Photo by Leong Chan Teik

SINGAPORE’S LEADING supplier of mooring and rigging equipment distributor, Teho, has had PSA as its key customer since the 1980s and enjoyed booming business from ship arrivals to Singapore.

Teho, expanding the horizons of its ambition, is planning to extend its distribution network to Shanghai as the Chinese city rapidly gains importance as a shipping hub.

Teho may be an unfamiliar name to stock investors as it was listed only in June 2009. It has hardly any listed peers on the Singapore Exchange, so its industry has not had much publicity .

Recently, the stock traded at 19 cents, which is a discount to its IPO price of 24 cents. Another attractive feature is its historical dividend yield of 7.4%.

So what do mooring and rigging equipment refer to?

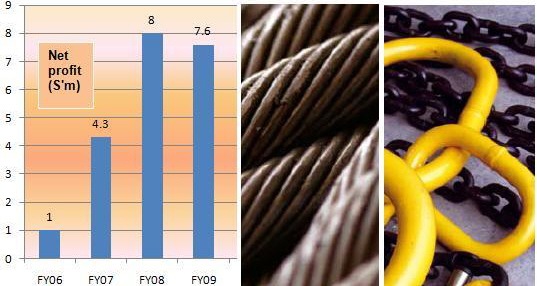

In layman terms, it is mainly steel wire and synthetic ropes for lifting and docking. These are fitted on vessels at ports and shipyards.

Teho's product range runs the gamut of related equipment such as chains, fittings, sockets, etc. Teho carries products of leading brands as well as proprietary ones.

Its marine customers include port operators (such as PSA), ship chandlers, ship owners, shipyards, and ship management companies.

In addition, Teho’s mooring and rigging equipment is also used in the offshore oil & gas sector, as well as in construction, defence and logistics.

Shanghai rep office

Being one of the world’s leading ports, Singapore accounted for over 80% of Teho’s revenues for the six months ended 31 Dec 2009 (1H10).

The company’s fortunes are mainly tied to the number of ship arrivals here but it is seeking opportunities to expand its sales presence overseas.

Already, it is working with third party logistic partners in the other major shipping hubs - Rotterdam, Houston and Dubai.

In an interview with NextInsight recently, its CEO Mr Lim See Hoe revealed that the company opened a rep office in Shanghai last month as the local market has reached saturation point.

”Singapore has handled the largest container throughput, but I believe it will be overtaken by Shanghai,” said Mr Lim.

Shipping traffic at Shanghai is large and growing rapidly: container throughput climbed 18.8% year-on-year to 13.86 million TEUs in the first six months of 2010.

For the same period, the Singapore port handled 14.06 million TEUs, up 14.3%.

|

|||||||||||||||

|

|

|||||||||||||||

Teho’s 1H10 net earnings of S$2.1 million was a 63.5% contraction year-on-year. However, in 1H09, the company had made a one-off gain of S$2.2 million by disposing of shares and properties.

For a distribution business model, its net margins are relatively high – a good 10.9% for 1H10.

At a stock price of 19 cents, the dividend yield was high too – 7.4%. Last year’s dividend payout was 20.5% of earnings. The company expects to announce its FY2010 earnings on 27 Aug.