DBS Vickers Securities yesterday (Jan 21) said its top picks to ride the Chinese dragon are Wilmar, Pac Andes, Hong Leong Asia, Midas, and China Animal Healthcare.

It said it liked Wilmar as it builds up its presence in China.

It recommended that investors look at Pacific Andes, as it offers compelling valuations relative to its peers.

Amongst consumer discretionary names, China Animal is expected to see EPS growth from the development of new vaccines.

DBS Vickers sees Hong Leong Asia and Midas as key beneficiaries of continued investment in infrastructure in China.

The key points underlying its view of China are:

• Domestic consumption and expenditure in China expected to continue strong growth in 2010.

• Companies that could benefit most are consumer and infrastructure names.

• Dual listings are still a catalyst, following the experience of China Fishery Group and Epure.

Excerpts from the report:

A Strong 2010 for China. DBS economist David Carbon believes 2010 will be the start of Asia’s decade. Fastest growing economy in Asia will be China. China’s ability to pull much of Asia on a V-shaped recovery out of recession is testimony to its increasing domestic demand.

Even as its export sector contracted in 2009 due to the global economic downturn, domestic retail sales and fixed asset investments continued to show double-digit growth.

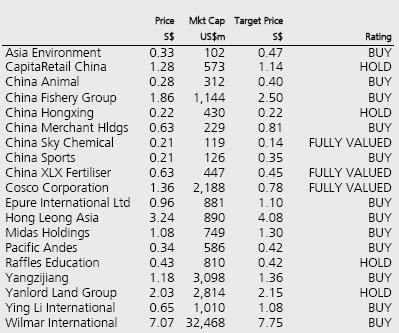

Looking for Beneficiaries. We take a fundamental screen of the S-Chips and also other Singapore companies with >50% revenue contribution from China (like Wilmar and Hong Leong Asia) for beneficiaries of China’s domestic consumption and expenditure. We focus on domestic-centric companies and filter through names in 4 sectors: consumer non-discretionary, consumer discretionary, infrastructure and real estate.

Scorecard Substantiates View. In relooking our S-Chip scorecard, export-centric companies continue to score poorly, while those exposed to infrastructure projects continue to show up high scores as they lock up recent contract wins, benefiting from positive fiscal stimulus. Policy tightening has impacted the scores for real estate and we downgrade Yanlord to a HOLD as we see policy risk capping outperformance.

Dual Listing Catalyst. China Fishery announced dual listing plans this morning, and we believe this factor will continue to be a catalyst for S-Chips, after similar plans by China XLX and Epure. In our earlier piece on 8 Jan 2010 (“Next on the list”), we had identified China Fishery as a potential dual listing candidate, with other possible names being Midas, China Animal and Yangzijiang.

CHINA ANIMAL HEALTHCARE VIS-A-VIS PEERS

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Top Picks: Wilmar, Pac Andes, HLA, Midas, China Animal. We like Wilmar for consumer non-discretionary as it builds up presence in China. We also recommend that investors look at Pacific Andes, as it offers compelling valuations relative to its peers.

Amongst consumer discretionary names, China Animal is expected to see EPS growth from development of new vaccines. We see Hong Leong Asia and Midas as key beneficiaries of continued investment in infrastructure in China