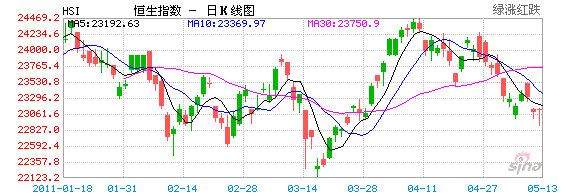

THE BENCHMARK Hang Seng Index in Hong Kong added 0.5% this week, closing up 0.9% today at 23,276.27, essentially shrugging off Beijing’s latest 50 basis point hike in the minimum amount lenders must keep on hand.

Banks and real estate counters, both sectors heavily dependent on credit availability, led the charge.

Analysts expect near-term resistance at 23,500.

Meanwhile, the benchmark Shanghai Composite closed up 1.0% today at 2,871.03 for similar reasons.

Hang Seng’s Financial Institution Sub-index added 1.11%, with a Chinese language piece in Sinafinance saying that the market had fully factored in the possibility of a hike in the reserve requirement ratio (RRR), which the People’s Bank of China announced yesterday, to kick in on May 18.

Additionally, the Hang Seng’s Property Sub-index also jumped on the fully-anticipated news from China’s central bank, adding 1.19% on the day.

“Yesterday’s RRR move was pre-digested by the market and came as no surprise. Investors expect no more than one prime lending rate hike for the remainder of the year, especially in this period of softening commodities prices.

“It is likely that many investors will wait on the sidelines to see if the Hang Seng will touch 22,000 before coming back in earnest,” the report cited a market expert as saying.

HSBC (HK: 5) rose 1.5% today to finish at 83.05 hkd.

Major borrowers of capital and consumers of commodities generally had a very strong close to the trading week.

Coal-fired electricity generator China Resources Power Holdings Co Ltd (HK: 836) leapt 3.52% to 15.9 hkd while Aluminum Corp of China Ltd (Chalco, HK: 2600) added 2.18% to close at 7.04. Coal firm China Shenhua Energy Co Ltd (HK: 1088) gained 1.90% to 34.85 hkd, while peer China Coal Energy Co Ltd (HK: 1898) rose 0.4% to 9.96.

H-share petroleum firms were up across the board. China Petroleum & Chemical Corp (HK: 386) rose 0.53% to 7.65 hkd, PetroChina Co Ltd (HK: 857) added 0.38% to 10.7 while China National Offshore Oil Corp (CNOOC; HK: 883) finished up 0.33% at 18.42.

Property firms were back in favor thanks in large part to the still affordable credit available in the PRC.

Hong Kong-based developers Sino Land (HK: 83) finished up 1.95% at 13.62 hkd, Wharf (Holdings) Ltd (HK: 4) rose 1.94% to 55.1, Cheung Kong (Holdings) Ltd (HK: 1) added 1.90% to 117.9 while Swire Pacific Ltd (HK: 19) jumped 1.73% to 117.8.

Real estate firms in Hong Kong were not only cheered by the credit environment, but also by the strong response to a government land auction, which saw three parcels of land auctioned for a combined 5.73 bln hkd yesterday, including a luxury venue bought by Sun Hung Kai Properties for 4.49 bln hkd, with analysts saying this was on the high end of expectations. Sun Hung Kai Properties (HK: 16) added 1.1% today to close at 87.45 hkd.

On the M&A front and unrelated to macroeconomic developments, ubiquitous hot-pot chain Little Sheep Group Ltd (HK: 968) shot up 24.5% to 6.14 hkd after Yum Brands (owner of KFC and Pizza Hut) offered to take the Hong Kong-listed firm private at 6.50 hkd per share.

See also:

TWO SUREFIRE MARKET STRATEGIES: Diversification, Discipline

HK WEEKLY WRAP: Shares Slide 2.4% On Week After 8th Straight Losing Session