BOCOM: VODone’s target hiked 75%

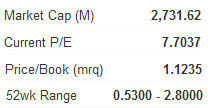

BOCOM International said it is hiking VODone Ltd’s (HK: 82) target price by 75% to 2.8 hkd, representing an upside potential of 131%, equivalent to FY12F 20x P/E.

The brokerage also reaffirmed its ‘buy’ call on the mobile gaming and lottery player after VODone acquired Huge Joint – a firm with exclusive phone and internet lottery sales operations in the Chinese province of Qinghai.

Huge Joint was acquired for a consideration of 100 mln yuan, with VODone financing the deal with 10 mln hkd in cash, with the remainder by the issue of 92.756 mln shares at 1.21 hkd per share.

Hong Kong-listed VODone said the issue price represents the closing price as of November 3, 2011, while the shares represent approximately 3.41% of the company’s issued shares of 2.719 bln shares as enlarged by the issue of the consideration shares.

VODone has been keen to expand its geographical reach across China in the gaming and lottery business.

Huge Joint owns the exclusive operational rights for phone and internet sports lottery betting in Qinghai Province.

“The acquisition could raise the possibility of securing the telephone and internet lottery licenses in the future.

"The new pickup could play a significant role in the expansion of VODone’s sports lotteries related business, enriching the lottery types and regional coverage,” BOCOM said.

The brokerage added that the acquisition will facilitate VODone’s application of paperless lottery sales licenses in the country which will soon be released by the Ministry of Finance.

“The acquisition could raise our expectations on the granting of telephone and internet lottery licenses within the country and our confidence in the company in securing national lottery licenses,” BOCOM added.

See also: VODONE: No.1 Mobile Gamer In China, Shares At 52-Wk Low... What Gives?

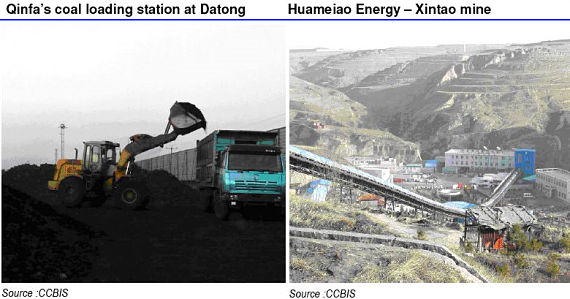

CHINA QINFA shares surge 28% on M&A proposal

China Qinfa Group Ltd (HK: 866), a trader, processor and transporter of coal, saw its Hong Kong-listed shares jump 28.2% in the first two trading days of the week to close Tuesday at 1.88 hkd.

The firm’s valuation surged following an announcement that wholly-owned subsidiary Guangfa Energy had entered into an acquisition agreement for a further 48% equity stake in Huameiao Energy for 2.88 bln yuan (approximately 3.51 bln hkd).

Upon completion, Huameiao Energy will become a subsidiary of Qinfa, with 80% equity interest.

Huameiao Energy has three wholly owned subsidiaries, namely Xingtao Coal, Fengxi Coal and Chongsheng Coal – all in the coal-rich northern Chinese province of Shanxi.

Final approval of the acquisition rests with the decision from an EGM to be held on or before December 9, 2011.

At the request of the company, trading in Qinfa’s shares has been suspended from 9:00 a.m. on October 27 until 9:00 a.m. on November 7.

Huameiao Energy was established on January 12, 2004 with a fully-paid registered capital of RMB 300 million (equivalent to approximately HK$365.85 million), and its scope of business includes (i) wholesale and retail sales of construction materials and chemical products; and (ii) mining business operations.

China Qinfa said the acquisition is being pursued for the following reasons:

1) Improvement in the liquidity of the Group;

2) To capitalize on strong cash flow from coal sales;

3) The Group’s overall coal transportation costs can be lowered through the procurement of coal from Huameiao Energy due to the close proximity of the coal mines of Huameiao to the Qinfa’s coal loading station in Datong, PRC.

See also: CHINA QINFA, HK-Listed Coal Firm, Initiated ‘Buy’: What Analysts Now Say...

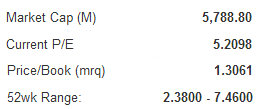

BOCOM: XTEP gets ‘sell’ call on order weakness

BOCOM International said it is cutting its recommendation on fashion sportswear retailer Xtep International Holdings (HK: 1368) to ‘sell’ from ‘neutral’ due to mounting pressure ahead.

BOCOM said it is downgrading on its “more skeptical view” of Xtep’s execution ability following the weaker-than-expected latest operating release with considerable 1Q12 orderbook cutback and 2Q12 orderbook slowdown, slowed 3Q11 SSS growth, lower FY11E new store target, higher inventory-sales ratio and increased retail sales discount.

“We believe the fact that the mass market is crowded due to a low entry barrier among the sportswear segments prompts us to believe Xtep is more vulnerable to the current deteriorating industry environment.”

The brokerage added that it sees Xtep’s operating challenges “amplified by the intensifying price war” given that key end-users in this particular market are much more sensitive to average selling prices.

“Coupled with our 25%/46% below consensus FY12E/13E EPS forecast, we believe the stock is likely to see further de-rating pressure.”

BOCOM is also cutting its target price for Xtep from HK$3.1 to HK$2.18.

“Our target price is based on 5x FY12E on a 30% discount to Xtep’s sportswear peers.”

See also: XTEP: Fashion Sportswear Co's 1H Net Soars 25% To 466 Mln Yuan