Hankore's water treatment projects are up and running, and the company is seeking funds for expansion. Above: Hankore's Jiangdu City waste water treatment BOT project. Company photo

Hankore's water treatment projects are up and running, and the company is seeking funds for expansion. Above: Hankore's Jiangdu City waste water treatment BOT project. Company photoHANKORE’S MANAGEMENT is very optimistic about both the industry’s prospects as well as the company’s.

As China urbanizes and ups its water quality standards, there is increasing demand for water treatment plants.

Executive chairman David Chen is Hankore's single largest shareholder with a 16.5% stake. Photo by Ngoh Yit Sung

Executive chairman David Chen is Hankore's single largest shareholder with a 16.5% stake. Photo by Ngoh Yit Sung

“The industry is growing rapidly. From less than 400 water treatment plants 10 years ago, China now has over 4,000,” said executive chairman David Chen.

He was speaking at a meeting with fund managers and analysts last week after Hankore posted a revenue gain of 50% year-on-year to reach Rmb 369.1 million for FY2013.

For more information about its financial performance, read its media release here.

”In recent years, the government has been rolling out more stringent water treatment standards, meaning that many plants built in the past two decades need to be upgraded or rebuilt,” he said.

It also helps that water treatment offtake for all its 11 plants have been guaranteed by the relevant municipal governments.

There is also a trend of rising water tariff rates as legislation makes the required water treatment processes more complex.

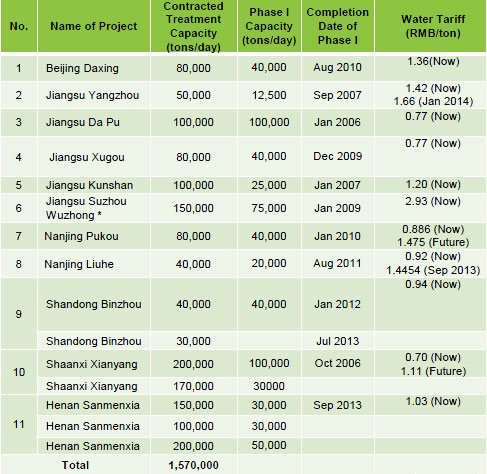

For example, the water tariff rate for phase 2 of its Xianyang Eastern Suburbs wastewater treatment plant was contracted at Rmb 1.01 per ton, compared to Rmb 0.70 per ton for phase 1.

”We have entered a high-growth phase now that all our 11 water treatment plants are into the second phase of construction,” he said.

”We are past phase one, when construction cost was higher due to investment in land and common infrastructure for our build-operate-transfer (BOT) projects.”

In February, the company won the 2012 China’s Top Ten Fastest Growing Water Companies at the Annual ChinaWaterNet Awards.

It is currently expanding and upgrading 6 out of its 11 plants.

”To drive our growth, we intend to expand our asset portfolio through acquisitions in addition to building our own plants. We will take on transfer-operate-transfer projects when we have sufficient funds,” said executive director cum CFO Felix Yau.

Below is a summary of the questions raised by fund managers and analysts at the meeting and the replies given by the management.

*In addition to 10 large scale wastewater pump stations, the Suzhou Wuzhong BOT contract includes 56km of wastewater collection pipe network. Company data.

*In addition to 10 large scale wastewater pump stations, the Suzhou Wuzhong BOT contract includes 56km of wastewater collection pipe network. Company data.

Q: When will your water tariff rates be raised?

Let’s use no.8, the Najing Liuhe project for illustration. (Refer to project listing chart above.) We started collecting Rmb 0.92 per ton X 20,000 tons a day under phase 1 when it was completed in August 2011. When we complete phase 2 this month, the tariff rate will increase to Rmb 1.4454 per ton X 40,000 tons a day.

Q: When will your projects under construction be completed?

We have 6 projects under phase 2 expansion and upgrading currently. Suzhou Wuzhong will be completed by 1Q2015. The other 4 plants will be completed by FY2014.

Q: Why do you need to build in phases?

The water treatment industry is capital intensive. We raised S$14.7 million via a placement and S$50 million by issuing bonds in August 2013 for working capital and building investments.

Instead of raising a huge sum to cover an entire project that may take a few years to build, we raise monies progressively as needed for construction.

This way, we avoid paying funding cost on external financing before it is ploughed into a project.

Q: What happens to the tariffs when you get to phase 3?

Tariffs are based on the legislated requirements for water treatment at the time of contract negotiation. CFO Felix Yau. Photo by Ngoh Yit Sung

CFO Felix Yau. Photo by Ngoh Yit Sung

Q: How much is your capital expenditure for the expansion and upgrade?

We are expecting to spend about Rmb 750 million for the expansion and upgrading of 6 plants.

In FY2013, our construction revenue was Rmb 160 million, which represents a mark-up of about 20% from cost of construction. Our revenue is benchmarked to the market rate of construction activities.

The bulk of capital spending for the expansion and upgrade will happen in FY2014.

Q: Why did you issue medium term notes in Singapore?

It is easy to obtain debt financing of 60% to 65% from local commercial banks for water treatment projects in China.

However, the loan term is very short compared to the government concession of 30 years to operate the water treatment facility. We usually need to repay the principal and interest within 5 to 7 years. This leaves us with a cash flow mismatch.

To finance the remaining 30% to 35%, we issued S$50 million in Singapore (out of a S$300 million multi-currency medium term note program). It is not possible to obtain this balance financing in China.

We hedged our currency exposure using a SGDUSD swap. So, our exposure is to the USD.

Q: What would your funding cost have been if you had issued a bond in China?

The cost would have been comparable - about 7.5% a year.

Q: What are your financial receivables of about Rmb 2 billion?

Under our non-current assets, we have financial receivables of Rmb 2.0 billion, representing monthly water tariffs which we expect to collect over the concession periods (25 to 30 years each) of our water treatment plants.

Two cost components are considered when we negotiate the water tariff rates: Capital investment for infrastructure and interest charged on financing the construction project. This interest income is booked as finance income from service concession arrangements in the top line of our profit and loss statement. The principal component is not booked as revenue. Only the interest that we charge the municipal government for providing the project financing service is booked as revenue.

Here is a hypothetical illustration of BOT accounting: The construction cost of a BOT project is Rmb 100 million. At the commencement of the project, we book construction revenue of Rmb 120 million according to progress of completion. Construction profit is booked at Rmb 20 million.

Rmb 400 million is a likely sum of financial receivables for such a project, calculated as cash flow from water tariffs due discounted at cost of capital (about 8%). Cash flow is calculated from tariff rate multiplied by capacity.

The Rmb 400 million of financial receivables are then amortized over the next 25 to 30 years, depending on the concession period.

When construction is completed, we start collecting monthly tariffs that accumulate to a total of Rmb 400 million over its concession period. This cumulative figure of Rmb 400 million comprises of Rmb 120 million in principal for project investment value plus Rmb 280 million in interest that Hankore charges the municipal government for providing the project financing service.

Q: Will you be able to pay dividends?

The company is in a high-growth stage. We will not distribute dividends during these few years.

Related story: HYFLUX, HANKORE, UEL: To Benefit From Monetary Easing