Excerpts from latest analyst reports...

SBI E2-CAPITAL: SAGE INTL to benefit from ‘quality projects’

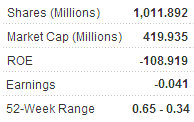

SBI E2-Capital called cemetery, crematory and funeral services provider Sage International (HK: 8400), a “high-end” firm in its sector, which will benefit from high-growth opportunities at new plot yards.

"In September 2010, Sage acquired its first cemetery asset and entered the sector via RTO. Subsequently, the company changed its name to Sage International from Info Comm and acquired additional projects. Sage was in the progress of developing a portfolio of cemetery assets targeting mid-to-high end market,” SBI said.

The brokerage added that management targets to grow Sage through a series of acquisitions, but that barriers to entrance in the business remain relatively high.

“Normally the State-owned Assets Supervision and Administration Commission of the State Council (SASAC) would not grant licenses especially to non-PRC individuals. Under the leadership of Chairman Andy Chui Bing Sun, Sage and management together holds 75% of Suzhou (Jiangsu) Cemetery, while Sage alone holds 70% of Huaiji (Guangdong) Cemetery as well as a 60% JV of Bijie Cemetery (Guizhou).”

To capture fast-growing opportunities from quality cemetery projects Projects on hand include Suzhou, Zhaoqing and Bijie Cemetery.

“Sage has a solid management team. There should be a reasonable steady return over gradual sales of plots and niches, and the value of Sage heavily depends on the pace of appreciation of said plots and niches,” SBI said.

The counter is currently trading at 5.0x P/B prior to CB conversion.

“We believe the company has solid management that could identify quality projects and promote growth for the company through acquisitions. Upon acquisitions of undervalued projects, NAV of the company should increase accordingly. Theoretically, plots and niches unsold would appreciate as well.

“On the other hand, while death rates are relatively stable and in short-term Chinese still prefer to stay where they were born after death, we believe cemetery business could capture a stable and steady income at good profit margin. The value of Sage largely depends on whether the management makes an excellent balance between short-term revenue recognition and long-term asset appreciation,” SBI said.

See also: SINO-LIFE: Averted Demise In Recession, Springs Back To Life

BOCOM: VODONE's 'buy' recommendation maintained, target 51% upside

BOCOM International said it is reiterating its 'buy' recommendation on tele-media, online lottery and games firm VODone Ltd (HK: 82), but that all is not well in the near term with its lottery business.

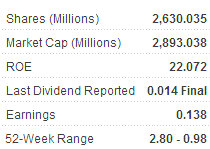

Earnings below our estimate by 20.2% Revenue in 1H11 soared 92.8% YoY to HK$583m while net profit increased 3.8% YoY to HK$111m, 20.2% below Bocom’s estimate, while EPS came in at HK$0.044.

“The lower-than-expected earnings could be attributed to the inclusion of a one-off fair value loss on deferred consideration shares of HK$24.845m, which was incurred merely due to the issue of the relevant consideration shares for the sake of acquiring 3GUU Group, the handset design assets of OWX Group and the business of Pinzheng Group at the end of 2010, while the relevant consideration shares was not yet issued at the end of the year and deferred payment was required,” Bocom said.

Net profit excluding the loss would represent a YoY increase of 27%, just 2% lower than Bocom’s forecast.

“Tele-media business showed the largest growth in profit,” Bocom added.

Revenue and profit of the mobile lottery business increased 54.9% YoY and 18.6% YoY to HK$133m and HK$60.868m, respectively.

Revenue of the tele-media business jumped 78.3% YoY to HK$294m while profit soared 137.6% YoY to HK$94.778m. Meanwhile, revenue of mobile games business reached HK$157m, up 200.1% YoY, while profit increased 84% YoY to HK$60.06m.

Lottery business displays short-term risks “China has eliminated the legal obstacles for the issuance of mobile phone and internet lottery licenses. However, welfare lottery centers strictly regulate mobile phone and internet lottery companies unauthorized by the MOF,” Bocom said.

Though the regulation paves the path for the ultimate launch of formal licenses, it will inevitably pose some negative impacts to the market over the short term, the brokerage concluded.

Bocom cut the target price by 68% to HK$1.6, corresponding to a FY11F P/E of 20x.

“We trim FY11F/FY12F EPS by 56%/52% to HK$0.08/HK$0.14, respectively. Our 'buy' rating is maintained as we are bullish on the company’s potential leading position in mobile and Internet lottery business after the establishment of the license system. The lottery business, however, displays short-term risks.”

See also: GAMING PLAYERS MGM CHINA, WYNN MACAU: What Analysts Now Say...