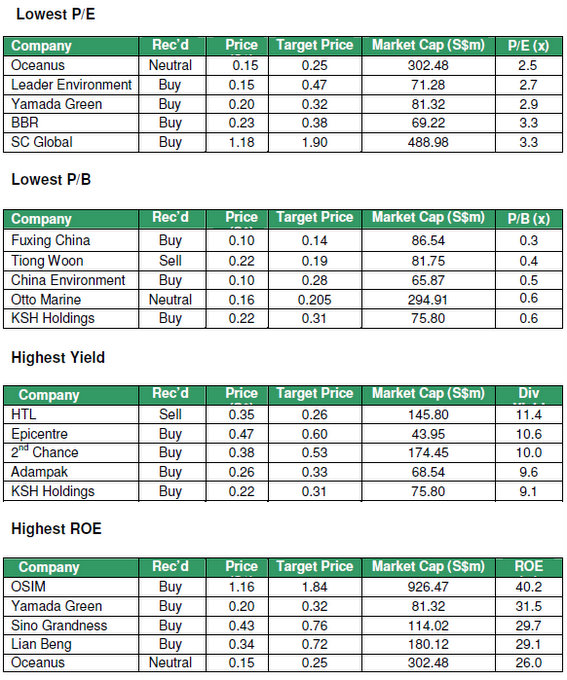

WITH THE market having corrected substantially, this is as good a time as any to see where stocks offer the best value for those with deep pockets and lots of patience. DMG & Partners has done such investors a service today by putting out the following tables:

Source: Bloomberg and DMG estimates (all ratios based on current year estimates)

Total = 5 cents.

Yield = 5 divided by stock price of 47

= 10.6%.

Note the 2 special dividends. They may not be repeated in FY11. I think it's unlikely the specials will be given again this year when the economic outlook is turning negative