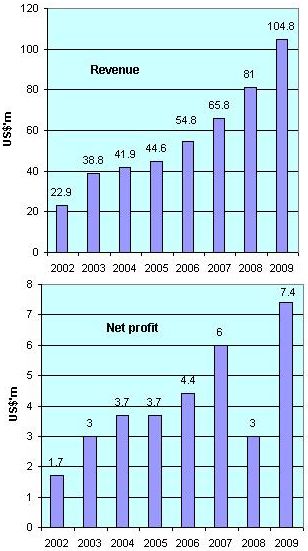

TECHCOMP HOLDINGS shareholders and some analysts were in the mood to congratulate the management after it announced record revenue and record profit for 2009 (see tables on this page).

Some attendees at the meeting with Techcomp management last Friday prefaced their questions with congratulatory remarks.

The US$7.4-million record profit wiped off the anguish that Techcomp management and investors had experienced when an otherwise record profit in 2008 was marred by forex losses.

Adding to the gloom, analysts stopped covering the stock.

At last Friday's meeting, it was a positive sign that the room at Fullerton Hotel was packed with over 25 analysts, fund managers and other guests from the investment community. They came to hear more about Techcomp's rebound.

An almost uninterrupted march upwards, except for profit in 2008 which was dragged down by forex losses.

Aside from the 2009 financial figures, Techcomp - which manufactures and distributes laboratory and life-science equipment - had dished out other good news:

* Bonus share issue: One bonus share for every two existing shares to increase the liquidity of the stock.

* A first and final dividend of 1.2 Singapore cents, unchanged from a year ago.

The market responded positively to Techcomp’s results, with the stock closing 2 cents up at 44.5 cents on Friday after touching 45 cents, a 52-week high, in morning trade.

It's still a long way off from the 80-cent level it traded at in May 2008 before the Lehman crisis.

Through the global financial crisis, Techcomp stayed steady as its 2009 results demonstrated.

On an annual basis, Techcomp has grown its revenue at a brisk 20+% in past years.

And its net profit margin had stayed at between 7.7% and 9%, except in 2008 because of forex losses.

Another predictable feature was reflected in its 2009 performance: As in past years, the second half of the year accounted for the bulk of the company’s revenue and profit. In 2009, the figure was 62% and 81%, respectively.

(Recognising this stable pattern, NextInsight in an 15 Aug 2009 article had extrapolated Techcomp’s 1H 09 results to come up with a profit figure of US$7.8 million for the full year. As it turned out, we almost hit the bull’s eye! See our article: TECHCOMP: Record 1H revenue, profit )

Techcomp added spice to its results announcement by revealing the acquisition of a 80% stake in Precisa Gravimetrics, an established (founded in 1935) Swiss maker of analytical weighing and moisture analysers for US$3.4 million.

This acquisition follows hot on the heels of Techcomp's first European acquisition barely a year ago.

Asked how Techcomp intended to turn loss-making Precisa around, Richard Lo, the President and CEO of Techcomp, said: "We are confident we can increase Precisa's sales in Asia. We will also help them lower their operating costs through our sourcing system in China, and by relocating some labour-intensive (and costly) work" to Techcomp’s manufacturing base in China.

In addition, Techcomp, which will not be involved in the day-to-day management of these companies, would extend the geographical reach of the acquired companies’ products via Techcomp’s extensive Asia network - and its Europe network too, said Mr Lo.

Techcomp is no new comer to working successfully with foreign companies. Said Mr Lo: "We are experienced in working with foreigners, especially European companies, in the past 10 years. We have done ODM projects, private labels. We know how to do things step by step."

Already, Techcomp's first European acquisition (HCC Group, established in 1918), has become profitable, from being loss-making in the first half of 2009. Starting in July 2009, HCC contributed US$4.3 million to Techcomp’s revenue in 2009.

Giving a rationale for these European acquistions, Eric Chan, vice-president of Techcomp, said Europe is a major market for laboratory and life-science products - far bigger than Asia.

With Europe's contribution and China's economic growth, Techcomp is poised for another good year. Mr Chan said: "Demand for our equipment is stable and growing - our business is resilient."

Mr Lo said he expects "a pretty exciting outlook for the Group in 2010."