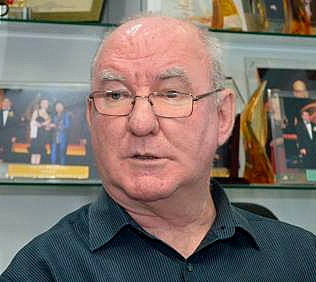

At Sinwa's 1QFY2014 results briefing, CEO Bruce Rann explained how Sinwa's dominant market position helps it get big contracts in a fiercely competitive industry. Photo by Sim Kih

At Sinwa's 1QFY2014 results briefing, CEO Bruce Rann explained how Sinwa's dominant market position helps it get big contracts in a fiercely competitive industry. Photo by Sim Kih

THE INCREASE in offshore support vessels in the Asia Pacific region is unlocking huge growth opportunities for marine and offshore supply and logistics players, but it is primarily sizable players like Sinwa Limited that will benefit.

Sinwa is the largest of 5 marine and offshore supply and logistics players that dominate about 65% of the Asia Pacific market.

The other 4 players are large multinational companies: Fuji Trading (Japanese), Wrist (Danish). HMS Group (German) and EMS Seven Seas (Norwegian / Middle Eastern).

Traditionally, about three quarters of Sinwa’s revenue came from the supply of technical stores such as parts used on the vessel deck, in the engine room, electrical peripherals accessories, safety equipment and tools.

The remaining one quarter came mostly from the supply of food provisions, which range from fresh, frozen and dried food to food ingredients.

The 24-7 nature of the marine & offshore supply business is an important barrier to entry, notes CEO Bruce Rann. As a case in point, just last week, one of Sinwa's largest clients placed an order worth S$185,000 and wanted it by 10am the following day. Sinwa filled the order on time. Photo by Sim Kih“Demand from large customers such as Sodexo and BP boosted our revenue contribution from food provisions to 55% during 1QFY2014,” said Sinwa CEO Bruce Rann during an investor meeting on Friday.

The 24-7 nature of the marine & offshore supply business is an important barrier to entry, notes CEO Bruce Rann. As a case in point, just last week, one of Sinwa's largest clients placed an order worth S$185,000 and wanted it by 10am the following day. Sinwa filled the order on time. Photo by Sim Kih“Demand from large customers such as Sodexo and BP boosted our revenue contribution from food provisions to 55% during 1QFY2014,” said Sinwa CEO Bruce Rann during an investor meeting on Friday.

Sinwa’s Group revenue increased 6.5% year-on-year to S$36.0 million for 1FYQ2014, thanks to an enlarged customer base for its marine, offshore supply and logistics business.

Profit attributable to shareholders increased 30.9% to S$3.8 million, as it had hived off its loss-making engineering business.

For more information on its financial results, click here.

Sodexo is one Sinwa’s largest clients and a global leader in food catering services.

From catering for 7 to 8 offshore facilities in the Gulf of Thailand about 18 to 24 months ago, Sodexo now caters for 23 such facilities there.

An oilrig has a crew of about 250 people instead of 60 like on a ship. Thus, each new contract for an oilrig amount to a surge in turnover volume of marine supplies.

As a result, Sodexo can no longer deal with smaller marine & offshore supply players.

It needs a leading player like Sinwa (which is already supplying to Sodexo out of Singapore and Australia) to provide professional, accredited and efficient service, with a process that is transparent and traceable.

Marine and offshore vessel operators are increasingly demanding a shorter turn-around time, and have even placed orders as frequently as short as 4 times a day, instead of once in two days.

Here's where small players lose out as they are not able to double their storage, capacity and supply on short notice.

Sinwa has many competitive advantages that smaller players lack. This includes accreditation (ISO 9001, 14001 & OHSAS 18001), ability to handle large contracts on short notice and supply at a regional level.

Such competitive advantages are only possible with the necessary supporting infrastructure such as warehousing and a large enough fleet of delivery vehicles, as well as sufficient manpower.

Sinwa serves more than 100 ports from offices and warehouses in Singapore, Malaysia, Australia, China and Hong Kong.

|

We are building new warehousing and expanding our refrigeration capacity so that we can directly import chilled foods such as Australian meat. |

Recent story: SINWA: FY13 Profit Jumped To $6.8m On Divestment of Non-Core Businesses