Venue: Stamford Tyres, 19, Lok Yang Way.

Time: 3 pm, 23 Aug.

Photos by Sim Kih

STAMFORD TYRES holds its AGMs in its headquarters in Lok Yang Way in Jurong but the faraway place doesn't mean that shareholder turnout is thin.

In part, that's because the company arranges transportation for its shareholders from Boon Lay MRT station and back.

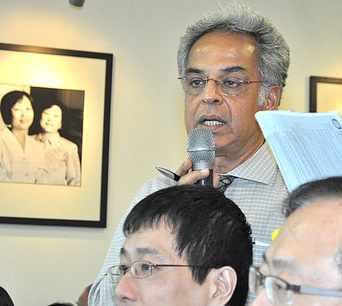

Shareholder Mano Sabnani is a former editor of The Business Times.

Shareholder Mano Sabnani is a former editor of The Business Times.

And at the AGM, they do get to understand more about the business and its recent performance.

It is not an event whose agenda the management wants to quickly get over with, as is apparently the case at some companies.

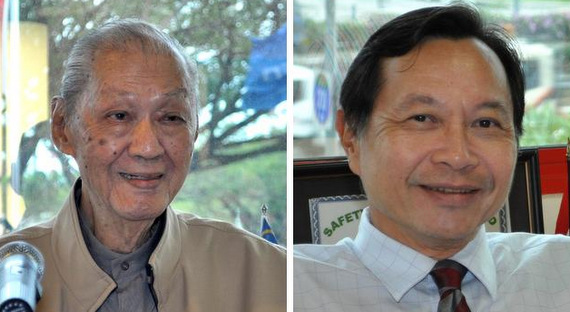

Last Thursday, Stamford Tyres President Wee Kok Wah gave a presentation as did vice-president John Ang (head of Singapore retail).

And shareholders (about 120 attended) raised questions and offered their views about Stamford Tyres' business of retailing, distributing and manufacturing tyres and wheels.

Its distribution business spans nine countries in the Asia Pacific, Africa, India and Australia.

Shareholders also approved a first and final dividend of 1.5 cents a share (FY11: 1.5 cents), which translates into a yield of 4.5% based on the company's recent stock price of 33 cents.

Here are some takeaways from the presentations and discussion:

1. New warehouse: Mr Wee gave an overview of Stamford Tyres' plan to develop a new warehouse next to its HQ at a cost of about S$23 million.

The warehouse will have 21,000 sq m of space, which will replace the 18,000 sq m belonging to third-party warehouses that the Group currently leases.

Mr Wee said the new warehouse would result in "greater sustainability in operating profits in the long term". In simple terms, it is more economical to own that warehouse than to pay rental that is ever rising.

Noting that most of the company's properties are currently mortgaged against bank borrowings, a shareholder asked if the construction cost of the warehouse would result in a financial burden for the company.

CFO Conson Sia said S$7 million will come from the proceeds of the company's recent sale of its stake in SRITP. The remainder will come from bank borrowings.

He added that the savings from rental would more than offset the instalment repayments on the bank loan for the warehouse.

2. Value of properties: A shareholder noted that the President's Message in the annual report mentioned that the Group owned 35,000 sq m of industrial land in Singapore, which has risen strongly in value since the properties were bought many years ago.

As a result, the revalued NTA of the Group is signifcantly higher than the reported 48.12 cents a share for the book value and the 33 cents recently-traded price of its shares.

Shareholder Lim Soon Hwee asked: "What's the market valuation of these properties and how can the value be unlocked for shareholders?"

Mr Wee replied the company didn't have a policy of revaluing its properties.

But offering an example of the value of the properties, he said the HQ (where the AGM was held) was bought for $650,000 and then rebuilt for $11 million (with $6 million from insurance proceeds) after a fire destroyed it in 1997. It's currently worth $40-45 million, he reckoned.

Shareholder Mano Sabnani suggested that the Group consider a sale and leaseback in order to unlock the value of the property.

Such a move would raise a lot of cash and enable Stamford Tyres to pare down its bank borrowings, with some surplus for developing further its core business, he said.

"If you do that, a few years down the road you would look very smart, since property markets move in cycles."

To chuckles from shareholders, Mr Wee replied: "Ten years ago, I was approached by a REIT with that same proposal. I declined. I don't look too bad now."

3. High inventory level: A shareholder noted the 28.8% jump in inventory to S$122 million as at end-April 2012 but CFO Conson Sia assured him that the level has come down and would continue to do so in the next few quarters.

4. Forex impact in South Africa: While the Group's sales in South Africa had surged by 17.6% in FY12, the South African currency depreciated by as much as 15% vis-a-vis the SGD.

This has led to a forex loss for Stamford Tyres.

Shareholder Mano Sabnani opined that the Singapore currency would continue to appreciate over the long haul.

To reduce the forex impact to the Group, Mr Wee said two steps were being taken:

> Increase the Group's equity in its South African business, and

> Increase local bank borrowings to reduce foreign currency denominated payables.

Recent stories:

STAMFORD TYRES: Rolling out new Falken ultra-high performance tyre

SERIAL keeps up its dividends, STAMFORD TYRES targets India market