NextInsight readers recently got a rooftop view of Koon's pre-cast subsidiary (Econ Precast) in Kranji Way. Briefing them is its general manager, Jessie Ong (centre, wearing dark slacks and a grey blouse). Photo by Leong Chan Teik

This article was first published in www.sharesinv.com and is reproduced here with permission

THE CONSTRUCTION sector plays a vital role in the growth of Singapore’s economy.

In 2010, Singapore’s construction demand, measured by the total value of construction contracts awarded, rose markedly by 14% from $22.5 billion in 2009 to $25.7 billion.

Following the recent policy move to increase public housing supply, the Building and Construction Authority (BCA) projected demand for construction would continue to be strong through 2011, with construction contracts to hit $22 billion to $28 billion this year.

Koon Holdings, armed with more than 30 years of experience in building works, is among the companies poised to ride on the robust growth of the industry.

Looking at its latest performance, the group’s FY10 results revealed a 41.8% drop in revenue mainly caused by lower contribution from its contracts segment. However, it registered a promising net profit of $13 million, a 22.2% year-on-year improvement, mainly due to better gross margin, increased dividend income and gains from the purchase of the precast division.

The improved margin was attributable to the implementation of various cost control measures at its construction division. Notably, its current dividend yield of 7.4% is amongst the highest in its industry.

Tan Thiam Hee, CEO of Koon Holdings.

Photo by Sim Kih

Photo by Sim Kih

Precasting simplifies the on-site construction process as it reduces the dependency on labour and saves considerable amount of time and costs, making its products highly desirable for mass housing projects.

The increased activity of the local precast market in recent years quickly caught the attention of Koon Holdings.

Seizing the opportunities to foster growth, Koon Holdings acquired a 75% stake in Econ Precast for $3.75 million in Mar-10 and the entire stake in Construction Technology (Contech) for $1.78 million in Aug-10.

With these acquisitions, the group now owns 2 of the 9 BCA licenced precasters in Singapore. The two precast businesses each holds a BCA L6 licence, which allow them to bid for contracts of unlimited value, providing the group with the advantage to undertake larger precast projects.

Striding ahead, the group extends its business reach to secure new precast projects. In April this year, it won new precast projects worth $16.3 million for the design, supply and delivery of precast components for the domestic public housing projects, through its two newly acquired subsidiaries.

Firming Up Its Order Books

Despite posting lower revenue from contracts, Koon Holdings managed to firm up its order books with more project wins to its construction business.

In Mar-11, it secured a $15.25 million contract to construct roads, drains, sewers and earthworks at Tampines Logistic Park, which brought its pure construction order book to $74 million.

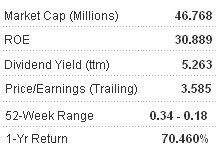

Based on recent stock price of 28.5 cents

The group’s trading liquidity appears to have improved after its recent 1-for-1 bonus issue.

According to Kim Eng Research, Koon Holdings appears undervalued as compared to its peers, trading at approximately 3.3 times PE ratio. It believes that a simple re-rating to sector average PE ratio would boost its share price by more than 60%.

All in all, Koon Holdings’ investments in the precast business put it in a good position to benefit from the construction trend of using precast products amid rising labour costs. Its status as one of the leading civil engineering specialists will be affirmed through its ability to secure new contracts in the highly competitive market moving forward.

Recent story: KOON, Construction sector, CIMB's picks for 2H11