Analysts check out a part of HanKore's water-treatment facility. File photoHSBC Global Research says China Everbright not ruling out HK listing for HanKore

Analysts check out a part of HanKore's water-treatment facility. File photoHSBC Global Research says China Everbright not ruling out HK listing for HanKoreAnalysts: Thomas Zhu, CFA, and Anderson Chow

We hosted China Everbright International (CEI) for an NDR (non-deal road show) after its 2013 annual results. Mr. Raymond Wong (CFO) and Ms. Grace Lee (Director of IR) attended our meetings.

CEI is still doing due diligence for the HanKore (BIOT SP, not rated) acquisition and CEI intends to become the controlling shareholder of HanKore.

Management likes the assets of HanKore as they are mostly located in the areas where CEI has a presence and therefore there are synergies between HanKore and CEI.

CEI said it does not rule out the possibility of getting HanKore listed in Hong Kong, if the acquisition goes through.

Recent story: Post-results: Buy HANKORE, GOODPACK, say analysts

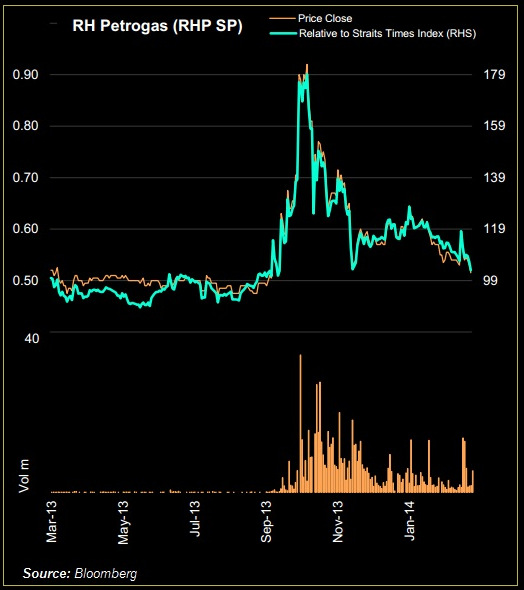

OSK-DMG says RH Petrogas is deeply undervalued

Analyst: Lee Yue Jer & Jason Saw

With its balance sheet cleaned up, RH Petrogas (RHP) is starting FY14 on a clean slate. Its current ~4,300boepd production is up from FY13’s 4,130boepd average, with three more wells starting production in March.

Adjusted FY13 EBITDAX is USD33.2m (+7% y-o-y).

With this cash flow and USD52m cash in hand, RHP has enough funds up to late-FY15. Its assets remain deeply undervalued. Maintain BUY and SGD1.23 TP.

Assets remain deeply undervalued. Its valuations suffered from the Oct 2013 small-cap saga fallout and investors’ over-reaction to its dry holes.

We see at least SGD0.77/share in liquidation value and, based on our NPV-and-risking model, our TP remains at SGD1.23.

RHP is the alpha Top Pick in our oil & gas universe and remains on track to upgrade 19m barrels of oil equivalent (mmboe) of 2C to 2P reserves, trebling the 2P figure.

Recent story: Analysts: "Buy RH Petrogas And Rex International On Sell-Down"