Photo: Sinopec

Translated by Andrew Vanburen from a Chinese-language piece in Securities Daily

IF THERE WERE ever such a thing as battle-tested stocks, five come to mind in China.

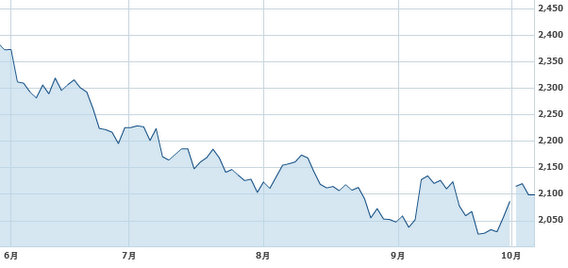

The PRC's stock markets may be struggling mightily this year.

But these firms have managed to make a pretty penny.

So who’s avoiding a mauling by the bears and breathing fire into their bottom lines, like a true Year of the Dragon firm ought to?

Of the bulk of firms already releasing their third quarter earnings statements, banks, brokerages and insurers occupy most of the top honors in terms of producing profits for their shareholders.

But other than these perennial favorites, petrochemical behemoth Sinopec (SHA: 600028; HK: 386) was one of the top take-home breadwinners in the January-September period, while the country’s leading steelmaking enterprises were some of the biggest losers over the timeframe in question.

Every day this year, Beijing-based Sinopec made some 153 million yuan on average... not bad in a so-called bear market.

But Sinopec’s bottom line in the third quarter actually declined by 7.5% to 18.3 billion yuan.

So why is it considered one of the best performers this year?

The most obvious reason is because it managed to pull in some 198 million yuan per day on average in the third quarter, much better than the January-September daily average of 153 million.

A lot of the earnings turnaround in the third quarter had to do with retail diesel prices during the period being at record levels.

China Shenhua Energy Company Ltd (SHA: 601088) also outperformed of late.

The main reason for its stellar showing was its ability to somewhat hedge itself against sharp declines in selling prices for raw coal for much of this year.

The coal play saw a 15.5% rise in January-September operating revenue to 178.4 billion yuan.

However, despite plummeting coal prices, the firm managed to suffer only a 6.5% decline in its January-September net profit to 36.6 billion yuan.

And even though its shareholders were confronted with a smaller bottom line over the period, it still ranked among the top three most profitable A-share listcos, excluding financial institutions.

Despite the floor falling out of coal prices this year, which led to net losses for many peers, Shenhua still managed to turn a pretty profit after all.

The firm’s well-timed, strategic balance between contract pricing and spot sales helped ease the pain.

Kweichow Moutai Co Ltd (SHA: 600519) is China’s best-known maker of the country’s most popular spirit – baijiu -- or the ubiquitous clear liquor served liberally at weddings and contract signings.

This southwest China-based distilling giant continues to be one of the most profitable consumer plays in the A-share market.

Many would write it off to its flagship product being recession proof.

But in such a crowded baiju sector with only a handful of brands achieving national recognition (most notably Kweichow Moutai), being profitable season after reporting season is no small feat.

Its January-September revenue soared over 46% to 20 billion yuan, producing a 59% year-on-year spike in net profit to 10.4 billion.

That represents an enviable profit margin of over 50%.

Sounds like its bottoms up for many lucky investors.

China Coal Energy Company Ltd (SHA: 601898) and residential property giant Vanke Holdings (SZA: 000002) round out the top five best-performing A-share firms of late.

See also:

POINTING FINGERS: ‘Immature’ Investors At Fault In China?

ONE MAN’S TRASH... Time To Look At ‘Garbage’ A-Shares?

CHINA CONSENSUS: Things Are Looking Up

CHANGING FACES: Five Sectors Turning Bullish