CIMB asks: Is privatisation on the cards for Biosensors?

Analyst: Gary Ng

Chart: BloombergShare price volatility and enlarged trading volume of late have caught the attention of many investors.

Chart: BloombergShare price volatility and enlarged trading volume of late have caught the attention of many investors. It is now harder for earnings to make any meaningful impact in the next two quarters and its bombed-out valuation and change in ownership suggest that the stock is no longer well owned.

We think that the new shareholder, CITIC, could seek to enhance its investment value through more active participation, potentially even taking the company private.

We keep our EPS estimates and SOP-based target price. We also keep our contrarian Add rating, which hinges on the instant success of product launches, regulatory approvals and M&A accretion.

What Happened: After CITIC group backed CB Medical, took over from Shandong Weigao as the substantial shareholder (S$1.05/share for a 21.7% stake in BIG) in late Nov 13, BIG’s share price has seen unusual volatility on the back of rising liquidity.

What We Think: Volatile share price movements aside, we reiterate our view that PE investors tend to explore various options where their companies have successful franchises but trade below market multiples. There could be a rethink about whether to keep BIG listed or, at a later stage, whether to relist BIG in another market, where there is better appreciation of a medical platform company.

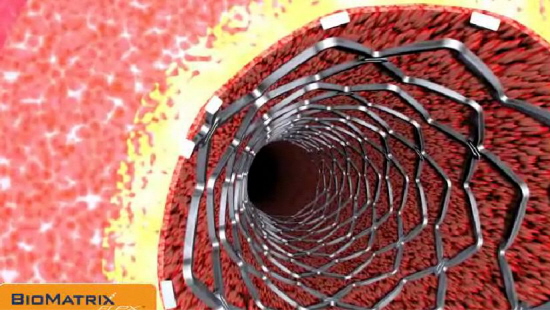

Biosensor's drug-eluting stent is used by surgeons to treat diseased coronary arteries. Image: companyWhat can cash do? Based on the latest reported financials, BIG still has S$238m in net cash and, more importantly, US$512m in cash. Granted that a large part of US$274m in loans are from the MTN (US$240m at a 4.875% fixed rate due in 2017), BIG has yet to reach its ceiling of US$800m. Given that working capital needs are typically in the US$10m range, there is really not much need for cash at the moment.

Biosensor's drug-eluting stent is used by surgeons to treat diseased coronary arteries. Image: companyWhat can cash do? Based on the latest reported financials, BIG still has S$238m in net cash and, more importantly, US$512m in cash. Granted that a large part of US$274m in loans are from the MTN (US$240m at a 4.875% fixed rate due in 2017), BIG has yet to reach its ceiling of US$800m. Given that working capital needs are typically in the US$10m range, there is really not much need for cash at the moment. At its current share price, US$500m represents c.43% of BIG’s market cap. From a financing point of view, this means that both its PE investors are very capable of funding a privatisation deal on BIG, especially given the potential of upstreaming the cash hoard. The only unknowns then are, in the event of a take-out play, price and timing.

What You Should Do: We urge investors to Add. BIG’s valuation has only priced in its near-term challenges, not a potential earnings lift from the commercialisation of new products in FY15. Other products are gaining ground with various regulatory authorities and a soft launch of BioFreedom remains a source of excitement.

Full pdf report here.

AmFraser initiates coverage of Vicom with 'buy' and target price of $6.28

Analyst: Victor Wai

Chart: BloombergVICOM Ltd has a balance of pro-cyclical and anti-cyclical business segments. Vehicle inspection (anti-cyclical) provides for earnings stability while investors may participate in economic cycle recovery provided for by its subsidiary SETSCO Services.

Chart: BloombergVICOM Ltd has a balance of pro-cyclical and anti-cyclical business segments. Vehicle inspection (anti-cyclical) provides for earnings stability while investors may participate in economic cycle recovery provided for by its subsidiary SETSCO Services. Resilient income stream. Mandatory vehicle inspections have to be conducted at any of the 9 inspection centers in Singapore. With 7 centers strategically located across Singapore, VICOM captures more than 70% of the market share.

Higher COE prices may extend the useful life of a car, thereby increasing the need for VICOM’s services.

Furthermore, regulatory changes such as stricter emission standards and the Lemon Law may boost demand for VICOM’s vehicle ancillary services.

Promoting the value of accreditation. SETSCO provides independent testing, inspection, calibration and certification services for companies across multiple industries looking to enhance consumer confidence. Increased focus on compliance with regulatory requirements and conformance to international standards will drive growth of SETSCO Services.

Strong track record. VICOM operates mainly in Singapore, but has achieved remarkable growth in both top-line and bottom-line.

In the last ten years, revenue grew at CAGR 9% while net income expanded at a pace of 14%. As long as Singapore continues to attract capital-intensive industries, SETSCO should continue contributing positively to VICOM.

Sustainable dividend yield. VICOM has been paying out more than 60% of its earnings in the last 2 years. Despite the bonus payout, the cash-rich company is able to consistently grow its cash holdings—debt-free balance sheet- at CAGR 24% in the last 5 years through FY12.

Moreover, income growth has been growing in the last 10 years.

Valuation at $6.28 using Discounted Dividend Model represents an upside of 26% from VICOM’s current share price. Our target price translates to 18.4x forward earnings, which is still cheaper than foreign-listed peers average of about 20x PE.

Previous story: VICOM: A rare 5-bagger in 5 years but....Would you buy it now?