WITH ITS FULL-YEAR results announcement around the corner, our attention was caught over the weekend by Hongwei Technologies' announcements to the Singapore Exchange regarding a key director's stock purchases.

The non-executive director, who is the spouse of the CEO, had gone on a last-minute shopping spree, buying the stock on two successive days (Jan 20 and 21).

It can mean a number of things, but certainly the company’s results will not be a nasty shock. Chances are, there is good news.

Madam Zhuang Xinxin, 40, is a co-founder of the company along with her husband, Lin Jimiao.

She owns 100% of Maxpro Global, which controls 63.9% of the issued share capital of Hongwei. (If you find her total ownership unusual, you are not the only one!)

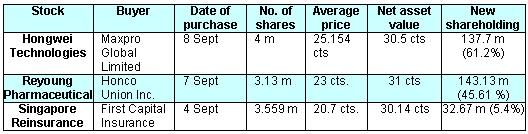

Maxpro's latest buys on the open market totalled 2 million Hongwei shares worth about $510,000 (see table below).

With that, Maxpro’s holding has reached 63.9%, or 4.6 percentage points higher than in March 2009, the cutoff date for the shareholder list published in the 2008 annual report.

|

|

Recently traded at 25 cents, the stock has a historical PE ratio of 4.2, which would be lowered if it turns out that the company’s earnings had recovered in Q4 of last year.

At end-Sept 09, its Earnings Per Share was virtually unchanged year-on-year.

Hongwei manufactures and sells polyester differential fibers primarily to the yarn and textile manufacturers located in south China.

It is a small-cap (S$56 million).

Two negatives to note:

a) Cashflow from operations fell sharply in the first nine months of 2009.

b) Receivables shot up from RMB 81.2 m as at end-Sept 08 to RMB 138.4 m as at end-Sept 09.

The company said the significant increase in receivables was mainly due to the company starting trading activities from February 09.

The Group buys raw materials and its related auxiliary materials as well as DTY fibres (which are of a different type from the Group's finished goods) for sale to customers.

The average gross profit margin is about 4% to 5%. Trading sales and purchases are done on 30-day credit terms basis.

Such activity contributed RMB 13.7 million in 9M 2009 and 4.6 million in 3Q 09 income.