CHINA MAY have overtaken Japan last year to become the world’s No.2 economy, but that hardly means PRC capital markets are immune to the impact of the tragic natural and man-made disasters pummeling Japan and its still-formidable industrial engine.

While thoughts and prayers from around the world are focused on Japan in its time of need, the markets nevertheless do carry on, and here is what is likely to happen to Chinese shares as a result of the earthquake and tsunami. according to a Chinese-language piece in SinaFinance.

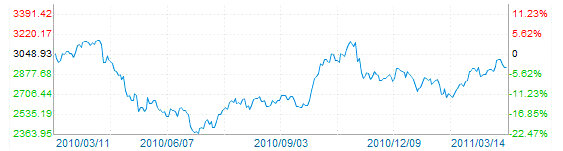

The trading week began with a shudder, largely related to the disaster still unfolding in China’s neighbor to the east. The Shanghai Composite Index, the benchmark indicator for Chinese A and B shares, opened Monday sharply lower but regained form to finish the day up 0.13% at 2,937.63.

So the question everyone with money in the Chinese market is asking is: Which sectors will be affected, and how?

First of all, it is inevitable that the renewed anxiety over the relative safety of nuclear energy will spark a fresh round of debate, regardless of how the emergency situation in northern Japan is resolved. Coal-fired power plants in China provide for nearly 80% of the country's electricity needs, but the cost in emmisions on the respiratory health of the citizenry is well documented.

However, the fear factor that is part and parcel of invisible radioactivity and the potentially more deadly effects of contamination makes for a much better horror story if things get out of hand.

Therefore, by default, solar, wind and water will all be reexamined as much safer forms of emmision-free power generators, and China's leading position in the manufacture of equipment for the first two will certainly bring renewed attentioin to listed panel and turbine makers.

Secondly, the most obvious economic victims in Japan are mainly the major exporters such as auto firms and machinery counters. All took a dive, especially after many of the major carmakers announced temporary production halts in Japan.

However, Chinese shares shook off the quake’s immediate impact as the trading day wore on, and near-term downside impacts on A- and B-share valuations are not expected to be chronic. Counters with an exposure to nuclear energy technology are likely to trend downward, at least until the instability at the Japanese atomic power plants is resolved favorably.

As we saw on Friday, after the 8.9 magnitude quake was announced during late afternoon trade, rescue equipment-related shares spiked on the news, and Monday morning Chinese-listed counterparts engaged in this business saw obvious valuation increases.

This demonstrates that speculative money sniffing out short-term gain in the Chinese market still holds sway and can swing the Shanghai Composite up or down with relative ease when strong sentiment runs wild.

However, the mini-run lacks staying power, once again proving the fickleness of such fast-growth funds and investment mentality.

Therefore, investors would do well to continue focusing on the viability of individual counters within key sectors and seek out the most sustainable options rather than responding to fluctuations linked to immediate news events, both domestic and foreign.

The A-share bourse, as has been shown even during the height of the downturn in the West and the sovereign debt crises gripping Europe, still dances to the beat of its own drum and is predominantly determined by domestic economic conditions and/or new policy coming out of Beijing.

That being said, there has been a trend for China’s capital markets to move slightly more in sync with other major equity markets around the world, especially following the long Lunar New Year Holiday earlier this year.

We cannot ignore the fact that Japan is still the third biggest overall trading partner of the PRC, following the EU and the US.

Therefore, when one sneezes, the other may not necessarily catch a cold... but sniffles are a possibility.

Initially, the impact post-quake will be an intangible hit to sentiment, with fears that the major economic burden or reconstruction laid at the feet of the world’s No.3 economy will put another stumbling block in the path of the ongoing global economic recovery.

But China’s economy is still fundamentally strong, and domestic shares will likely chase their intrinsic value into the near future.

That being said, Japan’s recent pumping of 60 bln usd into its banking system is bound to bring some global inflationary pressure, as well as making Chinese exports less competitive in Japan due to the likelihood of a weaker yen.

But we feel that a more important barometer of China’s market direction should be gleaned from the just-concluded annual legislative session in Beijing, and investors would be wise to study all the implications from the various announcements.

As for specific industries in China, Friday's earthquake in Japan -- the largest in the country's history -- has led to widespread closures of numerous manufacturing facilities engaged in a variety of industries including autos and auto parts, chemicals and electrical components.

We believe that these four sectors in particular will see the strongest "quake-effect" upside in Chinese-listed related shares over the near term.

Long term, we expect the massive rebuilding campaign just around the corner in Japan to provide previously unimagined opportunities for Chinese construction material makers.

Most notable among them are Chinese steelmakers, as the PRC remains the biggest steel producer by a long shot.

As the peak of the annual reporting season arises, investors would do well to pay close attention to any drastically revised forecasts among Japanese-based firms to determine which industries and counters will be most negatively impacted from sporadic shutdowns... and which Chinese-listed peers could step up to fill the void.

See also: CHINA SHARES Flirting With 3,000 On Coal Comeback