Time & date: 9.30 am, 28 Jan 2014

Time & date: 9.30 am, 28 Jan 2014

Venue: Orchid Country Club

A NextInsight reader, who is a shareholder of Nam Lee Pressed Metal, asked if we could attend the AGM as his proxy and raise certain questions. We obliged.

Surprisingly, the shareholder turnout was good despite the AGM location being not easily accessible by MRT or bus. Some two dozen shareholders were there, including two investors we know -- and their names appear in the top 20 shareholders' list in the annual report.

And the shareholders were anything but reticent in wanting to understand the company which, for FY2013 ended Sept, reported a 10.1% rise in turnover to S$155.2 million but a 56% fall in net profit attributable to shareholders to S$8.9 million.

This profit fall was the subject of a number of shareholder questions -- along with the perennial request for a higher dividend payout.  Shareholder Ng Kwong Chong owns 1.4 m shares of Nam Lee Pressed Metal.

Shareholder Ng Kwong Chong owns 1.4 m shares of Nam Lee Pressed Metal.

File photoNam Lee proposed to pay 1.5 cents a share in dividends (down from 2 cents a share for FY2012) which is a 40% payout on its FY2013 earnings.

Shareholder Ng Kwong Chong, who holds 1.4 m shares (as listed in the annual report), asked the board to consider raising the payout ratio to 50%.

"At 50%, the balance sheet, which is totally ungeared, will still look very nice with a lot of cash. Think about shareholders since you cannot invest the cash very profitably by buying bonds," he said.

Here are some takeaways from the meeting. Except in one instance, all the answers (below) to shareholders' questions came from Lim Hock Leong, General Manager of Nam Lee Pressed Metal.

Note that by "industrial products", he was referring to aluminium frames which Nam Lee produces for container refrigeration units of a particular MNC customer (which is not named in the annual reports or quarterly financial statements).

Q: Gross profit fell due to a project. Was that unexpected or did you submit a low bid? Was the higher 3Q and 4Q revenue due to this project?

A: The project suffered cost over-run which affected not only Nam Lee but other contractors involved in the project. Nam Lee's bid had factored in a profit but in the end it incurred a loss. And yes, the project did contribute to the higher revenue in 3Q and 4Q. (Management did not want to name the project. We believe it was the construction of JEM mall which suffered from a series of incidents including the collapse of a 50-m portion of its ceiling).

Q: Did this project contribute to the higher trade receivables as at end-FY2013 (S$40.5 million) compared to the a year earlier (S$24.6 m)?

A: No, the higher trade receivables were due to industrial products. There was a delay of a few weeks in the payment.

Q: Does the company have any problem collecting from contractors?

A: So far no problem. We are quite selective -- we work only with main contractors we have long term relationships with and we know their financial positions.

Q: Of the past five years, FY2013 had the worst profit margin and FY2012 had the best. Can you generalise and say what products give good margins and what don't?

A: The margin for industrial products is consistent and stable, and we do mass production. For projects, the margins depend on how aggressively you want the project, the site management, how much you can control costs.

Q: For the account receivables which were over 90 days, as in the annual report, how much has been collected?

Financial controller Hong Pay Leng replied: Almost 100%.

Q: What is the breakdown in revenue between projects and industrial products?

A: For last financial year, it was 60-40.

Q: In FY2012, the annual report said that the economic crisis in Europe affected Nam Lee's results. How can that be so when 98% of your sales are in Singapore?

A: Almost 100% of our industrial products are delivered to a customer in Singapore who will export them out.

Q: There's a build-up of inventory since 3Q. How long is it before inventory is used?

Our inventory used to be low because our customer was changing the product design. We cleared out the inventory to almost zero. With a new product model, we have built up our inventory. For products, we normally keep about 3 months of inventory. For projects, it depends on how fast the projects run and depends on the products -- aluminium, or glass, etc. Different products require different lead times.

Q: The annual report refers to the Group's "building products business bracing for a negative impact due to a slowdown in Singapore's property market coupled with an increase in competitors." If the property market is slowing down, why are there more competitors?

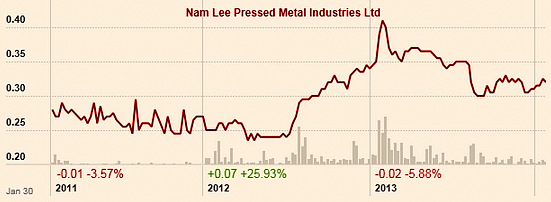

A: Building products are used for HDB flats. Everyone knows that HDB has ramped up the construction of its flats in the last two years and many competitors have come into the market. Last year-end, the HDB announced it would be slowing down its building programme. At 32 cents recently, Nam Lee stock trades at a PE ratio of 7.85 and dividend yield of 4.6% and sports a market cap of S$77 million. Chart: FT.com

At 32 cents recently, Nam Lee stock trades at a PE ratio of 7.85 and dividend yield of 4.6% and sports a market cap of S$77 million. Chart: FT.com

Q: On dividends: In FY2011, the earnings per share was 4.78 cents and dividends was 1.5 cents. In FY2010, the EPS was 4.37 cents but the dividend was higher at 2 cents. Is there an explanation for this?

A: We have a dividend policy of paying about a third of earnings. We also take into account the cash we have, our cashflow and our future capex commitments. For the last 4-5 years, we have paid out about 30+% every year.

Q: There was a more than 100% jump in salaries and bonuses, excluding directors' emoluments. Please explain.

A: It's mainly due to higher labour costs arising from a project's overrun. It's a one-off.

Q: The company has just bought a property in Sg Kadut with a lease that expires in 2019. Is there a more permanent home for the business?

A: Our objective is to move most of our operations to Malaysia where we have 4 factories and we are looking for another one. Singapore will have operations for only urgent projects and R&D. The new Sg Kadut property has about 6 years lease and we can apply to extend for another 6 years.

Q: The company has bought some bonds. What's the management's thinking in using $6.1 million to buy bonds at a time when interest rates will rise and impact bond prices? The bonds mature at the earliest in 2020.

A: We had a lot of cash -- over $50 m -- last year and decided to earn 2-3% from the bonds, instead of close to 0% in bank deposits. We will not hold the bonds to maturity -- we know that interest rates will go up.

Q: How much will you spend on renovating the new Sg Kadut property and how much will you save on rental on the property in Senoko that will be vacated?

A: For Senoko, we are paying $120-140K a month in rental. (Nam Lee has ceased to own the premises as its lease expired in June 2011 but subsequently entered into an operating lease that will expire in June 2014). For Sg Kadut, we are paying $30K a month in ground rent. We will spend not more than $1 m to upgrade some facilities there.  Nam Lee is the only third-party manufacturer of aluminium frames for container refrigeration units for a MNC. Photo: Carrier Q: For industrial products, how steady is your business in terms of size and profit margin and forex risk?

Nam Lee is the only third-party manufacturer of aluminium frames for container refrigeration units for a MNC. Photo: Carrier Q: For industrial products, how steady is your business in terms of size and profit margin and forex risk?

A: The forex risk and material escalation costs are borne by the customer. The profit margin is reasonable considering it's mass production and the model change is not frequent and we get long-term business from the customer. In the past years, this business has contributed to our bottomline. Our products are used in the container shipping industry and my customer is the world leader with more than half of the world's market -- and we are its sole supplier.

Q: If I'm not mistaken, the contract with this customer has expired. Can you update us on the new contract?

A: It expired in Dec 2014. We sign 5-year agreements and the draft for the new one is on my table -- we are going to change certain clauses and will sign after that.

Q: The average age of the directors is pretty high. Can you tell us about the company's succession plan?

A: We have identified certain key employees in their 40s as our possible future leaders. Also, our three founders have children who are working in the company starting as executives and then as managers.

Previous article: NAM LEE PRESSED METALS: Its large cash holding down by half in 9 months

6 million purchase of property plus 1 million furnishing at Q1, 2014 capex is already at its peak for the past 7 years. Think we can forget about good special dividends beyond 2 cents.

Although I think it's quite confirmed that contract will be renewed, it mentioned inventory fr new design, carrier natural cool series 3 is out in 2013 Q1, if they are building and increasing inventories for this series 3, most prob it is status quo