Excerpts from BNP Paribas initiation report dated 2 June on OCEANUS….

Analyst: Brenda Lee, CFA

Growing pains

We initiate coverage on Oceanus Group (Oceanus), the largest land-based abalone farming company with an integrated downstream processing and restaurant operations in China, with a HOLD and a target price of SGD0.28, 31.1% below consensus.

We value Oceanus based on 1.5x 2010E P/BV valuation in line with the aquaculture peers, at a 20-30% discount to its historical P/BV average. We believe Oceanus represents an attractive one-of-a-kind mass market PRC consumption growth story with highly sought after natural resources and scalable market potential as consumption for high-end delicacies, such as abalone, is still at an infancy stage in China.

Oceanus may deserve higher valuation given the lower risk profile of its land-based farming system; however, we are see lingering risks regarding its execution capabilities in terms of expansion targets on its caging capacity and restaurant operations.

We also see lower momentum on BA (biological assets) growth due to the needs of increasing juvenile abalone sales for working capital purpose. The thirst for cash is our biggest concern for this young company.

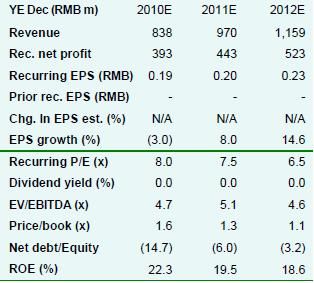

We estimate FCF to be positive only in 2013 and management may again disappoint on dividend payout and its intended acquisition in Taiwan and Australia. We also see downside risk on consensus forecast and risk of further BVPS and EPS dilution on warrant conversion and external funding needs. The business model is solid but we would remain on the sidelines above SGD0.25.

Strong and complementary management team

Corporate governance and transparency remains our biggest concerns on S-share investment. We think Oceanus stands out from the vast pool of S-chip stocks mainly due to the strength and track record of the management team and quality board. The Executive Chairman Mr Ng Cher Yew (also the majority shareholder of Oceanus) has more than 14 years experience in China, specializing in fluorochemistry, veterinary pharmaceuticals, and biological and precision engineering.

Dr Ng was a scholar serving the bond under the Ministry of National Development of Singapore and under the scholarship administered by the Government of Singapore. The CEO, Mr Yu De Hua, was a lecturer at Qiqihar University but then joined an F&B company in 1991 and started his own company, Zhangpu Longze in Zhangzhou Fujian in 1997, which is the key operating subsidiary of Oceanus.

A potential take-over target?

We believe that Oceanus’ farming assets offer much higher value to its competitors than its equity shareholding at this stage as established players may have the cash reserve to grow the BA but not tank capacity to keep the high-value larger abalones. We understand that Oceanus is currently talking to an A-share listed aquaculture company in China on potential M&A deals. Although we do not expect to see any concrete outcome in the next 6-12 months, this might help support the share price.

Further EPS and BVPS dilution to be expected in 2010-11

The company had issued 450m warrants at the price of SGD0.15. Currently, still 376.1m warrants are outstanding, and we believe that they will be fully converted in these two years. Warrant conversions, on the one hand, is positive for Oceanus as it will immediately save the company 9% interest rate, but on the other hand, it results in an estimated EPS and NAV per share 13% dilution as well as fair value loss for the conversion as the current share price is much higher than the exercise price of the warrants.

We note that the market is yet to factor this into the forecast. More importantly, we believe this might also create a temporary overhang on the shares.

Potential IPO for restaurant to be scraped

Oceanus has formed a 70:30 joint venture (JV) with the famous Ah Yat Abalone Restaurant (NR) to operate the mass-market abalone restaurant chain in China. This is a privately held company which currently operates 20 restaurants across China, Hong Kong, and Singapore. Management originally aimed to increase the total number of restaurants to 50 by the end of 2010 and to 100 by the end of 2011. The cost of opening a new restaurant is about RMB2m.

However, to secure a good location at the right price will be a challenge in our opinion. The ultimate goal is to position it for separate listing. However, currently, the company has changed the entire forecast, and it will maintain the number of restaurants at 20 given the strong Chinese competition. We believe that management will eventually seek a potential exit if the restaurant business is not operating as well as expected. Total divestment cost is estimated at SGD20m, but we believe it could overrun eventually.