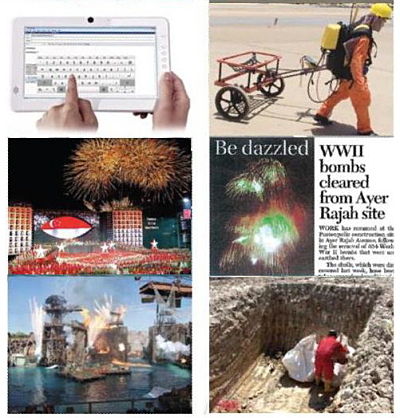

This montage (culled from TSH's 2009 annual report) illustrates the various businesses that the company is involved in, ranging from consumer electronics manufacturing, to managing fireworks displays, to recycling/disposing of ammunition and explosives in Singapore and overseas.

Someone had expressed his view to Kevin (who was on a golf course then) that TSH could be a 4-bagger in the making. Intrigued, Kevin later delved into the background and financials of the company.

His findings can be read here: KEVIN SAYS: 'Can TSH Corp be a 4-bagger?'

That was in late August. Just about two weeks later, which is Thursday evening (Sept 9), TSH announced a big contract win of US$8.72 million.

Now, this is the first time in the last 24 months (that’s the furthest that the Singapore Exchange public records go) that TSH has announced a contract win – which suggests that it has taken a step forward in corporate transparency.

(It, however, did give contract values and the nature of work of 3 projects in its annual report for 2009.)

What’s also a stand-out for the latest announcement is that the contract came from overseas.

TSH’s wholly owned subsidiary, Explomo Technical Services Pte Ltd, has been awarded a contract to dispose expired ammunitions from the Ministry of National Defense of Taiwan.

The contract is scheduled to be completed “by 2011,” said TSH.

John Wong, non-executive chairman, TSH. Photo by Sim Kih

However, to give some perspective to the US$8.72 million (S$11.8 million) revenue: In 1H2010, the company’s total revenue stood at S$28.3 million, of which S$14.37 million came from its Homeland Security Services businesses.

(TSH’s other revenue contributor is an unrelated business - contract manufacturing for the consumer electronics sector).

So, if you assume the Taiwan contract would be completed within six months, ie by around March next year, the contract does look like a big boost to TSH’s revenue in the near term.

But that’s also assuming that, aside from the Taiwan deal, TSH has revenue from its Homeland Security Services businesses that is at least maintained at the same level as in 1H2010.

Trouble is, the Homeland Security Services business is project-based and the customers are confined to government agencies, so revenue can be unpredictable.

Source: Bloomberg (stock price 17.5 c)

Adding to investor uncertainty, there is no analyst coverage of this stock, so there are no financial forecasts to refer to.

TSH is a small-cap stock (market cap: $42 m) which has been low profile, though of late the rising volume of its shares traded suggests that the market is happy to re-rate the stock, which touched its 52-week high of 18 cents recently.

On the contribution of the Taiwan contract, TSH said it would impact positively the net tangible assets per share and earnings per share of the Group for the financial year ending 31 December 2010.

It cautioned: “Any expectation of financial impact of the Contract on the Group is subject to a number of risk factors such as foreign exchange fluctuations, unanticipated cost overruns, delays in the Contract’s schedule and other risks associated with the Group’s business, which are or may be outside the Group’s control.”

Postscript: I wonder if the relevant person would be chatting with Kevin Scully again (on the golf course?), and I wonder what he/she will say now about TSH.