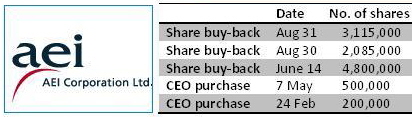

On Tuesday, it bought back 3.115 m shares for about $531,000, triggering market interest in the stock.

The total volume traded was about 24.6 million shares, compared to 2.2 million the day before when AEI (www.aei.com.sg) bought back 2.085 million shares.

Notably, these were two out of three share buybacks made by the company since June this year. In fact, they were the only share buybacks in at least the past two years.

The purchases were all made at roughly 17 cents a share.

The first was on June 14 when it bought back 4.8 million shares.

To date, AEI has bought 10 million shares, or 3.83% of the issued share capital.

Recent story: INSIDER BUYING: Osim, AEI, Thomson Medical, UMS, Best World, etc

The following posting on AEI was made by Kevin Scully, executive chairman of NRA Capital, on Aug 16 on his blog. Visit www.nracapital.com

I say surprise because as an aluminum extrusion company with significant exposure to the electronics sector, I expected Aei to report strong numbers in 2010.

Looking closely at the results, turnover for H1-2010 rose 43.7% to S$28.6mn but pretax profit fell to a loss of S$0.49mn compared to a profit of S$3.9mn in 2009.

The main culprit here is in other operating expenses where I notice a charge of S$3.57mn from the (MTM - mark to market for its outstanding LME aluminum contracts) as at 30 June 2010.

I spoke to the company and was informed that this is the first time they are using an LME Aluminum hedge and if we use today's prices for aluminum, the company would writeback the MTM charge plus a little more.

The chart below which shows the LME aluminum price shows that the price of aluminum as at 30 June 2010 was almost the recent low and prices have rebounded. The company was therefore being prudent in making the impairment charge.

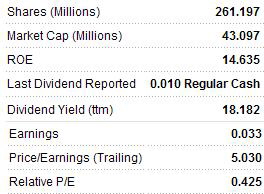

Putting the charge aside, Aei would probably have made just over S$3mn in the first half of 2010. So Aei is likely to deliver the same if not slightly higher profit in 2010 compared to 2009. Cash is down to S$22.6mn from S$33.1mn mainly from the dividend payout in 2009. NTA is at S$0.20 compared to the current share price of S$0.16.

When I first recommended Aei, the share was about 12 cents with NTA of about 20 cents, even at today's price of S$0.16, the share is still trading below its NAV of S$0.20 - with about S$0.085 being net cash per share.

I still like the stock and am keeping it as a Stock Pick but may move it into the dividend portfolio if they are not able to deliver stronger growth in the bottomline. Even if they pay half the dividend which they paid in 2009, investors can look toward a dividend yield of 8-10% for 2010 at current levels.

ROKKO: Heading for record profit this year