KevinScully, executive chairman of NRA Capital. Photo: CompanyMidas Holdings, one of My Stock Picks, has delivered a good set of FY2013 results with net profit of RMB47.7mn, up 67.2%

KevinScully, executive chairman of NRA Capital. Photo: CompanyMidas Holdings, one of My Stock Picks, has delivered a good set of FY2013 results with net profit of RMB47.7mn, up 67.2% The results show that the Group is slowly moving back and on the way to fully recover.

Don't forget that Midas reported a loss in Q1-2013 of RMB4.9mn.

Q2 2013 saw the group return to the black with profit of RMB14.9mn.

Q3 2013 saw Midas' profit rise again to RMB16.4mn.

This would mean that it made about RMB21.3mn in Q4-2013.

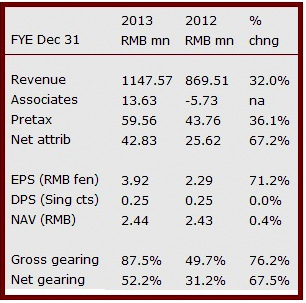

The table below summarises the FY2013 results.

Going forward, the company has indicated that it remains optimistic about the outlook for the rail sector in China despite the slower GDP growth.

The Chinese Government is targetted to spend RMB630bn in 2014.

"Outlook for the PRC rail transportation industry is expected to remain vibrant, notwithstanding the anticipated slow-down in the PRC’s economic growth to 7.4% in 2014.

"Outlook for the PRC rail transportation industry is expected to remain vibrant, notwithstanding the anticipated slow-down in the PRC’s economic growth to 7.4% in 2014. "The Government’s continued support to grow China’s transportation network will see the China Railway Corporation (“CRC”) making approximately RMB630 billion in railway fixed-asset investment in 2014.

"The PRC metro sector is also expected to grow, as local bureaus of the National Development and Reform Commission have continued to fast-track approvals for new metro projects. Presently, a total of 36 Chinese cities have approved plans to build new subway lines and the total urban rail network is targeted to grow to 3,000 km by 2015, and 6,000 km by 2020.

"According to the country’s 12th 5-year plan for railway development, China will have around 123,000 km of railways in operation by 2015, including 18,000 km of high-speed railways and an express railway network totaling 40,000 km in length.

"In line with this target, the CRC plans to build more than 6,600 km of new railway lines in 2014. As at the end of 2013, the PRC rail network has exceeded 100,000 km, with the high-speed rail network exceeding 10,000 km."

Patrick Chew, CEO of Midas, said that Midas had secured RMB812.5mn in new contracts in 2013 including its first high speed train contract since 2011.

No change in the company's dividend policy of Sing cents 0.25 interim and a final of the same amount - the same as in FY2012.

Commentary I still like Midas, it remains undervalued and now that the Chinese government has resumed its high speed rail building program, there is no reason why Midas and its joint venture partner, NPRT, will not reap the benefits. The decline of its share price from S$1.30-1.40 level was due mainly to the Chinese Government's decision to stop issuing high speed rail contracts in 2011 following a corruption investigation of the then rail minister and the subsequent Shanghai rail accident. The resumption in the issue of high speed rail contracts should assist Midas' shares in recovering their loss glory. Keep an eye on the gearing level which is inching up as Midas needs to finance its capex to meet expected demand. This can be in the form of debt and or equity.....so worth keeping an eye on. |

|

Recent story: Kevin Scully: More high-speed rail contracts on the way to MIDAS