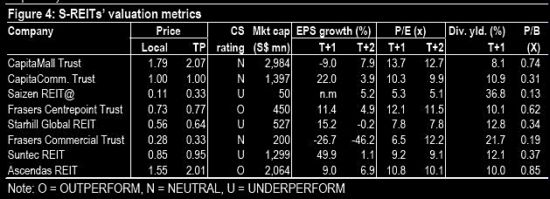

Source: Credit Suisse (Jan 9)

IT'S REITS again! REITs are showing up on analysts' radar these days as two refinancing deals in quick succession allay market concerns arising from the credit crunch.

UOB Kayhian and DMG & Partners have come out with positive recommendations for REITs.

Credit Suisse last Friday (Jan 9) stated its preference for REITs over property developers.

CapitaCommercial Trust sank as low as 59.5 cents in early Dec but rose 64% to 97.5 cents by Jan 12.

”Recent successful refinancing by Cambridge Industrial Trust and CapitaCommercial Trust has eased solvency concerns, especially for the bigger REITs, although we expect rates to be 100-250 basis points higher,” wrote Credit Suisse analyst Tricia Song.

As highlighted by UOB Kayhian and DMG, and now Credit Suisse, the current dividend yields of REITs are attractive at 13-14%, but Tricia noted that the key risks remain:

* A worse-than-expected downturn, and

* Potential asset devaluations as rents dip, which will affect REITs with high gearing.

Assets owned by REITs are expected to achieve lower valuations but this is expected to lag with staggered rental reversions and could be pre-empted by some recapitalisation throughout 2009, noted Tricia.

Credit Suisse’s top pick is AREIT given its diversified portfolio of 88 industrial properties with long leases to expiry, benign near-term refinancing needs and a strong sponsor (Ascendas).

As for property developers, Credit Suisse continued to avoid recommending developer stocks in anticipation of more negative macro news flows and possible capital restructuring.

Credit Suisse said it would revisit the property developer sector after 1Q09.

*****

Nomura Singapore head of research Lim Jit Soon is not too optimistic about REITs still.

In a Singapore Strategy report on Jan 9, he wrote that “refinancing remains a concern,” with some S$3.7billion of loans in the broker’s universe of coverage to be refinanced in FY09F.

”Inevitably, banks will continue to re-assess loan-to-value ratios as well as absolute exposure to specific REITs and the REIT sector in general. Following the re-financing of Cambridge Industrial Trust's debt, we envisage 2009 debt to be rolled over, though pricing for non-sponsored REITs is likely to see upward pressure.”

Recent stories:

DMG: Overweight healthcare, REITS, telecoms, land transport

REITS: Refinancing concerns allayed further