Excerpts from latest analyst reports.....

OSK-DMG maintains 'buy' call and 40-c target for King Wan Corp

Analyst: Lee Yue Jer

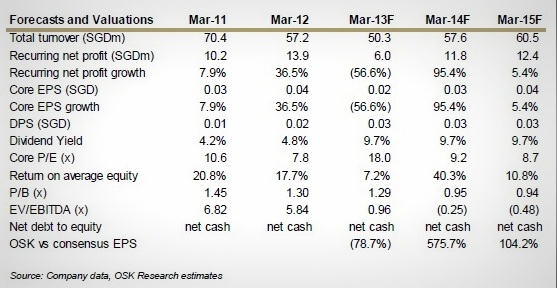

Three years of order book supports 1.5¢ core dividend. Maintain expectations for another 1.5¢ special dividend, raising sustainable yield to 9.7%. The outstanding order book of SGD166.7m is equivalent to three years’ work, which supports our core dividend expectation of 1.5¢.

We continue to expect special dividends over the next 10 years from the sale of the Thai Associates, which doubles the dividend to a juicy 9.7% yield sustainable for the next 10 years.

Near term catalysts in March and May. We see near term catalysts in the form of the lodging of the KTIS Prospectus likely in March, and the declaration of the special dividend on the full-year results in May.

Maintain BUY, TP of SGD0.40 based on 7.5% yield. We maintain our Buy call on KWAN with a TP based on 7.5% yield.

Although the stock has risen 15% since our initiation three days ago, we believe that the 9.7% sustainable yield presents a still-attractive entry point.

Recent story: WILMAR, KING WAN: What analysts now say

CIMB raises ASL Marine's target price to 86 cents

Analyst: Yeo Zhi Bin

Ang Kok Tian, executive chairman and MD of ASL Marine.

Ang Kok Tian, executive chairman and MD of ASL Marine.

NextInsight file photo

ASL delivered a sterling 1H report card owing to robust growth from all three segments. The most telling indicator of a bright outlook during the briefing was a marked bullishness by ASL’s conservative CEO, Mr Ang.

Quarterly earnings momentum and strong orders are catalysts.

At 32% of our FY12 forecast (1H at 69%), 2Q core earnings were 52% ahead of our expectations, and broadly in line with consensus.

The positive variance stems from higher-than-expected gross margins across all segments. We raise our FY13-15 estimates by 4-23%.

Maintain Outperform and raise our target price, still at 0.9x CY13 P/BV, its 5-year mean.

Recent story: ASL, NOL, SEMCORP INDUSTRIES: What Analysts Now Say…

Maybank KE expects another good set of quarterly profits

Analyst: Wei Bin

China Minzhong is expected to announce its 2QFY6/13 results on 14 Feb 2013. We are anticipating a set of good results with revenue likely to post robust growth. We expect 2Q revenue to come in at CNY800m, up 23% YoY due to more favourable weather conditions.

The unusually cold weather in China this winter will not only speed up the growth of champignon mushrooms, Minzhong’s biggest revenue contributor, but also lift the prices of its other vegetables.

Minzhong’s share has gained 94% since our BUY call in June 2012. Despite the strong rally, the current valuation of 3.7xFY6/13F PER still seems undemanding.

Maintain BUY and target price of SGD1.16.

Recent story: CHINA MINZHONG, CORDLIFE : What analysts now say....