UBS: CHOW SANG SANG ‘Well Managed’

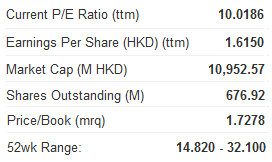

UBS Investment Research said it is initiating coverage of Chow Sang Sang Holdings (HK: 116) with a “Neutral” recommendation, calling it a “well-managed jewelry retailer.”

“Chow Sang Sang is a quality, reputable jeweler in a difficult year that is accelerating its expansion in China,” UBS said.

In 2010, it had a market share of 8.7%/2.0% in Hong Kong/China in terms of sales.

“We believe the China market has better long-term growth potential due to its low jewelry consumption per capita and rising disposable income, while the tourist effect in Hong Kong could be tapering off.”

The brokerage said Chow Sang Sang is a purely self-operated model, which it called “a double-edged sword.”

“All of CSS’s retail stores are self-operated. We believe CSS will benefit from a self-operated model in the long term due to higher operating efficiency (reflected in its sales per store) and better brand protection.

“In the medium term, we are concerned about market share loss due to its peers’ more aggressive store expansion plans and a heavy working capital and capex drag on the balance sheet.”

UBS is assigning Chow Sang Sang a first-time target price of 16.00 hkd.

“CSS is trading at 9.8x/8.0x 2012/2013E PE, in line with the average for its Hong Kong peers.

"We think CSS is fairly valued due to earnings volatility (given its gold exposure) and the threat of competition in the medium term, especially in lower-tier cities.”

See also:

CHOW SANG SANG Looking Golden

CHOW SANG SANG Sales Surge; Move Over, India?

CHOW SANG SANG Kept ‘Buy’

UBS: Initiating LUK FOOK ‘Neutral’

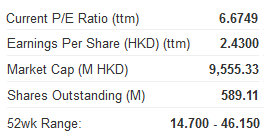

UBS Investment Research said it is initiating coverage of jewelry retailer Luk Fook Holdings (HK: 590) with a “Neutral” rating with a price target of 17.40 hkd.

“Luk Fook is an asset light jeweler with 42 stores in Hong Kong, Macau and overseas, and 819 stores in China,” UBS said.

The brokerage said Luk Fooks points of sale (POS) were over 88% operated by franchisees.

“The wholesaling/licensing businesses generated higher EBIT margins of 21%/67% than the retail business’ 12% in FY12. Therefore, we expect Luk Fook to continue expanding its franchise business and forecast 120/80 new franchised stores in FY13/FY14.”

Despite the franchised business’ better profitability, the 42 self-operated retail stores in Hong Kong and Macau represent 67% of total EBIT.

“With slowing same-store-sales (SSS) growth in FY13E, we expect operating deleveraging for the Hong Kong/Macau market to result in 2.5ppt EBIT margin erosion. As the result, we forecast an NPAT decline of 6% in FY13 and growth of 20%/12% in FY14/FY15.”

See also:

HK Jewelry Retailers: 'Buy CHOW SANG SANG, LUK FOOK On Weakness'

UBS: Downgrading DAPHNE to ‘Neutral’

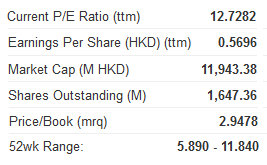

UBS Investment Research said it is reducing its recommendation on footwear firm Daphne International Holdings (HK: 210) to “Neutral” from “Buy” on the “heavy impact” of price discounts.

Previously we turned slightly more positive on Daphne on a stronger-than-expected top-line growth in Q212. However, we were disappointed with the declining profitability triggered by deeper promotions and higher operating costs,” UBS said.

The brokerage said management confirmed that eventually the company will gradually replace all its franchisees, which would allow Daphne to respond quicker to dynamic changes in the footwear sector, but lead to higher operating costs.

“Our latest checks suggest heavy promotions did not bring sustained sales growth and June sales might decline MoM for the footwear sector. We believe a slowdown could extend into H212 as consumers tend to make their purchases only during promotional periods.”

UBS added that even though some investors pointed out that Belle’s slightly higher SSS in Q212 could suggest a sector deceleration might have reversed, the brokerage believes sales growth driven by heavy promotions might not be a true indication of underlying consumption demand.

“We lower our 2012/13/14 earnings estimates by 21%/17%/6% to reflect a lower gross margin assumption and higher operating expenses, with our price target lowered to 8.40 hkd from 10.00.”

See also:

HK Flicks, Footwear & Financiers: Latest Happenings...

Goldman Sachs: Staying ‘Buy’ on DAPHNE

Goldman Sachs said it is maintaining its “Buy” recommendation on Daphne International Holdings (HK: 210) with an expected return potential of 51%.

“Margin contraction has been priced in,” Goldman Sachs said.

Daphne announced 2Q12 SSS of 14%, in line with Goldman’s forecast of 13%.

Core brand reached 5,968 store count as of June 30, in-line with full-year guidance.

“Management expects low single-digit pts OPM contraction in 1H12, driven by: (1) a mid-single digit ASP decline on heavy promotion; (2) a staff and rental expenses increase; (3) a loss in the department store brand segment,” Goldman said.

Goldman’s 12-month target price for Daphne drops to 11.5 hkd from 12.0, implying 51% upside.

The brokerage added that key risks to its recommendation on Daphne include a worse-than-expected promotion impact on gross margins.

See also:

TOP FIRST HALF HONG KONG GAINERS: Property King Of The Hill