Excerpts from latest analyst reports…..

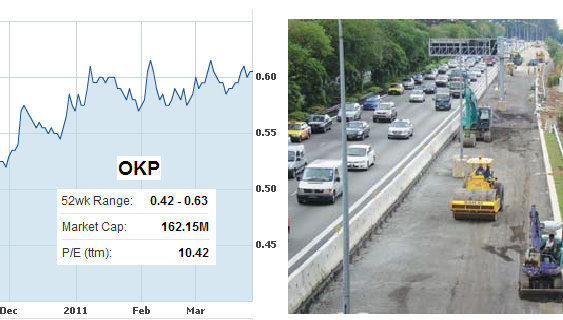

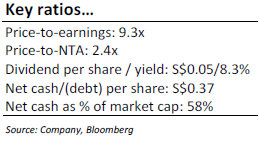

Kim Eng Research highlights OKP’s 8.3% dividend yield

Analyst: YEAK Chee Keong

Good orderbook visibility. As at 22 February 2011, OKP had an outstanding orderbook of $309.9m, with projects stretching up to 2014. This should provide strong support for its earnings for the next few years. Moreover, there is still a high possibility of new contract wins.

Strong net cash position. Net cash makes up 58% of its market capitalisation. Dividend yield of 8.3% for FY10 is impressive.

Based on consensus estimates, the stock trades at an undemanding forward FY11 PER of 8.5x and would look even more attractive if net cash is stripped out.

CIMB speculates that RAFFLES EDUCATION could be privatized

Analyst: Gary Ng

A cup of tea with the busy man: We finally had a chance to catch hold of Mr Chew Hua Seng, CEO of Raffles Education.

• Resumption of dividends signals confidence. Management highlighted that it has a comprehensive and sustainable education business model that will propel its growth for many years to come. Mr Chew said that RLS is starting to see results from the expansion of its network of colleges in the region as its new colleges take root.

He is confident and that optimism saw the board announcing the resumption of dividends (after omitting for two years) starting with the declaration of an interim dividend of 0.15 cents per share for this half-year.

Our speculative view

• What market already knows, we are not interested in. While the market is aware that RLS is pushing for the listing of OUC in HK, we like to think or even speculate that a company like RLS can in future explore a HK listing angle. Recall Mr Chew’s brother runs Midas, which is a HK dual-listed stock as well. Now that is not the lucrative bit. Dual-listing has so far only re-rate stock in the short term, but done nothing to substantially change the valuation of stocks.

• But it is possible if … Drawing references from CMA’s recently proposed dual listing in Hong Kong, what if Mr Chew (the CEO) decides to privatize RLS simply because there is a lack of appreciation by the market here for his business model? By taking RLS out of the Singapore market, packaging it with OUC for a potential listing in HK would certainly make the whole deal more palatable and more appreciative to worldwide investors, especially to Chinese investors.

Recent story: RAFFLES EDUCATION, HU AN, MENCAST, GENTING, HYFLUX: What analysts now say....