings meat left in Waterscape, but after that, it will have to wait for its Aussie profits to kick in from 2017.

However, unlike stocks which stand only on their earnings projections, asset-rich counters like Hiap Hoe (current NAV $1.54) are unlikely to plunge on poor earnings alone.

My personal estimate of Hiap Hoe’s RNAV (not taking into account its Aussie projects) is about $1.70-80 (mainly from unrecognized Waterscape profits and surplus valuation of Superbowl’s commercial spaces).

However, I am not expecting good dividend payouts unless the company is successful in selling Treasure at Balmoral or its Superbowl assets.

Yesterday, the company also released information (although skimpy) on sales at Marina Tower Melbourne. It said sales there had hit about S$150m, without giving details on the number of units sold, selling prices, etc. Nevertheless, sales Down Under are much better than for its projects in Singapore.

Recent story: SUMER: My latest take on 5 property counters