IN HIS ARTICLE two days ago,SINO GRANDNESS: More Positive Newsflow To Come On GardenFresh IPO, Ernest Lim pointed out that Garden Fresh, which is aiming for listing in Hong Kong, may benefit from the improving prospects of China Huiyuan Juice Group and the high valuation that it fetches on the Hong Kong bourse.

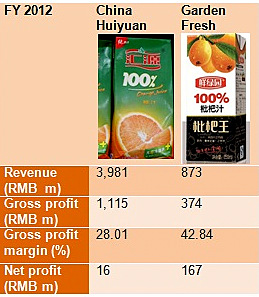

I have dug up some financial data and made a comparison between Huiyuan and Garden Fresh, which should be interesting to investors (see table).

I have dug up some financial data and made a comparison between Huiyuan and Garden Fresh, which should be interesting to investors (see table).

Despite its longer history, Huiyuan trails Garden Fresh in gross profit margin as well as net profit. There are two possible reasons for this.

Firstly, orange juice, which Huiyuan mainly sells, fetches a lower price than Garden Fresh's loquat juice, which has yet to face significant competition.

Secondly, Huiyuan's extensive network of 43 factories are running at low utilisation rates.

In contrast, Garden Fresh, whose sales were a quarter of Huiyuan's, produced from only four factories, of which three are OEM.

Most notably, Huiyuan was a bottling concern, buying orange concentrate from the firm owned by Huiyuan's Chairman.

That, however, changed dramatically in May when Huiyuan announced that it would acquire the concentrate business.

Huiyuan's stock price started rising sharply about two months after the company announced it would acquire the concentrate business from its chairman. The stock rose from HK$3.20 at the start of Aug to hit HK$5.26 recently for a gain of 64.4%. During the same period, the Hang Seng Index rose only 4.9%. Chart: Bloomberg The acquisition will play a large part in improving Huiyuan's prospects because the concentrate business is a highly profitable one.

Huiyuan's stock price started rising sharply about two months after the company announced it would acquire the concentrate business from its chairman. The stock rose from HK$3.20 at the start of Aug to hit HK$5.26 recently for a gain of 64.4%. During the same period, the Hang Seng Index rose only 4.9%. Chart: Bloomberg The acquisition will play a large part in improving Huiyuan's prospects because the concentrate business is a highly profitable one. In Huiyuan's announcement to the HK Stock Exchange, the concentrate business' sales to parties other than Huiyuan in 2012 was said to amount to RMB286 million and it reaped gross profit of RMB88 million, or a gross margin of 30.8%.

The net profit of the entire concentrate business was RMB358 million.

The sharply rising share price of Huiyuan is testament to the value that the concentrate business is expected to bring it.

Huiyuan's chairman was paid in new Huiyuan shares and convertible preference shares at an issue price of HK$3.10 apiece.

Clean slate for Garden Fresh

Garden Fresh initially relied on OEM, which buys concentrate from third parties to produce its juice drinks.

In-house production of juice and concentrate started in Sichuan only after Sino Grandness was certain of market acceptance of its loquat juice.

Thus, Garden Fresh has started on a clean slate, without interested party transactions, and this should enhance its investment merits.

It is also going further upstream.

During the recent EGM, in response to a shareholder's question on whether Garden Fresh might face a shortage of supply of loquat as its beverage business expands, the CEO of Sino Grandness replied that Garden Fresh will explore the possibility of owning loquat plantations, making Garden Fresh a fully-integrated group.

Sino Grandness is an old hand at upstream activities, having had long-standing relationships with farm cooperatives which supply vegetables for it to process for export to Europe, Mexico and Australia in the past 20 years or so.

Huge market potential awaits

Sino Grandness CEO Jack Huang checking out placards touting his company's loquat juice at a F&B trade fair in Hubei last weekend. Photo: Parry Ng/Sino Grandness.Garden Fresh is a 4-year-old start-up. Its main markets are now in Zhejiang, Guangdong and Sichuan provinces. The company intends to grow its business in Hubei, where its second juice factory is located.

Sino Grandness CEO Jack Huang checking out placards touting his company's loquat juice at a F&B trade fair in Hubei last weekend. Photo: Parry Ng/Sino Grandness.Garden Fresh is a 4-year-old start-up. Its main markets are now in Zhejiang, Guangdong and Sichuan provinces. The company intends to grow its business in Hubei, where its second juice factory is located.Even in the three existing provinces, Garden Fresh has not reached the third-tier cities. Its growth potential is therefore huge as the brand becomes more entrenched and Garden Fresh is closely identified with loquat in the same way Coca Cola is associated with the cola drink.

If Garden Fresh achieves sales of RMB 1.4b this year, and continues to enter new territories, it won't be too far behind Huiyuan.

If Garden Fresh fulfills the RMB250m profit target in 2013 set under a convertible bond agreement, and reaches RMB 300m in 2014, it will be on par with Huiyuan in profit.

I share Ernest Lim's optimism that Garden Fresh may be able to fetch a PE valuation (based on estimated 2014 earnings) close to Huiyuan's 30x.

(Ernest has pointed out that Huiyuan’s estimated net profit for 2014 is around RMB317m and the stock is trading at an estimated 2014 PE of around 30x.)

Even if Garden Fresh manages to garner a much lower PE of, say, 17x, its valuation just before the issue of new IPO shares will be RMB 5.1b (=17 * RMB 300m).

In theory, Sino Grandness' 75.3% stake will then be worth RMB 3.84b (S$768m), or $1.31 per post-split share.

(When Garden Fresh is cleared for a listing in Hong Kong, bondholders who lent to Garden Fresh will exercise their rights to convert their lendings into an aggregate stake of 24.7% in Garden Fresh.)

South China Morning Post reported on the Huiyuan acquisition of the concentrate business, as follows:

China Huiyuan Juice Group plans to acquire fruit planting and juice-concentrate-making businesses from its founder and chairman, Zhu Xinli, as it seeks to bolster investor confidence.

The company said after the market close yesterday the transaction, valued at HK$4.9 billion, would help enhance its profitability while creating a vertically integrated business model for the Huiyuan brand.

The firm now deals with only downstream businesses including bottling and sales of Huiyuan-branded products.

The acquisition of the upstream assets from Zhu could shore up Huiyuan's earnings and enhance the transparency of its business operations, the company said.

Nearly all raw juice needed by Huiyuan is now supplied by Zhu's own businesses, with the amount reaching 1.25 billion yuan (HK$1.5 billion) last year.

Huiyuan is the mainland's largest juice brand in terms of sales.

Zhu said the decision to merge with the upstream assets reflected confidence in the mainland's juice market as consumers became increasingly aware of food safety.

"Chinese people are increasingly caring more about the health benefits of different food and drinks," he said. "I am bullish about the company's outlook."

Mainlanders drink an average of about one litre of juice a year. Zhu said he hoped that would increase to 5 to 10 litres.

Under the deal, Huiyuan would use bank loans to repay HK$1.5 billion owed by Zhu's upstream businesses.

It would also issue 1.1 billion shares to Zhu at HK$3.10 each, a discount of 5.2 per cent to the stock's close yesterday.

Among the shares issued, 655.3 million are convertible preferential shares.

Zhu's stake in Huiyuan would increase to 68.3 per cent from 41.9 per cent after the deal.

The transaction, expected to be completed in the third quarter, is subject to independent shareholders' approval.

"Existing shareholders' ownership in Huiyuan will be diluted after the acquisition but they will be rewarded with an increase in the company's earnings," Zhu said.

Huiyuan reported a net profit of 16.16 million yuan last year, compared with 310.5 million yuan in 2011. Revenue rose to 3.98 billion yuan from 3.83 billion yuan.

The RMB 2,063m (determined by Maybank), based on Sino's residual 55% stake in Garden Fresh after vendor share disposal and issue of new IPO invitation shares, excludes the cash from vendor share sale. It clearly understates Sino's interests in Garden Fresh.

The IPO prospectus of Sino Grandess dated 13 Nov 2009 provides some relevant info on how the worth of Sino Grandness was determined back in 2009.

Before the IPO exercise, Huang Yupeng owned 117, 448,280 Sino shares, which was 67.05% of the number of pre-invitation shares of 175,172,414.

The IPO exercise involved the issue of 70,000,000 new shares and 15,520,000 vendor shares in Sino Grandness.

The number of Sino Grandness shares became 245,172,414 following the issue of 70,000,000 new IPO invitation shares.

As a consequence, Huang's stake in Sino Grandness decreased to 47.9%. (Huang did not take part in the vendor share sales.)

The new IPO invitation shares and vendor shares were offered for 29c apiece, giving rise to a PER of 4.9x based on 2008 historical profit.

Before the issue of new IPO invitation shares, Sino Grandness was therefore valued at $50.8m (=29c* 175,172,414 shares).

Huang's 67.05% stake then amounted to $34.06m.

Page 48 of the prospectus gives $71.1m (higher than the $50.8m) as Sino's market capitalisation based on the invitation price of 29c and post-invitation share capital of 245,172,414.

Huang's 47.9% stake post-invitation was therefore valued at $ 34.06m (= 47.9% * $71.1m), which is the same as the worth pre-invitation.

Back to Garden Fresh.

The intrinsic value of Sino Grandess' interests in Garden Fresh should therefore be determined before the issue of invitation shares. Multiplying the post-invitation stake of 55% by the pre-invitation worth ($50.8m) does not seem correct.

Subscribers of new IPO invitation shares, who are attracted by the PER of 15x, expect the money they invest in Garden Fresh will provide them a PER of at least 15x. The money raised from them will increase the worth of Garden Fresh.

................ .............. KEMB ....... SI

Profit RMB mil .... 250 ....... 300

PER ...................... 15 ........ 17

Val RMB mil ...... 3,750 ......... 5,100

SG's stake ...... 55%........ 75.3%

SG's share ...... 2,063.......... 3,840

Noted that the diff are due to SI using higher PER and higher profit. If common PER and profit are used, then SI's valuation is RMB 2,824 mil (15* RMB 250 mil*75.3%) about RMB 800 mil higher than KEMB's computation.

Why is SI's SG's stake in Garden Fresh 75.3% and not 55% per KEMB's?