BLUEFOCUS COMMUNICATION GROUP (SZA: 300058) recently grew to become Asia’s biggest PR agency.

But that doesn’t mean the Beijing-based firm is satisfied with its current size or client base, an executive told investors in Shenzhen.

BlueFocus became the first Chinese PR firm to go public, raising some 160 million yuan through the sale of 20 million A-shares in Shenzhen back in early 2010.

And thanks to a strong first full year of post-listing performance in 2011 in which the company reaped 1.3 billion yuan in operating revenue --- surging 155.4% year-on-year -- it is now the biggest player in its sector on the continent.

“To grow as a firm, we felt must go public to attract capital. We wanted to be the grape vine, not the grape seed. That’s why we listed,” said BlueFocus Deputy General Manager Xu Zhiping.

The firm counts among its clients 25 of the Global Fortune 500 giants, including Royal Dutch Shell, Toyota, Canon and China’s own PC maker Lenovo.

“A lot of our competitors attempting to list fail and give up quickly. But our listing process has been rather smooth and seamless. There are high entry barriers to this industry, especially for PR firms looking to go public,” he said.

Founded in 1996, BlueFocus began as a dedicated public relations firm, but has since expanded and diversified into investor relations consulting, trade shows and exhibition planning, IPO advising, roadshow organizing and strategic M&A planning activities.

“We were born as a PR firm but expanded from there via M&As. For example, to bolster our investor relations skills and capacity, we acquired Singapore-based Financial PR a year ago and they do a very good job and are a growing presence in Singapore, Hong Kong, Mainland China and Taiwan,” Mr. Xu said.

And earlier this year, BlueFocus fully acquired Kingo Advertising & Communication Co for 430 million yuan.

BlueFocus completed the acquisition by means of cash plus private placement, of which 25% shares were paid to a major shareholder of Kingo.

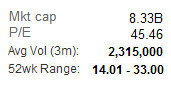

Following the transaction, the total number of shares of BlueFocus stood at 196,008,336.

“There are two basic ways to fund an acquisition. The first is via a share swap which saves you on transaction taxes but means giving up some equity control.

“The second way is via an outright cash purchase. This allows you to maintain equity control, but taxes become an issue,” Mr. Xu said.

Despite BlueFocus’ rapid expansion through non-organic means, it wasn’t just a matter of hunting down a potential target and naming your price.

“Actually, Mainland China’s market is still quite shaky and rocky, and the domestic M&A game remains a bit risky, but is still is full of potential. At the same time we must increasingly be more aware of rules and regulations these days to keep our clients healthy and find good M&As,” he said.

And although BlueFocus was based in Beijing, the PR firm was in no way focused on China’s capital city alone.

“We are Beijing-based but not limited to Beijing. In fact we are a full-fledged multinational firm if you judge us by the geographic origins of our clientele as well as our increasing number of acquisitions. So the sky’s the limit for us, geographically.”

He provided the conference room full of investors with an insightful breakdown of the current state of the public relations industry in China.

“The PR industry has been transformed dramatically over the past couple of decades. At first, very few Chinese listed enterprises were very familiar with public relations and what it’s all about. The extent of the exposure was funding their own ads or hiring ad agencies for short-term contracts.”

He said that in the 80s, 90s, and 2000s, foreign PR firms enjoyed a virtual monopoly in China.

“But now the industry has grown rapidly, often around 30% per year in China, and everyone knows what PR is and the potential value it brings to a firm,” Mr. Xu said.

He said that in the PRC, companies eventually began to think of PR services as a “good deal” that offered more and more services and package deals, especially results presentations, speakers, events, etc.

“And we could do it all more professionally rather than leaving it to their in-house talent. Now the impression is that not only foreign companies have the money or desire to hire PR firms, but increasingly, Chinese firms as well.”

See also:

Wonderful Sky: First PR Firm To List In HK, 'Tread Carefully'

BLUEFOCUS: PR/IR Play Reaped 100% Gain In Net Profit To 121 M Yuan

China IR Firm BlueFocus Nearly Triples Its 3Q Revenue

BLUEFOCUS: China PR Firm Share Price Up Over 56% Since End-Feb Debut!