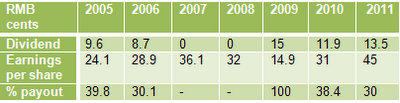

WORLD PRECISION MACHINERY CEO Shao Jianjun said that the company will pay dividends as long as it is profitable.

In this respect, it is more like blue-chip Singapore companies and unlike many S-Chips which hoard cash and pay no dividends.

For FY 2011, World Precison Machinery maintained its dividend payout track record of about 30% and proposed a final cash dividend of RMB13.5 cents per share.

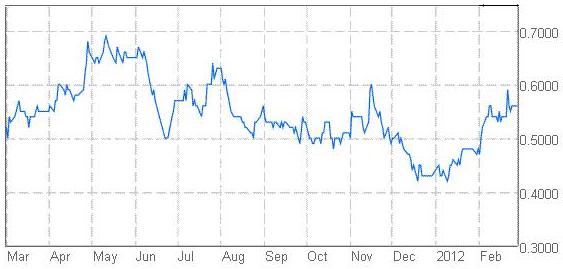

This translates into a dividend yield of 4.8% based on yesterday’s closing price of 55.5 cents.

The CEO of the leading PRC domestic stamping machine maker was speaking at its FY2011 results briefing yesterday after it announced a net profit attributable to equity holders of RMB179.4 million for FY2011, up 43.8% year-on-year.

There is another aspect of World Precision that resembles a blue chip – it is part of a larger group that boasts combined revenues to the tune of USD 2 billion.

In addition to its organic growth, UOB Kayhian analyst Jonathan Koh believes World Precision holds potential for restructuring growth as major shareholder World Group is able to inject its other business assets, which include an industrial equipment conglomerate involved in production of agricultural machineries, construction equipment, gantry cranes, horticultural tools and automobile components.

World Precision's FY2011 revenue increased by 14.2% year-on-year to reach a record high of RMB1.2 billion. Gross profit margin expanded by 3.8 percentage points to 29.4% and net profit margin improved by 3.2 percentage points to 15.2%.

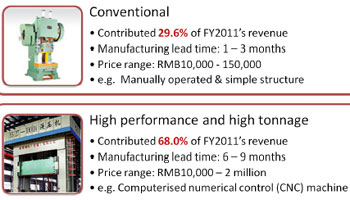

Gross profit margin for high performance and high tonnage stamping machines increased from 27.0% in FY2010 to 35.0% in FY2011, and gross profit margin for conventional stamping machines improved from 23.5% in FY2010 to 30.3% in FY2011.

Blue-chip stock in the making?

”We expect bottomline growth to continue to outperform top line growth,” said Mr Shao, who expects its margin expansion to sustain as it moves up the value chain.

The company is expanding its output for high performance and high tonnage stamping machines, which have better margins than its conventional machines.

Its high performance and high tonnage stamping machines are widely used to produce automotive parts, such as car hoods and car doors.

Riding on the booming after-sales market for automotive parts in the PRC, sales of high performance and high tonnage stamping machines improved by 26.0% to RMB806.9 million in FY2011, and contributed 68.0% to World Precision’s revenue, compared to 61.7% in FY2010.

Mr Shao wants to sell more high performance and high tonnage stamping machines and expects this segment to eventually contribute three quarters of World Precision revenue.

When construction of its Shenyang plant to produce high performance and high tonnage stamping machines completes by the first half of this year, it will have capacity to produce another Rmb 300 million worth of machinery a year.

Below is a summary of the questions raised by investors at World Precision’s results briefing and the answers provided by Mr Shao and non executive director Cheng Hong.

Q: Why are you expanding your facilities at Shenyang?

We want to be nearer to customers in the Bohai area in Northeastern China, which is a hub for large heavy industries. Leading automotive manufacturers such as BMW and FAW have set up their bases there. Germany’s BMW has a base at Shenyang and there are several hundred high-end automotive component factories serving BMW there. These high-end automotive component factories are very large organizations and rely on us to manufacture and supply their capital equipment. It took us only three years to generate annual revenue contribution of almost Rmb 180 million from this region.

We are producing high-tonnage equipment valued at Rmb 3 million to Rmb 5 million each for our Bohai customers. It is expensive to transport such heavy products from our existing facilities at Danyang to Bohai. Steel, which accounts for about 80% of our cost of goods sold, is also produced in Northeastern China. We can save about 10% in cost of production by eliminating long distance transportation when procuring for steel and delivering our products.

Secondly, the Shenyang government has offered the World Group many investment incentives because it is one of the top 500 PRC enterprises. For example, World Precision was able to acquire land use rights at a 30% discount to market rates because its products directly support high tech heavy industries. To develop the Bohai region into a hub for heavy industries, the government is giving tax rebates to relevant manufacturers like World Precision.

Q: Will factories on the eastern coastal region of China relocate inland?

The probability of relocation is higher for low-end labor-intensive factories such as textile manufacturers because of the escalating cost of labor. On the other hand, it takes 3 years to train a skilled technician for a high-tech factory. The difficulty with replacing skilled technicians deters a high-tech factory from relocation. So, customer relocation risk is relatively low for us.

Q: What will happen when there is a capacity glut?

Demand still out-strips supply currently. I do not foresee this trend to change in the medium term.

For conventional machines, we can deliver within one week. For high-value machines, customers pay a deposit of 30% to 40%. Even if they cancel the order, it is easy for us to retool the production line and sell it to someone else. We have low inventory risk.

Q: Why has your inventory increased?

We are building up inventory in anticipation of a spike in orders post-Chinese New Year. Based on current negotiations from repeat customers, we anticipate more orders and are building commonly used components now so that we can have a faster turnaround cycle during the peak season in March to May.

In our trade, only financially strong companies hold high inventory levels. Our inventories are tools that do not really depreciate, unlike other types of businesses.

Q: What is your inventory made of?

70% of our inventory is made up of dominant devices. Secondary devices make up the remaining 30%.

Q: Why have your finance costs increased?

We took bank loans to finance the building of our plant at Shenyang. We are paying the prime rate of about 6% that only the best companies are entitled to. Our interest coverage is 18 times.

Q: How much do you expect to borrow this year?

We expect to spend another Rmb 100 million on our Shenyang plant this year. Capital investment for our Shenyang plant is expected to continue in the next few years. We will only choose equity financing at good market valuation. Otherwise, we intend to use bank loans.

Q: Do you export?

Yes, we sell globally. However exports only comprise a small portion of group revenue.

Related story: UOBKH notes stock price catalyst from possible asset injection into WORLD PRECISION MACHINERY