Comtec CFO Keith Chau taking questions in Hong Kong yesterday. The firm's shares closed down 11.1% despite reporting a robust first half. Photo: Frances Leung, Aries Consulting

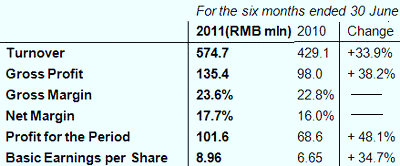

COMTEC SOLAR Systems Group Ltd (HK: 712), a major manufacturer of monocrystalline solar wafers, saw its first half net profit jump 48.1% to 101.6 mln yuan on a 33.9% top-line increase to 574.7 mln.

Chairman John Zhang said the stellar results took place despite a “challenging industry environment.”

Overall shipments as of June 30, 2011 were approximately 109.4 MW, representing a 28.3% increase over the same period of last year (1H FY2010: 85.3 MW).

“During the period, we maintained healthy profit margins despite a soft macro market in which average selling prices declined along the whole industry supply chain,” said Comtec Chairman John Zhang.

Amidst a challenging and increasingly competitive industry environment, Comtec Solar strives to differentiate itself by offering higher value-added products. Photo: Comtec

"And this drives continuous healthy growth of our business in a competitive and challenging industry environment.”

Thanks to continuous cost reductions and efficient execution, Comtec said its gross profit increased 38.2% year-on-year to approximately 135.4 mln yuan, representing a gross margin of 23.6% (versus 22.8% a year earlier).

Rising Sun: Stephen Peel (left), managing partner of TPG Asia, listens to Comtec Solar Chairman John Zhang earlier this year answer media queries alongside Comtec CFO Keith Chau and Kent Lo (standing) of Aries Consulting. Photo: Andrew Vanburen

The company’s first half net margin stood at 17.7%, versus 16.0% in the preceding period, while basic earnings per share (EPS) also climbed significantly by 34.7% to 8.96 HK cents (1H FY2010: 6.65 HK cents).

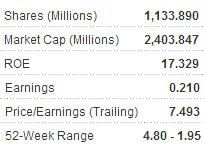

Comtec maintained a very strong and healthy financial position and remained in a net cash position of 20.5 mln yuan, with cash and cash equivalents amounting to approximately 809.0 mln as at June 30 (December 31, 2010: 293.7 mln).

Comtec now: 2.01 hkd

Amidst a challenging and increasingly competitive industry environment, Comtec Solar strives to differentiate itself by offering higher value-added products with premium quality to its customers.

During the first six months of the year, Comtec completed the qualification process for pilot orders of its advanced monocrystalline wafers (the “Super Mono” wafers) which can achieve over 20% improvement in the conversion efficiency comparing to traditional P-type monocrystalline wafers.

Looking ahead, Comtec Solar said it is confident it can continuously drive down production costs in order to provide customers with advanced premium wafers.

The Hong Kong-listed firm believes the demand for solar products is highly price-elastic and the continuous improvement of the cost effectiveness along the industry supply chain will sustain strong prospects of the cost leaders in the industry and lift entry barriers to the industry.

"To maintain our superior and healthy profit margins, we aim to gradually increase the shipment of Super Mono Wafers to no less than 30% of our total shipments in the second half of 2011 and no less than 50% of our total shipments in 2012 so that we may further strengthen our cost leader position and hence benefit our customers by improving their cost effectiveness,” Chairman Zhang said.

Founded in 1999 and tapped into the solar wafer industry in 2004. Photo: Comtec Solar

“To cater to stronger market demand for advanced monocrystalline wafers, we will expand our production capacity to approximately 1,400 MW within the first half of 2012,” he added.

Founded in 1999 and tapped into the solar wafer industry in 2004, Comtec Solar is a leading monocrystalline solar ingot and wafer manufacturer in the PRC and one of the first manufacturers in the the country to be able to mass produce 156mm x 156mm monocrystalline solar wafers with a thickness of approximately 170 microns.

With its production base in Shanghai, it focuses on the design, development, manufacture and marketing of high-quality solar wafers and has accumulated strong industry experience in the manufacture of semiconductor ingots and wafers.

Currently, the company supplies most of its solar products to the leading solar cell/module manufacturers.

Listed on the Main Board of the HKSE on October 30, 2009, Comtec Solar is committed to enhancing product quality as well as developing new and innovative solar wafers.

As it is well positioned to benefit from the growth of the solar PV industry, the company aims to broaden its customer base internationally.

See also:

CHINA MINZHONG FOOD, COMTEC SOLAR: What Analysts Now Say...

COMTEC SOLAR: HK Wafer Listco Gets 1.2 Bln Hkd From TPG Capital