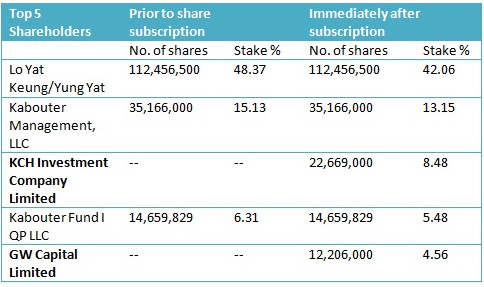

GW Capital Limited, which is wholly owned by Mr. Guo Yong, will own a 4.56% stake.

These are private investors who share something in common: They were co-founders of Centre Testing International (Shenzhen) Co. Ltd, which is a US$1.15 billion company headquartered in Shenzhen and engaging in consumer product testing, inspection, certification, and consultation.

Until July this year, they were also directors of Centre Testing International.

They will subscribe for an aggregate of 34,875,000 Techcomp shares at HK$2.40 apiece, a discount of approximately 5.51% to the closing price of HK$2.54 on the HK Stock Exchange on Wednesday (8 Oct).

The total net proceeds from the share sale will be approximately HK$83.3 million, and will entirely be used for an acquisition, as described below.

At yesterday's closing stock price of 43 SGD cents on the SGX, Techcomp has a market cap of about S$100 million and trades at a trailing PE of 9.4X, according to Bloomberg.

The company is expected to ride on strong growth in the food safety industry the PRC, and the entry of the two big investors could add further spark to market interest in Techcomp.

|

|