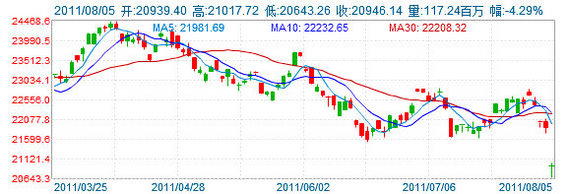

HONG KONG’S benchmark Hang Seng Index lost 4.3% today, its biggest one-day drop in nearly three years, with shares down 6.7% on the week to finish at 20,946.14, an 11-month low.

Investors were spooked by the 5.1% selloff Thursday on the Nasdaq.

The weekly loss was the most drastic since early 2009.

At one point in afternoon trade, the Hang Seng Index fell by over 5.5%, but bargain hunters swooped in and helped ease the blow by market close at 4pm Hong Kong time.

A whole range of destabilizing factors contributed to the panic buying today in a day of heavy trading volume.

Turnover today hit a nine-month high of 124.7 bln hkd.

Following the huge selloffs in New York, European bourses fell to a 13 month nadir, crude oil – taking a cue from a sputtering US recovery – fell nearly 6% on the day, and the Japanese yuan lost 2.3% against the greenback on massive moves by Japan’s central bank.

More storm clouds appeared on the investment horizon today, with Taiwan’s benchmark index plummeting 5.6%, big selloffs in both Tokyo and Seoul, and a slightly less bearish reaction in Mainland China, with the benchmark Shanghai Composite Index falling 2.2% on Friday.

A Chinese language piece in Sinafinance cited a Pegasus Fund market watcher as saying: “Amid concerns about the US falling back into a recession, equities in New York took a dive. The ongoing EU sovereign debt crises didn’t help matters much. This sent a chill through Hong Kong today and caused the massive selloffs.

“I wouldn’t be surprised if the Hang Seng tested 20,000 near term, as things are quite bearish. Unless the US suddenly launches another quantitative easing (QE3), then I don’t see any near-term jump starts on the horizon.”

He added that the fund would move into bargain-hunting mode if things didn’t pick up soon.

Another analyst from Phillip Securities Group said: “The Hang Seng should find support at around 19,700 because there are just too many upbeat blue chip earnings on the near horizon. That being said, I don’t expect central banks around the world, including here in Hong Kong, to sit around and idly watch capital markets continue to hemorrhage capitalization.”

Major movers today included steel and mining conglomerate Citic Pacific Ltd (HK: 267) which fell 6.63% to 14.94 hkd on global economic slowdown worries.

Local telecom giant Hutchison Whampoa Ltd (HK 13) plummeted 8.25% today to close at 82.90 hkd on weaker-than-expected first half earnings.

See also: BAOFENG MODERN, HKEx: What Analysts Now Say...