At ASL Marine's 340-m long drydock, which is the largest in Indonesia, an oil tanker is being converted into a Floating, Storage and Offloading Vessel in a multi-million dollar project. Photo: Leong Chan Teik

At ASL Marine's 340-m long drydock, which is the largest in Indonesia, an oil tanker is being converted into a Floating, Storage and Offloading Vessel in a multi-million dollar project. Photo: Leong Chan Teik

Ang Kok Tian, chairman and MD of ASL Marine, chatting with analysts on board ASL Marine's ferry. Photo: Leong Chan Teik

Ang Kok Tian, chairman and MD of ASL Marine, chatting with analysts on board ASL Marine's ferry. Photo: Leong Chan Teik

ASL MARINE, listed in Singapore and having its main operations in Batam, has just achieved the distinction of owning the largest drydock in Indonesia.

The drydock was lengthened from 260 metres to 340 metres, which enables it to repair and maintain large vessels such as Very Large Crude Carriers (VLCC) - ships that can transport two million barrels of oil.

This drydock, along with two other medium-sized ones in the same shipyard, makes ASL Marine the best-equipped shipyard in the whole of Indonesia, said chairman and MD Ang Kok Tian when he met analysts last Friday.

And ASL Marine could capture more shiprepair and conversion business going forward.

Over a dozen Singapore analysts visited ASL Marine’s yard, where an oil tanker was undergoing a multi-million dollar conversion to become a FSO (floating storage and offloading vessel).

This is a vessel that stores oil or gas produced from nearby offshore sites until the oil or gas can be offloaded onto a tanker or transported through a pipeline.

ASL Marine’s yard repairs the bigger vessels, such as bulk carriers, FSOs, oil rigs and semi-submersibles.

It is the only yard in Indonesia that can service construction vessels that are very wide.

Customers include Saipem, Global Industries, Nippon Steel, Hyundai, Swiber and Ezra.

Mr Ang said his company is specialised in its services, which is how it distinguishes itself from other yards in Indonesia.

ASL’s chief competitors are instead yards in Singapore, where the pricing is often higher, and yards in China which enjoy lower operating costs.

However, its Chinese competitors are some distance away and the threat of typhoons during certain times of the year deter customers from heading there for repair and conversion jobs.

Lower profit margins

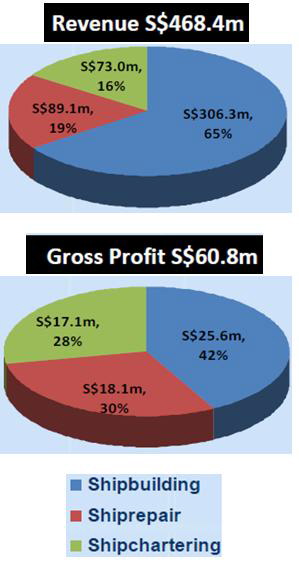

ASL Marine's revenue from shiprepair and conversion rose by 28% to S$89 million in the year ended June 2010. However, gross profit fell by 16% to S$18.1 million.

“Customers are more cost-conscious. In the good times, they wanted the work done fast and price was not a big factor since they were making good money from high charter rates,” explained Mr Ang.

Charter rates that went for US$100,000 a day now hover below US$20,000.

Shiprepair contributed 19% to ASL Marine’s total revenue of S$468.4 million in FY10, and 30% of its gross profit.

Shipbuilding formed 65% and 42%, respectively.

ASL Marine’s shipbuilding orderbook stands at $327 million, including new orders announced last month worth S$55 million for 30 vessels. As we saw on our visit, the shipyard was busy as it has a total of 47 vessels to be delivered progressively up to 1Q of 2012.

This morning, OCBC Investment Research analyst Low Pei Han, in a report, said that ASL is currently trading at an attractive level at 6.8x core FY11F earnings and 0.86x P/B. With an upside potential of about 18%, she maintains her buy rating with a fair value estimate of S$1.04.

Read about our previous visits to ASL Marine:

ASL MARINE: Busy with shiprepair work

ASL MARINE: Riding the wave of shiprepair boom