Excerpts from anaysts/ reports

CIMB initiates coverage of Singapore Kitchen Equipment with 17.3-c target

Husband-and-wife team: Alan Lee oversees the technical and maintenance service division. Sally Chua is responsible for day-to-day management decisions, overall strategic and expansion plans. NextInsight file photo SKE is an established player in the commercial and industrial kitchen solution provider industry, serving notable customers from the F&B and hospitality segments.

Husband-and-wife team: Alan Lee oversees the technical and maintenance service division. Sally Chua is responsible for day-to-day management decisions, overall strategic and expansion plans. NextInsight file photo SKE is an established player in the commercial and industrial kitchen solution provider industry, serving notable customers from the F&B and hospitality segments.

The IPO will provide greater brand visibility and credibility to further reinforce its market position.

CIMB initiates coverage of Singapore Kitchen Equipment with 17.3-c target

Husband-and-wife team: Alan Lee oversees the technical and maintenance service division. Sally Chua is responsible for day-to-day management decisions, overall strategic and expansion plans. NextInsight file photo SKE is an established player in the commercial and industrial kitchen solution provider industry, serving notable customers from the F&B and hospitality segments.

Husband-and-wife team: Alan Lee oversees the technical and maintenance service division. Sally Chua is responsible for day-to-day management decisions, overall strategic and expansion plans. NextInsight file photo SKE is an established player in the commercial and industrial kitchen solution provider industry, serving notable customers from the F&B and hospitality segments. The IPO will provide greater brand visibility and credibility to further reinforce its market position.

Poised for growth. Post IPO, SKE will be using part of the proceeds to invest in new equipment and talent training to expand its current capacity in both the fabrication and maintenance segments.

This places SKE in a favourable position to ride on the growth of the local F&B and hospitality segments following the recovery of the Singapore economy and the rising influx of tourists.

This places SKE in a favourable position to ride on the growth of the local F&B and hospitality segments following the recovery of the Singapore economy and the rising influx of tourists.

Expansion into ASEAN comes with uncertainty. SKE’s plan to expand into the ASEAN markets through joint ventures and strategic alliances is promising given the strong expected yoy growth from these countries. However, such an expansion plan

comes with uncertainty as there are issues of licensing, foreign exchange controls and availability of partners which are not within the control of SKE.

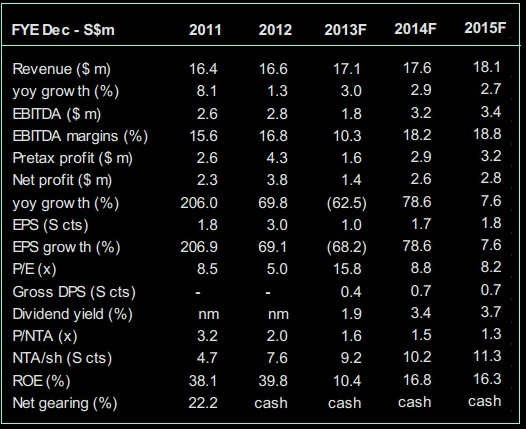

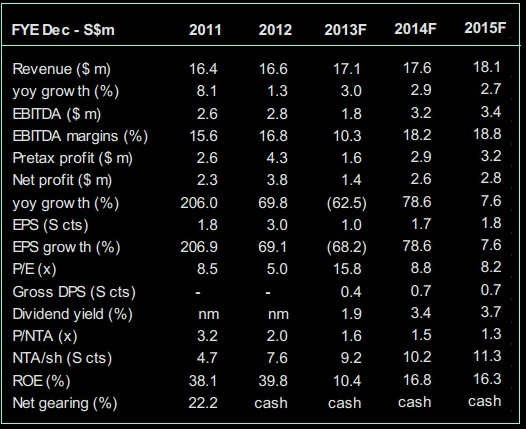

Reasonable dividend yield with a 40% dividend payout ratio for FY13-15. SKE is committed to paying out at least 40% of its net profits as dividends for FY13-FY15, representing a reasonable dividend yield of 3.4%- 3.7%. With strengthening

cash flows, we believe this is an achievable target.

Initiate with Hold and target price S$0.173. Using closest peer Fujimak Corporation’s 6 years historical average forward P/E of 10.1x on our CY14 EPS of 1.71 Scts, we derive a target price of S$0.173.

Recent story: S'PORE KITCHEN EQUIPMENT: Homegrown kitchen specialist raises S$3m to ride ASEAN tourism boom

OKS-DMG highlights A-Sonic Aerospace as a beneficiary of Changi Airport expansion

A-Sonic Aerospace CEO Janet Tan. NextInsight file photo.The recent news on the development of Changi Airport’s mega Terminal 5 will, besides cementing Singapore’s position as an air hub, benefit the local logistics and transportation-related services sectors with the expanding fleets of Asian carriers touching base in Singapore.

A-Sonic Aerospace CEO Janet Tan. NextInsight file photo.The recent news on the development of Changi Airport’s mega Terminal 5 will, besides cementing Singapore’s position as an air hub, benefit the local logistics and transportation-related services sectors with the expanding fleets of Asian carriers touching base in Singapore.

We had earlier highlighted MRO players such as ST Engineering and SIA Engineering as key beneficiaries of the growing volume of repair work in the region. Another niche player, A-Sonic Aerospace, a logistics and freight-forwarding company, will also end up being a winner with the resultant rise in demand for leased aircrafts.

This is a new segment which the company had been working on for the past few years, when it started acquiring pre-owned airframes and engines, and reassembling them at its preferred MRO in Europe and the Americas.

Recent story: S'PORE KITCHEN EQUIPMENT: Homegrown kitchen specialist raises S$3m to ride ASEAN tourism boom

OKS-DMG highlights A-Sonic Aerospace as a beneficiary of Changi Airport expansion

A-Sonic Aerospace CEO Janet Tan. NextInsight file photo.The recent news on the development of Changi Airport’s mega Terminal 5 will, besides cementing Singapore’s position as an air hub, benefit the local logistics and transportation-related services sectors with the expanding fleets of Asian carriers touching base in Singapore.

A-Sonic Aerospace CEO Janet Tan. NextInsight file photo.The recent news on the development of Changi Airport’s mega Terminal 5 will, besides cementing Singapore’s position as an air hub, benefit the local logistics and transportation-related services sectors with the expanding fleets of Asian carriers touching base in Singapore. We had earlier highlighted MRO players such as ST Engineering and SIA Engineering as key beneficiaries of the growing volume of repair work in the region. Another niche player, A-Sonic Aerospace, a logistics and freight-forwarding company, will also end up being a winner with the resultant rise in demand for leased aircrafts.

This is a new segment which the company had been working on for the past few years, when it started acquiring pre-owned airframes and engines, and reassembling them at its preferred MRO in Europe and the Americas.

Focusing on the single-aisle MB-83 planes, it has to date leased out two aircrafts and expects to lease out another two by the end of the year, with letters of intent to acquire one more aircraft, 3 airframes and 3 aircraft engines. We see leasing revenue steadily ramping up, providing the group with a new source of high-margin, recurrent income.

The stock last traded at SGD0.055 with a market capitalization of SGD39m.