OKP's design-and-build project --- the interchange at TPE/Sengkang West Road/Seletar Aerospace Way. Photo: annual report OKP's design-and-build project --- the interchange at TPE/Sengkang West Road/Seletar Aerospace Way. Photo: annual report Or Toh Wat, MD of OKP Holdings. Photo: Company. Or Toh Wat, MD of OKP Holdings. Photo: Company.

OKP HOLDINGS reported an erosion in gross margin and a lower net profit for 1Q2014, despite an increase in revenue. |

Linc Energy reveals personal reasons behind 2 directors' share sale

RARELY DOES a company comment on the reasons for the sale of its shares by its management or directors.

The company's press release this morning said Mr Dark and Mr Ricato have each, with the Board’s prior knowledge, sold shares to meet "unavoidable personal financial obligations".

Mr Dark, the company chairman, sold 747,000 million shares in two transactions in April 2014, leaving him with 1.29 million shares.

Mr Dark's businesses are described on Linc Energy's website thus: "His current business includes the ownership and operation of a small chain of independent fuel and grocery outlets both at a retail and wholesale level. Over the years Ken has managed to find time to own and operate a sheep/beef enterprise in New South Wales, with time spent in freelance management consulting to round out his experience."

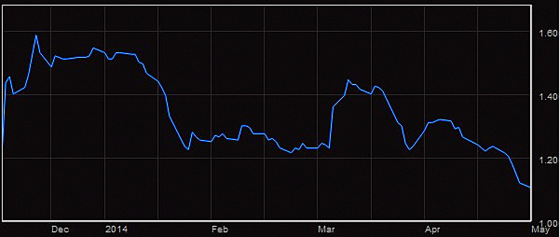

Linc Energy's share price ($1.13) is trading near its 52-week low of $1.10. The company has a market cap of S$636 m and reported a 1HFY14 loss of AUD114.9 million. Chart: Bloomberg

Linc Energy's share price ($1.13) is trading near its 52-week low of $1.10. The company has a market cap of S$636 m and reported a 1HFY14 loss of AUD114.9 million. Chart: BloombergMr Ricato, previously Linc Energy's Director - Legal & Corporate Affairs, sold a total of 1.5 million shares in three transactions in April 2014, leaving him with 1,001,561 shares.

"Mr Ricato sold down a portion of his Linc Energy stock over a short period of time to address taxation obligations."

Linc Energy MD Peter Bond.

Linc Energy MD Peter Bond. Photo: CompanyMr Peter Bond, Managing Director, said, "I understand that the market views negatively any director share sale, but the reality is that directors have personal lives and obligations that sometimes need addressing through the sale of a portion of their Company stock.

"When you consider that Ken Dark has been involved with Linc Energy for nearly 10 years and Mr Ricato has been involved for nearly 7 years, the long term dedication, ethics and overall confidence in the Company and its assets by both directors over this term has been outstanding.

"Both directors have told me they have a strong faith in the Company’s future and were very disappointed that circumstances beyond their control had caused them the need to sell some of their Linc Energy stock holdings at this time."

Recent story: Initiation reports: Buy BREADTALK, Buy LINC ENERGY