Rokko recorded $2.9 m in net profit in 1H compared to a $1.2 million loss last year.

Speaking to investors at CIMB yesterday, Rokko MD Gary Lim guided for a sustained good time in 2H, as his company has an orderbook of $15.5 million as at July 2. Generally, Texas Instruments accounts for 50% of Rokko’s business.

The orderbook, he said, would be cleared within 3 or 4 months, which likely means that the 2H’s sales would exceed the previous corresponding period’s $23.9 million.

2H is traditionally stronger than the 1H of the same year, said Mr Lim, so Rokko looks set to more than double the 1H earnings per share (EPS) of 1.92 cents.

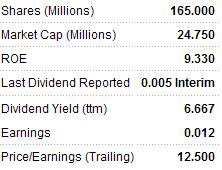

Let’s assume an annualised 3.84 cents a share in EPS for the full year. Based on the company's guidance of a 30% payout from net earnings, Rokko could deliver dividends of 1.15 cents in FY10, translating into a yield of 7.7% based on a recent stock price of 15 cents.

Listed in Oct 2007, Rokko has declared its first-ever interim dividend recently, of 0.5 cents. The stock has just gone x-dividend.

In comparison, Rokko paid a 0.5 cent first and final dividend for FY09.

In price-earnings terms, the stock is trading at 3.9X PE, assuming an annualized EPS of 3.84.

And it is trading just above its end-June Net Asset Value of 14.70 cents.

With its $15.5 million orderbook fulfilled around end of 3Q, Rokko would have surpassed the $33.3 million sales and $5.1 million net profit achieved in 2007, the year of its IPO.

The IPO price of its shares was 25 cents.

Some background on its business: Part of Rokko’s business is to design, develop and manufacture automated equipment for semiconductor ‘backend’ assembly processes.

Mr Lim said that some of its equipment sell for S$1 million each.

With lots of business to grab, Rokko bought a factory in Nusa Cemerlang Industrial Park in Malaysia in March this year, and will start operations there next year.

It is also setting up a manufacturing plant in China this year.

Recent story: NRA CAPITAL's 9 best tech picks