Prior to his retirement, Chan Kit Whye worked more than 30 years as Regional Finance Director, Financial Controller and Manager in a multinational specialty chemical business. He has played an active role in CPA (Australia) Singapore Branch, taking up positions in its Continuing Professional Development and Social Committees. Kit Whye is a Fellow of CPA Australia, CA of Institute of Singapore Chartered Accountants and CA of the Malaysian Institute of Accountants. He holds a BBus(Transport) Degree from RMIT, MAcc Degree from Charles Sturt University and MBA from Durham Business School.

Prior to his retirement, Chan Kit Whye worked more than 30 years as Regional Finance Director, Financial Controller and Manager in a multinational specialty chemical business. He has played an active role in CPA (Australia) Singapore Branch, taking up positions in its Continuing Professional Development and Social Committees. Kit Whye is a Fellow of CPA Australia, CA of Institute of Singapore Chartered Accountants and CA of the Malaysian Institute of Accountants. He holds a BBus(Transport) Degree from RMIT, MAcc Degree from Charles Sturt University and MBA from Durham Business School.GOLDEN AGRI: Full-year revenue for 2013 was up 8.8% over previous year's at US$6.6 billion, but gross profit of US$1.36 billion was 15% lower.

Golden Agri-Resources is the world's second largest palm oil plantation company with a total planted area of 471,000 hectares (including smallholders) as at end-Dec 2013. Photo: CompanyOperating expenses dropped by US$111 million, or 11%, partly due to lower export tax incurred.

Golden Agri-Resources is the world's second largest palm oil plantation company with a total planted area of 471,000 hectares (including smallholders) as at end-Dec 2013. Photo: CompanyOperating expenses dropped by US$111 million, or 11%, partly due to lower export tax incurred. Lower gross margin has, therefore, contributed to lower operating profit of US$528 million, a 22% decline.

Net profit for the year was US$316 million, 24% lower.

Higher interest costs on borrowings and FX loss contributed to the decline in net profits.

Earnings per share was 2.4 cts US or 3.1 cents SGD, vs prior year's 3.2 cts US or 4.1 cts SGD.

NAV per share was S$0.87.

Total borrowings were US$2.6 billion, of which 41% are due to mature within a year. Gross debt gearing was at 29%.

Free cash flow was negative at US$500 million, contributed mainly by capital expenditure for fixed and biological assets. A final dividend of 0.515 cents has been proposed.

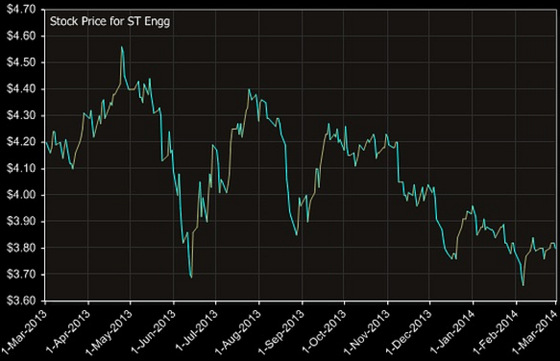

ST ENGINEERING: For the full year 2013 vs 2012, ST Engineering reported revenue growth of 4% to $6.63 billion. The bulk of the growth came from its mrine segment which contributed 90% of the total revenue growth and 22% of the marine segment growth. Profit from operations was up by 2.3% to $673 million. Profit after tax was $592 million which was 2.5% higher than previous year. Profit attributable to shareholders was flat at $581 million. Earnings per share was 18.7 cents which is similar to previous year's.  ST Engg ($3.80) has a trailing PE of 20X and a market cap of S$11.8 billion. ST Engg ($3.80) has a trailing PE of 20X and a market cap of S$11.8 billion. Chart: Company website Free cash flow per share was 20.8 cents, lower than previous year's 26 cents. A final dividend of 12 cents was proposed, giving a total dividend for the year of 15 cents. Previous year's total dividend was 16.8 cents. The final dividend will be paid on 20 May 2014. At the current price, the total dividend yield is 4%. Not good enough for me. But that 12 cents is equal to 3.1% yield on an annual basis. So if the share price goes up 12 cents from current level, cum-dividend, I may sell. Between the time I bought ST Engineering and the time I decide to sell in future is less than 6 months, so the annualised yield should be more than 5%. However, if the future prospects of ST Engg is bright, then I will keep the share for longer term. I am comparing ST Engg and SPH to see which has a brighter future, because I switched my portfolio from SPH to ST Engg. Should I switch back from ST Engg to SPH by selling off ST Engg when it trades cum-dividend? I need to do some homework to compare both to see which one has a better future and potential for dividend growth. |