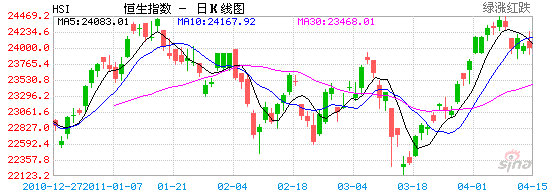

HONG KONG’S benchmark Hang Seng Index ended the week 1.6% lower at 24,008.07, after edging down Friday by 0.02%, marking the first week in four that shares ended lower.

Meanwhile, Hong Kong’s peer index across the defacto border – the Shanghai Composite -- finished 0.26% higher on Friday at 3,050.53, registering a 0.7% increase for the week.

Analysts say the coming week in Hong Kong could be further tamed by continued worries over interest rate and reserve requirement action following newly-released inflation figures in China.

China’s National Bureau of Statistics announced Friday that the country’s economy in the first quarter grew by 9.7% year-on-year, a rate faster than expected.

This naturally puts the market on edge, with expectations that more interest rate hikes may be in the pipeline, as the People’s Bank of China has already implemented four such hikes to the prime lending rate since October with similar moves likely going forward, a Chinese-language piece in SinaFinance said.

This is especially true given that the CPI, the most looked-to barometer of inflation in the country, jumped 5.4% last month versus the year-earlier period, compared to a 4.9% increase in February.

Food price increases were cited as one of the chief culprits in the higher-than-expected inflation rise, and this makes the likelihood of further central bank action all the more possible given Beijing’s near obsession with offsetting any social instability that might be triggered by higher costs for staples, especially in the less-developed hinterlands.

Higher credit, or worries thereof, hit capital-intensive sectors like real estate the hardest, and new mortgage rate hikes in Hong Kong didn't help matters.

Property developer China Resources Land Ltd (HK: 1109) was one of the most widely sold counters on the day,dropping 2.28% to 14.56 hkd.

Lenders themselves were not immune from the renewed credit squeeze anxiety impacting the markets today.

HSBC (HK: 5), a bank constituting the heaviest weighting on the Hang Seng Index, closed down 0.66% to finish Friday at 83.1 hkd.

However, local rival Hang Seng Bank (HK: 11) added 0.33% on Friday to finish at 122.1 hkd.

This week’s losing performance in Hong Kong for the benchmark index followed last week’s 2.5% increase, which reached a three-month high.

That led to profit-takers returning to the market on Monday, with the Hang Seng Index shedding 0.38%, which then dropped a further 1.34% on Tuesday on a weak resources sector due to less robust commodity prices, notably crude oil.

Trading on Monday and Tuesday marked the largest two-session selloff in Hong Kong since the

disaster in Japan last month.

Wednesday saw bargain hunters breathe life back into the market, with the Index adding 0.66% on a buying spree of mainly large cap stocks.

However, the bears returned on Thursday, with the Hang Seng Index losing 0.5% on the day, mainly on a selloff in Shanghai-listed property developers and lack of visibility on future reserve requirement adjustments.

Trading turnover in Hong Kong on Friday was 72 bln hkd, which is around 12% lower than the previous 30-day moving average, as investors held off on major purchases following the release of major macroeconomic data from the PRC.

Analysts expect the market to continue to show lower-than-average turnover next week as investors digest the latest GDP and inflation figures from China, anticipate further credit-tightening activity and await upcoming IPOs in Hong Kong.

See recent: HK WEEKLY WRAP: Shares Up 2.5% To Near 3-Month High